0 ratings0% found this document useful (0 votes)

451 views36 pagesABC Costing Notes

Uploaded by

Muhammad FaizanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

0 ratings0% found this document useful (0 votes)

451 views36 pagesABC Costing Notes

Uploaded by

Muhammad FaizanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

You are on page 1/ 36

WHAT’S WHAT OF ABC ?

The activity is the work that is done.

The resource is what the activity uses to do the work.

The cost of the activity depends on the quantity of

resources used to accomplish the activity.

The cost driver for an activity is the factor that influ

the amount of the resources that will be consu

activity.

The activity driver measures how much of,

used by the cost object.

The cost object is whatever it is you wish to cost

be a product, service, process, job or customer. ¢ N :

a, RY

Scanned by CamScanner

Scanned with CamScanner

Activity Based Costing (ABC)

ABC isa

ABC is designed to “good Sipplement

provide managers with to our traditional a

cost information for ey

strategic and other

decisions that

potentially affect

capacity and therefore

affect fixed as well as

variable costs.

2

\asreg, )

Merton

Scanned by CamScanner

Scanned with CamScanner

How Costs are Treated Under

Activity—-Based Costing a

Traditional Costing

The predetermined

overhead rate is based

on budgeted activity.

This results in applying

all overhead costs

including unused, or

idle capacity costs to

products.

@ ABC bases level of activity on capacity.

aq in five WayS:

ABC

Products are charged

for the costs of

capacity they use —

for the costs of

capacity they don’t

use. Unused capacity

costs are treated as

period expenses.

not

Scanned by CamScanner

Scanned with CamScanner

Aaivity Bose _certing

Sole pa 72

less mM ataial

keh our

Vari able

Other oven}

snl VANE A

© Maching tast dvethencl

v Engineering ig Oveibgen cd

vw SA up ove hecxof :

/ In spe chien aVesheaA

Mime ——_— —.

Fradiional Couinp 7

Rin

ete So FY

les matsiat

“feb our :

Oe ovehead overall

—— |

Scanned by CamScanner

Scanned with CamScanner

How Costs are Treated Under

Activity-Based Costin

"Best practice” ABC fers rom radonal costing #49 WY:

‘Best practice” ABC differs from traditional © costing in

ABG

Traditional

product costing

Scanned by CamScanner

Scanned with CamScanner

Preparation of ABC pipauct prottabity report

= i fobs ds

The next step is to compute the Activity Cost Driver Rate

(ACDR).

|The ACDR is the amount determined dividing the activity

expenses by the total quantity of the activity cost driver.

Activity-Based | losting r

Finally, ABC Products Profitability Report is prepared. It

_combines activity expenses assigned to each product with their

‘direct (labour and material) costs.

The activity expenses assigned to a product is arrived at|

multiplying the ACDR by the quantity of each activity cost,

(driver used by each product.

Scanned by CamScanner

Scanned with CamScanner

Tracing Costs from Activities to Products

| Transaction ue

Transaction drivers are used to count the frequency of an

activity/the number of times an activity is performed.

Duration drivers represents the amount of time required

to perform an activity.

are “used to charge directly for

Intensity drivers”

each time an activity is performed.

the resources used

Scanned by CamScanner

Scanned with CamScanner

TRADITIONAL COSTING VS ABC

> traditional cost accounting it is assumed that cost objects

consume resources whereas in ABC it is assumed that cost

objects consume activities.

Traditional cost accounting mostly utilizes volume related

allocation bases while ABC uses drivers at various levels.

Traditional cost accounting is structure-oriented whereas ABC

is process-oriented.

