0% found this document useful (0 votes)

115 views2 pages10 Keys of Money Management

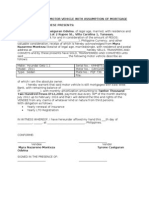

The document outlines 10 keys to effective money management: 1) Create a budget to track income and expenses. 2) Track spending to identify areas to cut back. 3) Build an emergency fund with 3-6 months of living expenses. 4) Prioritize paying off high-interest debt. 5) Save and invest for long-term goals like retirement and homeownership. 6) Diversify income sources to enhance financial security. 7) Continually develop skills through education to increase earning potential. 8) Start retirement planning early to benefit from compound interest. 9) Practice smart tax management to maximize benefits. 10) Maintain a good credit score to access better rates and opportunities. Mastering money management requires discipline and continuous learning.

Uploaded by

LuxesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

115 views2 pages10 Keys of Money Management

The document outlines 10 keys to effective money management: 1) Create a budget to track income and expenses. 2) Track spending to identify areas to cut back. 3) Build an emergency fund with 3-6 months of living expenses. 4) Prioritize paying off high-interest debt. 5) Save and invest for long-term goals like retirement and homeownership. 6) Diversify income sources to enhance financial security. 7) Continually develop skills through education to increase earning potential. 8) Start retirement planning early to benefit from compound interest. 9) Practice smart tax management to maximize benefits. 10) Maintain a good credit score to access better rates and opportunities. Mastering money management requires discipline and continuous learning.

Uploaded by

LuxesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 2