0% found this document useful (0 votes)

147 views2 pagesFinancial Accounting Assignment-3

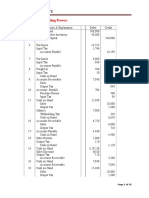

This document contains an accounting trial balance from XYZ for March 31, 2018 along with adjustments that need to be made. It also includes two accounting problems - one asking to prepare the machinery account from 2014-2017 with additions, sales, and depreciation and the other asking about the format and preparation of a cash flow statement using the indirect method with adjustments. The final question asks about ratio analysis, its benefits in financial statement analysis and limitations.

Uploaded by

ANURAG SHUKLACopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

147 views2 pagesFinancial Accounting Assignment-3

This document contains an accounting trial balance from XYZ for March 31, 2018 along with adjustments that need to be made. It also includes two accounting problems - one asking to prepare the machinery account from 2014-2017 with additions, sales, and depreciation and the other asking about the format and preparation of a cash flow statement using the indirect method with adjustments. The final question asks about ratio analysis, its benefits in financial statement analysis and limitations.

Uploaded by

ANURAG SHUKLACopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 2