Scanned by CamScanner

Scanned with CamScanner

Step 1: Identify

Resources

Step 2: Identify

Activities

Step 3: Identify

Cost Objects

Step 4: Determine

Resource Drivers

Step 5: Determine

Cost Drivers

STEPS

INVOLVED

Scanned by CamScanner

Scanned with CamScanner

~ Cost

Customer Pools

Order Processing

Material Planning/Acquisition

|

Cost Drivers

No. of customers

No. of order source (customer Noeation

No. of orders by quantity

No. of by value

No. of customers visits aa

No. of items/parts/components ay

No. of deliveries m

No. of material receipts

No. of material orders

No. of material movements

No. of stock shortages/discrepancies

No, of material transactions

Weightvolume of materials

No. of material movements

Scanned by CamScanner

Scanned with CamScanner

VVSLFOOIS

\ \nspection and Quality Control No, of inspecti Cost er

rt cllons

Production Control

Maintenance

Research and Development

Customer Service

Customers Accounting

No. of rejects

No, of Teceipts

No. of parts/volume

No. of customers

Balch sizes

No, of product changes

No. offset-ups

No. of suppliers

No. of product changes

No. of parts Operational

No. of production hours

No.of machine changes

No, of order board changes

_| No. of personnel supervised

No. of schedule changes

“| No.of machine layout changes

No. of production batches

No. of set-ups

No. of work orders

No. of set-ups

No. of machine break-downs:

Capital expenditure

«| No. of defects

No. of toot changes

‘Activity levels A

No. of product changes

No. of production hours

No. of engineering changes

Maintenance schedule

No. of research projects

Personnel hours on a project.

Technical complexities of projects

No. of services calls 5

lo. of products serviced

Ms ‘of hours spent_on servicing pro.

No, of despatches

No. of deliveries

Jo. of invoices:

te ‘of accounting reports

No, of sales orders

ee ed

Scanned by CamScanner

Scanned with CamScanner

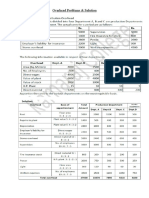

SUestion # log ' Products

XYL YZT ABW

(000) (008) ¢000)

Sales and production (units) 50. 40 30

()

» Selling price (per unit) So os 3

Prime cost (per unit) 32 Bd 6S

Hours Hours Hours

Machine departinent 7

(machine hours per unit) -

Assembly department _ 3 2

Greet labour hours

Per unit)

Overheads allocated and eppoitioned to production

der

Partments (including service cost centre cbsts)

‘were to be recovered in product costs as follows:

Machine department at

+ £1.20 per machine hour

Assembly department at

£0.825 per direct labour hour

‘You ascertain that the above overheads could be re+

Analysed into ‘cost pools’ as follows:

Quantity *

for the

Cost pool £000 Cast driver period

rd

+ Machining 387 Machine hours 429000

services :

Assembly 318 Direct labour $3000

services hours

Setup costs: 26 Set-ups 520

Order processing 156 Customer orders 32000

Purchasing _84 Suppliers’ orders - 11 200

9a,

You have also been provided with the following

estimates for the period:

Products

XY YZT ABW

‘Number of get-ups 120-200 200

‘Customer orders 9000 8000-16000

_Suppliers* orders 3000-4000 @ 4200

eres prefer cone t

Scanned by CamScanner

Scanned with CamScanner

SA4e. fe unit us ay 2

es. Prime Cast Paronif 3.2. BY os

cim fe anit tS H+ “G

X_ BL vodume

uniP SOO Wa

20)

otal Crbibrtin margin SSaan

Ybb4a0 _alig.wp

ley DVehe

machine Dp, it ovsheaa as ey

(enochine Pee ubid ot oabccd 120,060 |e Ihtaon \

a nanan unk} 290) eh | Bow || 59 sry _|

: a

poset RU TASO —TaTan 85a

Scanned by CamScanner

Scanned with CamScanner

— ABC Parfit Catintrt

«cag

2Y7r Tr We

08" ‘a ae

Gotet Cim 680 Gly p 226

less avabeadls

machine Rept

Overhead | RS a) ye

Accembly Defrt

Diche,, tl R10 Jz RY4

set-up Ca & 76 10

idler Dike Kir seal 34 Fe

fated Sr-$—e Qype

PrAT ay eS 4

Scanned by CamScanner

Scanned with CamScanner

Waking Ei Paal_overh oy ead (a 5}

fa machine _~ 98 Jo =

OBS pay _marclyre four:

t

6e6VICe

L124) an.

a Aceh See 0:60 Per pired Apo toy.

