THE INSTITUTE OF CHARTERED

ACCOUNTANTS (GHANA)

NOVEMBER 2011 EXAMINATIONS

(PROFESSIONAL)

PART 4

ADVANCED FINANCIAL REPORTING

(Paper 4.1)

Attempt ALL Questions

TIME ALLOWED:

Reading & Planning - 15 Minutes

Workings - 3 Hours

Page 1 of 12

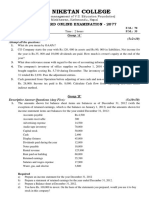

�QUESTION 1

(a) The need to develop agreed set of accounting standards to enhance high quality corporate

reporting cannot be over-emphasised.

You are required to:

(i) Explain why accounting standards are needed to help reporting entities and users of financial

statements. (4marks)

(ii) Outline any three (3) costs associated with increased disclosure of information in the

financial statements to the reporting entity. (3 marks)

(b) ABC Ltd issued a GHS5,000,000 18% convertible loan note at par on 1 January 2010 with

interest payable annually in arrears. Three years later, on 31 December 2012, the loan note

becomes convertible into equity shares on the basis of GHS100 of loan note for 50 equity

shares or it may be redeemed at par in cash at the option of the loan note holder. The

financial accountant of the company has observed that the use of a convertible loan note was

preferable to a non-convertible loan note as the latter would have required an interest rate of

24% in order to make it attractive to investors. The present value of GHS1 receivable at the

end of the year, based on discount rates of 18% and 24% can be taken as:

18% 24%

GHS GHS

End of year 1 0·847 0· 806

2 0·718 0· 650

3 0·609 0·524

Required:

Show how the convertible loan note should be accounted for in ABC Ltd‟s income statement for

the year ended 31 December 2010 and statement of financial position as at 31 December 2010.

(8 marks)

(c ) Sika Ltd has been in business as a General Merchant for a number of years. During its

accounting year ended 30th April 2011, the following transactions took place:

GHS

(i) Purchases: 1st July 2010 160,000

1st January 2011 80,000

(ii) Sales 320,000

(iii) Sundry Expenses 38,000

The statement of Comprehensive Income for the year ended 30th April 2011 and the Statement of

Financial Position as at 30th April 2011, prepared on the Historical Cost Accounting basis were on

follows:

Page 2 of 12

�INCOME STATEMENT

GHS GHS

Revenue 320,000

Cost of sales (260,000)

Gross profit 60,000

Operating expenses 38,000

Depreciation 6,000 (44,000)

Operation profit 16,000

STATEMENT OF FINANCIAL POSITION

GHS GHS

Property, plant and equipment 64,000

Depreciation (24,000) 40,000

Inventories 18,000

Net current monetary items 12,000 30,000

Net assets 70,000

Financed by: 49,000

Stated capital 21,000

Income surplus 70,000

Additional information:

(i) The inventories were valued using the FIFO method.

(ii) The Consumer Price Index (CPI) were:

INDEX

Purchase of Non-current Assets and issue of equity share 120

30th April 2010 215

1st July 2010 223

1st January 2011 238

Average for the year 226

30th April 2011 240

Required:

(i) Prepare Current Purchasing Power Financial Statements (Income Statement for the year

ended 30th April 2011 and Statement of Financial Position as at 30th April 2011).

(ii) A statement reconciling the Operating Profit of the two accounting systems – Historical cost

and Current Purchasing Power.

(15 marks)

(Total: 30 marks)

Page 3 of 12

�QUESTION 2

(a) Countries and entities adopting International Financial Reporting Standards (IFRSs) for the

first time should consider the possible conflict of some provisions of IFRS with local

legislations. Such is the case in Ghana in respect of exclusion of subsidiary from

consolidated financial statements. IAS 27 “Consolidated and Separate Financial

Statements” and Ghana Companies Code, 1963 (Act 179) (under review) are in conflict in

respect of exclusion of subsidiary from consolidation.

Required:

Identify the conflicts between Section 127 of Ghana Companies Code 1963 (Act 179) and IAS 27,

Consolidated Separate Financial Statements as regards exclusion of subsidiary companies from

consolidation.

