0% found this document useful (0 votes)

413 views2 pagesInvoice

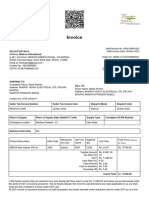

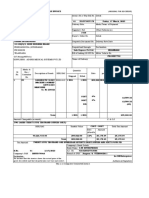

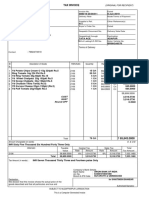

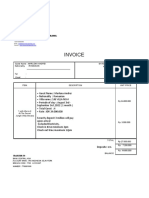

This invoice from Krishna Computec to Satyendra Kumar documents the sale and delivery of 60 "surya Yes WLed Luminaire Light" pieces. The total price of Rs. 486,000 includes taxes and was delivered on July 4, 2023 to the consignee's location in Rajasthan. The seller declares that they are not covered by GST e-invoicing provisions due to their maximum turnover being below the threshold and will comply with e-invoicing if/when required.

Uploaded by

Mukesh ChoudharyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

413 views2 pagesInvoice

This invoice from Krishna Computec to Satyendra Kumar documents the sale and delivery of 60 "surya Yes WLed Luminaire Light" pieces. The total price of Rs. 486,000 includes taxes and was delivered on July 4, 2023 to the consignee's location in Rajasthan. The seller declares that they are not covered by GST e-invoicing provisions due to their maximum turnover being below the threshold and will comply with e-invoicing if/when required.

Uploaded by

Mukesh ChoudharyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 2