Seevico $3000

Pep celui cit « 240m

OP Leth co}

fc ISOOTD 9D Per Cu

fer ceded Pwrasing < ee a¥2S Pr Cuda,

ger Puychasing cach = Quay 9S Per tuppyier

12a tae

ab ove Los

yf af Abi

WN umby q Je-up Ne 24. 2m

x x

Az $0 Lecsckup wt Co Ta eo

—- — —

A 6660 len lan,m |

Custom ova Ya Yon Ban

Pec_cuslome nis __. 2269-996

Scanned by CamScanner

Scanned with CamScanner

ng

.1 Example: Activity based costi

2.1 Examp! Y and Z. Output and cost data for the periog jy.

‘Suppose that Cooplan manufactures four products, W, X,

ended are as follows. nuombar of

yroduction '

a inthe Material cost Direct labour Machine

Output units period per unit hours per unit — hours per unit

$

w 10 2 20 i 4

x 10 2 80 8 ;

¥ 100 5 20 1

z 100 5 80 3 3

u

Direct labour cost per hour : $5

Overhead costs $

Short run variable costs 3,080

Set-up costs 10,920

Expediting and scheduling costs 9,100

Materials handling costs 7,700

» — 30,800

Required

Prepare unit costs for each product using conventional costing and ABC.

Solution

Using a conventional absorption costing approach and an absorption rate for overheads based on either

direct labour hours or machine hours, the product costs would be as follows.

Ww x yy zZ “Total

$ $ $ $ $

Direct material 200 800 2,000 8,000

Direct labour 50 500 1,500

Overheads * 700 7,000 “21,000

950 9,500 44,000

Units produced 10 “100

Cost per unit $95 $305 $95

* $30,800 = 440 hours = $70 per direct labour or machine hour.

Scanned by CamScanner

Scanned with CamScanner

Using activity based

eae ae hapa) at He ed of production runs is the cost driver for set-

ts h material it

cost driver for short-run variable costs, unit costs would eae eae ea

w

: $ e y Zz Total

Direct material 200 io § s

aaa ot 50 150 ‘500 ‘ts00

jort-run variable overheads (W1) 70 210 700 2,100

Set-up costs (W2)_ 1,560 1,560 3,300 31900

Expediting, scheduling costs (W3) 1,300 1,300 3.250 3.250

Materials handling costs (W4) i : 2.750

21,500 44,000

Units produced 10 100 100

Cost per unit $612 $131 $215

Workings

1 $7 per machine hour

2 $780 per run

3 $650 per run

4 $550 per run

Summary .

Conventional costing ABC Difference per Difference in

Product unit cost unit cost i i

$

: + 428 +333 43,330

, 305 512 +207 42,070

: e 431 +36 43,600

i 218 90 9,000

z

The figures suggest that the traditional volut

(a) It under-allocates overhead cos!

overheads to higher-volume pro

(b) It under-allocates overhe:

work needed per unit) and

ts to low-volume products (here,

ducts (here Zin particular).

ad costs to smaller-sized products (here W and Y

over allocates overheads to larger products (here

me-based absorption costing system is flawed.

Wand X) and over-allocates

with just one hour of

X and particularly Z)-

Scanned by CamScanner

Scanned with CamScanner

Traditional costing (v) ABC

£ Question:

lhe same equipment and similar process¢

manufactures two products, L and M, using t aye

pesciurit production data for these products In one period is shown below.

extract of the con /

Quantity produced (units) , ql 7,000

Direct labour hours per unit 3 i

Machine hours per unit 40 a

Set-ups in the period ie :

Orders handled in the period

Overhead costs §

Relating to machine activity 220,000

Relating to production run set-ups 20,000

Relating to handling of orders 45,000

285,000

Required

Calculate the production overheads to be absorbed by one unit of each of the products using the following

costing methods.