(5 marks)

(b) In its quest to dominate the textiles industry in Ghana, management of Tema Ltd decided

to acquire shareholdings in two entities in the industry, Akosombo Ltd and Juapong Ltd.

Consequently, on 1 January 2010, Tema Ltd acquired the following non-current investments

in the secondary market:

i) 15 million ordinary shares in Akosombo Ltd. The consideration was settled as follows:

A share exchange (immediate) of one share in Tema Ltd for every two shares in

Akosombo Ltd, (The market price of each Tema Ltd‟s share at the date of

acquisition was GHS4) , plus

A cash consideration of GHS2 per each acquired Akosombo Ltd share to be settled

on 1st January 2011. The cost of capital for Tema Ltd approximates 20% per annum.

ii) 6 million of the ordinary shares of Juapong Ltd at a cost of GHS4.50 per share in cash.

Payment was effected immediately. By this acquisition, Tema Ltd could exercise significant

influence in the operating and financial policies of Juapong Ltd

The share exchange and the deferred considerations of the above investments have not been

recorded by Tema Ltd.

The financial statements of Tema Ltd, Akosombo Ltd and Juapong Ltd for 2010 financial

year are as follows:

Income statements for the year ended 31 December 2010

Tema Akosombo Juapong

GHS‟000 GHS‟000 GHS‟000

Revenue 193,000 90,000 76,000

Cost of sales (126,000) (64,000) (40,000)

Page 4 of 12

�Gross profit 67,000 26,000 36,000

Distribution and admin expenses (22,000) (10,400) (6,000)

Finance costs (1,000) (600) -

Other Income 6,000 ______ ______

Profit before tax 50,000 15,000 30,000

Income tax expense (10,000) (3,000) (6,000)

Profit for the year 40,000 12,000 24,000

Statements of financial position as at 31 December 2010:

Tema Akosombo Juapong

GHS’000 GHS’000 GHS‟000

Assets

Non-current assets

Property, plant and equipment 95,000 52,000 90,000

Investments in shares 27,000

Available-for-sale investments 32,500

154,500 52,000 90,000

Current assets

Inventory 34,500 31,000 18,000

Trade receivables 16,000 7,500 12,000

Total assets 205,000 90,500 120,000

Equity and liabilities

Ordinary shares (all issued at GHS1 each) 50,000 20,000 20,000

Retained earnings 90,000 44,000 80,000

140,000 64,000 100,000

Non-current liabilities

Loan notes 25,000 5,000 5,000

Current liabilities 40,000 21,500 15,000

Total equity and liabilities 205,000 90,500 120,000

The following information is relevant:

(i) At the date of acquisition, the fair values of Akosombo Ltd‟s assets were equal to their

carrying amounts with the exception of a landed property which had a fair value of

GHS2,000,000 below its carrying amount; This has not been reflected in the separate

Page 5 of 12

� financial statements of Akosombo as at 31 December 2010. (Ignore depreciation

implication)

(ii) On 1 January 2010, Tema Ltd transferred an item of plant to Akosombo Ltd at its agreed fair

value of GHS13 million. Its carrying amount prior to the transfer was GHS10 million. The

estimated remaining life of the plant at the date of transfer was five years (straight-line

depreciation). Akosombo Ltd charges depreciation on plant to „cost of sale‟

(iii) In December 2010, Akosombo Ltd transferred some finished goods to Tema Ltd at a

transfer price of GHS15 million. Akosombo Ltd had marked up these goods by 25% on

cost. Tema Ltd had all of these goods still in its inventory at 31 December 2010. Also

included in the inventory of Juapong Ltd at 31 December 2010 were some raw materials

transferred from Tema Ltd at a transfer price of GHS5 million . Tema Ltd had also

marked up these goods by 25% on cost. There were no intra-group payables/receivables at

31 December 2010.

(iv) The available-for-sale investments are included in Tema Ltd ‟s statement of financial

position (above) at their fair value on 1 January 2010; they have a fair value of GHS36

million at 31st December 2010

(v) During the year ended 31 December 2010, the companies paid the following dividends and

were charged to the statements of changes in equity (retained earnings column).

