0% found this document useful (0 votes)

119 views8 pagesChapter 14 Lecture Notes (Student Copy)

1) The document discusses accounting for business combinations under IFRS 3, including identifying the acquirer, determining the acquisition date, recognizing and measuring identifiable assets and liabilities acquired at fair value, and recognizing any resulting goodwill or gain from a bargain purchase.

2) The consideration transferred by the acquirer is measured at fair value as of the acquisition date and may include cash, other assets, equity instruments, liabilities assumed, and contingent consideration. Acquisition-related costs are expensed as incurred.

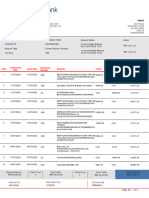

3) Illustrative Example 14.1 shows the trial balance of Whiting Ltd to demonstrate accounting for consideration transferred in a business combination.

Uploaded by

Tsz Mei WongCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

119 views8 pagesChapter 14 Lecture Notes (Student Copy)

1) The document discusses accounting for business combinations under IFRS 3, including identifying the acquirer, determining the acquisition date, recognizing and measuring identifiable assets and liabilities acquired at fair value, and recognizing any resulting goodwill or gain from a bargain purchase.

2) The consideration transferred by the acquirer is measured at fair value as of the acquisition date and may include cash, other assets, equity instruments, liabilities assumed, and contingent consideration. Acquisition-related costs are expensed as incurred.

3) Illustrative Example 14.1 shows the trial balance of Whiting Ltd to demonstrate accounting for consideration transferred in a business combination.

Uploaded by

Tsz Mei WongCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 8