(@) _ Atraditional costing approach using a direct labour hour rate to absorb overheads

(b) An activity based costing approach, using suitable cost drivers to trace overheads to products

(a) Traditional costing approach

Direct labour

: hours

Product L = 5,000 units x 1 hour 5,000

Product M = 7,000 units x 2 hours 14,000

19,000

= $285

19,

= $15 per hour

.. Overhead absorption rate

Overhead absorbed would be as follows.

Product L 1 hour x $15 = $15 per unit

ProductM 2 hours x $15 = $30 per unit

Scanned by CamScanner

Scanned with CamScanner

(b) ABC approach

Machine hours

Product L = 5,000 units x 3 hours 18,000

Product M = 7,000 units x 1 hour

Using ABC the overhead costs are absorbed according to the cost drivers.

$

Machine-hour driven costs 220,000 + 22,000 m/chours = $10 per m/c hour

Set-up driven costs 20,000. + 50 set-ups 3400 per set-up

Order driven costs 45,000 + 75 orders = $600 per order

Overhead costs are therefore as follows.

Product L Product M

$ $

Machine-driven costs (15,000 hrs x $10) 150,000 (7,000 hrs x $10) 70,000

Set-up costs (10 x $400) 4,000 (40 x $400) 16,000

Order handling costs (15 x $600) 9,000 (60 x $600) 36,000

Units produced 5,000

Overhead cost per unit $32.60

These figures suggest that product M absorbs an unrealistic amount of overhead using a direct

labour hour basis. Overhead absorption should be based on the activities which drive the costs, in

this case machine hours, the number of production run set-ups and the number of orders handled

for each product.

Scanned by CamScanner

Scanned with CamScanner

10.6* Intermediate: Comparison of traditional

product costing with ABC

Having attended ‘a CIMA course on activity-based

costing (ABC) you decide to experiment by apply-

ing the principles of ABC to the four products

currently made and sold by your company. Details

of the four products and relevant information are

given below for one period: :

Product A.B ¢ Dd

She Eee

Output in units 120 100 80 120

Costs per unit: @):...€° &). . ©

Direct material — a0) 50 40 | 00

° Direct labour ~ 283.22) eil4-s: 21

Machine hours (per unit) 4 88202! 3

. The four products are similar-and are usually

produced in production runs of 20 units and sold

in batches of 10 units. _ $

The production overhead is currently absorbed

by using a machine hour rate, and the total of the

+production overhead for the period. has been

-analysed as follows:

‘

@)

“Machine department

Costs (rent, business

Tates, depreciation : 10430

/ and supervision) i as

Set-up costs ‘wae aah 4c 5250 -*

Stores receiving - 3.600

» Inspection/Quality control == «22: 100

~ Materials handling and despatch 4620 -

Scanned by CamScanner

Scanned with CamScanner

You have ascertained that the “cost drivers’ to be ]

_ used are as listed below for the overhead costs |

shown: _ :

Cost Cost Driver

Set up costs Number of production

runs

Stores receiving _ Requisitions raised

Inspection/Quality control Number of production

: runs

Materials handling Orders ‘executed

and despatch

+ The number of requisitions raised on the stores was

20 for each product and the number of orders

~ executed was 42, each order being for a batch of

10 of a product. You are required

(a) to Calculate the total costs for each product if

all overhead costs are absorbed on a. machine

_ hour basis; : ' ” (4, marks)

(b) to calculate the total costs for each product,

_ “using activity-based costing; (7 marks).

(c). to calculate and list the unit, product costs,

from your figures in (a) and (b) above, to show

- the differences and to comment briefly on any

“conclusions which may be drawn which could

= ici d profit implications. :

- have eee an P ae)

(Total 15 marks)

Scanned by CamScanner

Scanned with CamScanner

1120 x 4 hrs) + (100 x 3 hrs) + (60 X 2 hrs) + (120 x 3hrs) Question 10.6

1300 hrs.

