0% found this document useful (0 votes)

138 views6 pagesBudget Assignment

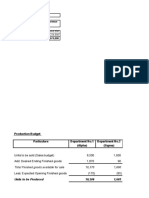

The document contains sample budgeting questions and answers related to managerial accounting. It includes examples of cash budget calculations, production budgets, manufacturing overhead budgets, static budget reports, and flexible budgets. The key information provided are examples of different types of budgets commonly used in managerial accounting.

Uploaded by

Gurveer Karen, and the PriceCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

138 views6 pagesBudget Assignment

The document contains sample budgeting questions and answers related to managerial accounting. It includes examples of cash budget calculations, production budgets, manufacturing overhead budgets, static budget reports, and flexible budgets. The key information provided are examples of different types of budgets commonly used in managerial accounting.

Uploaded by

Gurveer Karen, and the PriceCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 6