£10 430 + £5250 + £3600 + €2100 + £4620

Machine hour overhead rate = Ts00ke

= £20 per machine hour

Product A B c D

© © © ©

Direct material 40 50 30 60

Direct labour 28 a 4 2

Scanned by CamScanner

Scanned with CamScanner

i 80 0 40

Overheads at £20 per machine hour a ¢@ 2 «

: 20 100) ay

Units of output £17760 £13100 £6720 gyn)

Total cost

Cost driver Cost driver Cost per

(e) Costs transactions — unit

© ©

10430 Machine hours 1300 hours 8.02

Machine department 5250 Production runs 21 250

Set-up costs | 3.000 Requisitions,raised 80 (4 * 20) 6

Stores receiving antral 2100) Production 1uns 21 109

Inspection/quanly Number of orders

Materials handling executed 42 no

Pate : = ut (420 snits)/20 units per set-up.

Number of production runs = TO) OOP 9p units)/10 units per order.

Number of orders executed = To!

The total costs for each product a

re computed by multiplying the cost driver rate

t driver consumed by each product.

per unit by the quantity of the cos!

A B (ey D

Prime costs 8 160 (£68 X 120) 7100 3520-9720

Set ups 1500 (£250 x6) 1250 (£2505) 1000 1500

Stores/receiving 900 (£45 x 20) 900 3900 900

Inspectiorvquality 600 (£100 x 6) 500 400 «600

Handling despatch 1320 (£110 x 12) 1100 (£110 10) 880-1320

Machine dept cost* 3851 2407 1284 2888

Total costs 16331 13257 7984 16928

Note

*A = 120 units x 4 hrs X £8.02; B = 100 units x 3 hrs x £8.02

(©) Cost per unit

Costs from (a) 148.00

Costs from (b) i 131.00 $4.00 141.00

Difference 13257 99.80 141.07

(11.91) 157 15.80 0.07

Product A is over-costed with the

Costed and similar costs are re}

accurately measures resoure

used, the transfi

activity-based ‘costs are

; us

. eported profits wil differ

for stock

traditional system. Products B ‘

ti . and C are under

Ported with Product D. It is claimed that ABC more

relying on misleading Product coat ne by produets (see ‘Errors arising fi rom

fet to an ABC system ogi spect 10). Where cost-plus pricing s

" resale in different product prices. !!

aluations then stock valuations an!

Scanned by CamScanner

Scanned with CamScanner

Qi \ (PTTL RON:)

A company plans to experiment activity based costing (ABC) by appl its

principles to its four products. Details and relevant information are given below for

a particular month:

eee

Products Wor oY 2 I'D

80120 = S

Output in units (720 100 20.

Cost per unit : Rupees

~~ Raw material 4—~ nn)

Direct labour 21 14 a

“Machine hours per unit Ao 3 2 =

All the products are similar and usually manufactured in production uns. of. 20 units

ntly absorbed by

and sold in batches of 10 units. Manufacturing overhead is curre!

using a machine hour rate of Rs. 20 per hour. Total overhead forthe month and

cost drivers To be used are as follows:

Manufacturing overhead ‘Amount (Rs) __cost driver to be used

Machine department cost 10.430 :

Set-up costs 57250 Number of production runs

Stores receiving 3,600 Requisitions raised

Inspection/ quality control 2,100 Number of production runs

Materials handling and despatch 4,620 Orders executed

Number of requisition raised on the stores was 20 for each product and number of

orders executed was 42. Each order has a batch of 10 units.

Required: :

Calculate thé following:

i)" Total cost for each product, if all overhead costs are absorbed on machine

hour basis. : 3 - ; 02

(i)___Menufacturing overhead cost per unt,“ os od

(iit) Fotai cost for each product, using ABC.approaciS—— 06

Solution: fs : oat

(i) Total cost of each product if overhead costs are absorbed on machine hour:

Product: WW - x y, Zz

Raw material ~ 40 50 “30 60

Direct labour’ f 24 14

—Dverhead at Rs. 20 perhour 60 40 60

7 ‘ost per units ~~ 148. 131 84 =

vg ~Gutput in units 129 - 100 80 ‘2

o ~fotal cost 17,760 13,100 ;

oy Sw.

oo rn

Scanned by CamScanner

Scanned with CamScanner

Ww

Manufacturing overhead cost per unit:

° Cost!

Overhead Ri Cost driver

: Costdriver Transactions fm

Machine department cost 110,430 “Machine hours 13000 hours 023

Set-up costs 8,250 Production runs* 2 + 250.000

Stores receiving

: 3,600 Requisitions raised 4x20 =80 45.000

Inspection / quality control 2,100 Production runs” 4 100.000

Material handling and dispatch _4,620_ Orders executed** 42 448.000

No. of production run = 420 units +20 units per set-up = 21 runs

No. of order executed = 420units + 10 units per order = 42 orders

{ill) Total cost of each product using activity-based costing:

‘Material & labour ()

8,160 7,100 3,520

9,720

Set-up costs (2) 1500 1,250 1,000 1,500

Stores receiving (20 at Rs.45) 900 900 900 900

Inspection/quality control (3) 600 500

Mat. Handling and dispatch (4) 1,320 4,100

Machine department cost (5) _3,854 2,407

Totalcost 16,331 13,257

Notes

(4) Cost per unit x output units

a Based on production run‘of 21

Based on production run of 24

(4) Material handling 110 x 12

(8) Output units x machine hours per unit x machine dept. cost per unit.

Scanned by CamScanner

Scanned with CamScanner

A steel manufacturing compan)

; i IP

simple Activity Based Costing (ABC

pools and activity measures:

Activity cost pool

Assembling units.

Processing orders

Supporting customers

Others Not applicable

The company has two types of overhead with following

Production overhead

Selling and administrative overhead

Total overhead costs

ES

‘oduces filing cabinets. The company has @

) system which has the following activity cost

Activity measures

Number of units

Number of orders

Number of customers

cost break-up:

Rs. 000"

2,000

“4,200-

iw

3,200

34

any allocates the overhead cost to the activity cost pools on following

The comp:

basis:

Distribution of Resource consumption Across [Assembling Processing Supporting | others

Activity Cost Pools Units Orders | Customers

0

Production overhead % \ 50% 35 = oy i ef

Selling and administrative overhead %. 1 45 25 al

7000 | 250 400

Total activity units orders | customers

filing cabinet

jling price of @

ae Rs. 720 an

direct labour are

ordered 80 cabine

id Rs.

is Rs. 2,380. Per unit cost of direct materials and

260 respectively. Last month, a customer

g (in total) at four different times.

Required:

Calculate the following

(i) V “Allocate total overhead costs to the activity cost pools oe

fay Aactivity rates for the activity cost pools =

(iii) Overhead cost attributable to four orders for'80 cabinets te

(iv) Customer margin cs

Scanned by CamScanner

Scanned with CamScanner

Solution: aa

{i) Allocation of costs to the activity cost pools:

Assombing Tt Bs. 000

ssembling — Processing Supporting

Is

~~ Aativity cost poo! Units Orders Customers Uners Total

Production overhead 700~ ~ 10 200° 2,000"

Selling & administrative O.H : _ 540 301 240 1,200

Total overhead costs 11205 1,240 440 3,200

(ii) Activity Rates for the Activity Cost Pools:

x Rs. ‘000"

Total Cost

Total Activity Activity Rate (Rs.)

(Rs.) E __

Assembling units 1,120,060 units 7AN205 per unit

Processing orders 4,240,000 orders 4,960 per order

Supporting customers customers | 4,000 _per customer

{iii) Overhead cost attributable to 4 orders of 80 cabinets

t

1,120 S~ [80 units —~

4 orders

t+ customers

"ABC Gost (Rs.)

—

Assembling units

Processing orders

Supporting customers

iv) Customer Margin: A” /)

(iv) Customer Margin: / C1

Rs.

—

‘Sales (80 units @ Rs. 2,380) 190,400

Less: Costs

Direct material (80 units @ Rs. 720) 57,600

Direct labour (80 units @ Rs. 200) 16,000

Overhead under ABC method: a

Unit related overhead 89,600

Order related overhead 19,840

Customer related overhead 4,000_ |

187,040

Customer margin - 3360

Scanned by CamScanner

Scanned with CamScanner

duct X is produced in two

200 units. Assuming each

tent. The manufacturing

7

F Question No. 17

XYZ Ltd. Company manufactures two Products X and Y Pro

runs of 500 units and Product Y in five independent runs of

product consumes equal direct material and direct labour con' ee

overheads amounts to Rs. 14,000, which comprises of line set-up costs of Rs. 7,000,

product inspection costs of Rs. 3,500 and Rs. 3,500 for material movement to the product

line. Total costs incurred for producing 1000 units of Product X and 1000 units Product Y

Rs.

10,000.

2,000

will be as under:

Direct materials

Direct labour

Manufacturing overhead

Scanned by CamScanner

Scanned with CamScanner

Answer No. 17

Product wise Total Cost unde!

Traditional Costing

Particulars Total | por unit

; cost

00 5,000

Direct materials - e,o0e ‘ 00 1,000

Direct labour ; 1000) Fo] 71

Manufacturing overheads (700% of direct labour) 7,000 :

Total cost 43,000 | 13.00 |

Product wise Total Cost under Activity Based Costing (Rs)

Product X Product Y

Particulars {1.000 Unit) Ti cee san

Total | perunit | 10%! Per unit

cost cost

Direct materials (000 5.00| 5,000 5.00

Direct labour 4,000 1.00] 1,000 1.00

Manufacturing overhead:

Line set-up costs

(Two set-ups; Five set-ups) 2,000 2.00| 5,000 5.00

Product inspection costs

(Two inspections; Five inspections) 1,000 1.00] 2,500 2.50

Material movements

(Two movements; Five movements) 1,000 1.00 2,500 250

10,000 | 10.00 [~ 16,000[- 46.00

Total Cost. -

Scanned by CamScanner

Scanned with CamScanner

Chapter.g2

question No. 16 Pres

eted overheads ang cost dtiver vai

eS OF XYZ Lid; Ay

oat Budgeted ° Are as follows:

Overhead (Rs) | | Cost a

| eames tend a oe ate Budgeted volume

t 350,000 No. of movements

5,000 No. of set-ups

| : Re Maintenance

| K —|.No. of i i

uesomn Of inspections :

No.of machine hours

of 2,600 components of AX-1! 5,.its material cost was,

245,000. The USage activities of the said batch are

company has produced a batch

*30,000 and labour cost was Rs.

S

k al orders - 26

. Maintenance hours

ial movements 18 Inspection

-upS 25°. Machine hours.

Required:

Calculate cost driver rates “that are used for \racing

overheads to the said batch.

5) Ascertain the cost of batch of components using ABC.

(3)

appropriate amount of

(

Scanned by CamScanner

Scanned with CamScanner

answer No. 16 q i

Calculation of Cost Driver Rates

Rs. §80,000/1,100

(a)

Material procurement

Materia! handling

Set-up

Maintenance i

Quality control Rs. 176,000/900

Machine _ = Rs, 720,000/24,000 =. Rs.30

») Calculation Cost of a Batch of 2,600 Components of AX-15 aby

Direct material ti 130,000

Direct labour 245,000

Prime cost 375,000

Add: Overheads ie

Material procurement (26 x Rs. 527)

Material handling (18 x Rs. 368)

Set-up cost ; 5) (25 * Rs. 798)

Maintenance 8 (690 * Rs. 115) k

Quality control (28 * Rs. 195) §

Machine (1,800 * Rs. 30) . 179,086

Balok nnn es & 554,086

Scanned by CamScanner

Scanned with CamScanner

Marks

Q.2 The details of the cost, volume and cost drivers for a particular period in respect of Daata

Textile Limited are as under:

es Product = Allipha Beta Zeta_—‘Total

Production and sales (units) 45,000 35,000 10,000

Sale price (Rs.) 100 110 = 100

Raw material usage (units) 5 5 1"

Direct material cost (Rs./ unit & total) aos 15 2,375,000

Direct labour hours 2 4 2 280,000

Machine hours 2 3 2 215,000

Direct labour cost (Rs./ unit) 12 15 10

Number of production runs 3 7 2 30

Number of deliveries 9 a 20 32

Number of receipts of inventory components 15 35220 270

Number of production orders 5 dO: 25) 50

Overhead cost: Rupees _

Set-up 50,000

Machines 800,000

Receiving 500,000

Packing 300,000

Engineering 400,000

2,050,000

In the past the company has allocated overheads to products on the basis of direct labour

hours, though the majority of overheads are more closely related to machine hours than direct

labour hours.

The company has recently redesigned its costing system for recovering overhead of receiving

department using two volume-related bases: machine hours and a material handling

overhead rate.

Required:

(a) Compute the product-wise profitability using a traditional volume-related costing system

based on:

(i) past practice. 04

(ii) current practice. 04

(b) Compute product-wise profitability using an aclivity-based costing system. 06

(6) Briefly explain the differences between the productwise profitabiliy calculated in

(a) and (b) above.

Scanned by CamScanner

Scanned with CamScanner

Q.2 (a)

(i) Product-wise profitability — past practice:

Total Machine hours

pect labour overhead rate = —--Toaoverheads ___ 2,050,000 5

bea celles Tolal direct labour hours 250,000.

Product cost: Rupees

Product Alpha Beta. Zeta

Direct material 30 25 15

Direct labour 12 15 10

Overhead (W-1) 16 33 16

Total cost 58 73 a

Sale price per unit 100 110 100

Profit per unit 42 37 59

Workings:

Rupees

Bela___Zela

400 2.00

© Per hour rate 8.20 8.20 8.20

s@_Overheads 1640 32.80 _16.40

“(ii)_ Product-nise profitability — current practice:

Receiving department overheads

. . piving

You might also like

- ABC Latest Theory and Practice Questions PDFNo ratings yetABC Latest Theory and Practice Questions PDF18 pages

- Activity-Based-Costing - PAST PAPER QUESTIONSNo ratings yetActivity-Based-Costing - PAST PAPER QUESTIONS14 pages

- ABC Latest Theory and Practice QuestionsNo ratings yetABC Latest Theory and Practice Questions18 pages

- Cash & Receivables (Ch-7) CMA Questions & Solutions100% (1)Cash & Receivables (Ch-7) CMA Questions & Solutions24 pages

- Cost Accounting SEM 5 (Sample Question Paper)No ratings yetCost Accounting SEM 5 (Sample Question Paper)10 pages

- E1 Answer Key Intermediate Accounting II Exam 1No ratings yetE1 Answer Key Intermediate Accounting II Exam 113 pages

- Activity Based Costing Spring 2020 Answers Final - pdf-1No ratings yetActivity Based Costing Spring 2020 Answers Final - pdf-120 pages

- Activity Based Costing and Activity Based Management - ProblemNo ratings yetActivity Based Costing and Activity Based Management - Problem3 pages

- Cash Flow Basics for Accounting StudentsNo ratings yetCash Flow Basics for Accounting Students23 pages

- Management Accounting Model Answers Series 3 2012No ratings yetManagement Accounting Model Answers Series 3 201214 pages

- Labour Costing: Calculation of Wages & BonusesNo ratings yetLabour Costing: Calculation of Wages & Bonuses13 pages

- Management Accounting Information For Activity and Process DecisionsNo ratings yetManagement Accounting Information For Activity and Process Decisions30 pages

- C01 First Test (Classification and Behaviour of Cost)100% (1)C01 First Test (Classification and Behaviour of Cost)5 pages

- Great Zimbabwe University Faculty of CommerceNo ratings yetGreat Zimbabwe University Faculty of Commerce6 pages

- Activity Based Costing Spring 2023 With ThoeryNo ratings yetActivity Based Costing Spring 2023 With Thoery12 pages

- Paper - 3: Cost and Management Accounting: © The Institute of Chartered Accountants of IndiaNo ratings yetPaper - 3: Cost and Management Accounting: © The Institute of Chartered Accountants of India28 pages

- Part 1 - Section D Activity Based CostingNo ratings yetPart 1 - Section D Activity Based Costing42 pages