Tema Ltd GHS25 million ( dividend per share of GHS0.50)

Akosombo Ltd Nil

Juapong Ltd GHS10 million (dividend per share of GHS0.50)

The „other income‟ in the separate income statement of Tema Ltd consists of the dividend

received from Juapong and the gain on transfer of plant to Akosombo Ltd.

vi) It is the group‟s policy to value non-controlling interest at full fair value. The market price of

a share of Akosombo Ltd immediately prior to the acquisition of controlling interest by

Tema Ltd was GHS4.80.

(vii) Impairment tests on 31 December 2010 concluded that the value of the investments in both

Akosombo and Juapong were not impaired.

Required:

Prepare the consolidated income statement for the year ended 31 December 2010 and a

consolidated statement of financial position as at 31 December 2010.

(20 marks)

(Total: 25 marks)

Page 6 of 12

�QUESTION 3

Sweet Potato Limited operates a large-scale commercial farm. It now plans to off-load some of its

shareholding to the public in order to raise funds to expand its operations.

Financial statements of Sweet Potato Limited are as follows:

Statement of Comprehensive Income for the year-ended 31st December, 2010

GHS

Turnover 245,800

Cost of sales 117,300

Gross profit 128,500

Selling, general & administrative expenses 87,140

Earnings before interest & tax 41,360

Interest 3,360

Profit before taxation 38,000

Taxation at 25% 9,500

Profit after tax 28,500

Income Surplus Account for the year ended 31st December 2010

GHS

Balance at 1/1/2010 95,940

Profit for the year 28,500

Dividends paid (12,400)

Balance at 31/12/2010 112,040

Statement of Financial Position as at 31st December, 2010

GHS GHS

Property, plant & equipment 197,500

Patents 16,400

Development expenditure 26,100

240,000

Current Assets

Inventories 43,400

Receivables 25,002

Bank and cash 11,888

80,290

Current Liabilities

Payables 30,800

Net Current assets 49,490

289,490

14% Medium-term loan (24,000)

Net assets 265,490

Page 7 of 12

� Financed By:

Stated capital 100,000

Capital surplus 53,450

Income surplus 112,040

265,490

Additional Information:

(i) Stated Capital is made up as follows: GHS

Ordinary shares (issued @ GHS0.20 each) 80,000

22% Irredeemable Preference Shares 20,000

100,000

(ii) A review of the development expenditure revealed that 60% of it is worthless.

(iii) An independent valuer has placed values on some of the assets, detailed as follows:

GHS

Property, plant & equipment 222,000

Inventories 32,400

Receivables 20,000

(iv) Profit forecasts for the next five years are as follows:

Profit before Tax Depreciation Charge

GHS GHS

2011 29,800 2,200

2012 32,000 2,450

2013 38,500 3,100

2014 39,600 4,050

2015 43,100 4,260

The estimated profit before tax figures are arrived at after charging the estimated

depreciation.

(v) Yam Limited is a competitor listed on the Ghana Stock Exchange and data extracted from its

recently published statements revealed the following:

Market capitalisation = GHS2,000,000

Number of ordinary shares = 800,000

Earnings per share = GHS0.20 (20 pesewas)

Dividend payout ratio = 80%

(vi) The patents represent a license to produce an improved variety of potatoes and is expected to

generate a pre-tax profit of GHS20,000 per year for the next five years.

(vii) The cost of capital of Sweet Potato Limited is 18%.

Required:

(a) Determine the value to be placed on each share of Sweet Potato Limited using the following

methods of valuation:

Page 8 of 12

� (i) Net assets

(ii) Prices-earnings ratio

(iii) Dividend yield

(iv) Discounted cash flow

(12 marks)

The discount factors and annuity at 18% for the relevant years are as follows:

Year 1 2 3 4 5

Discount factor 0.847 0.718 0.609 0.516 0.437

Annuity 0.847 1.565 2.174 2.690 3.127

(b) Outline any three (3) reasons why the dividend yield of Yam Ltd should be adjusted before

it is used to value the shares of Sweet Potato Limited.

(3 marks)

(Total: 15 marks)

QUESTION 4

Malibu Limited, producers of telecommunication equipment has been making losses in recent

times. The directors have proposed a scheme of reorganization, to take effect on 1st October 2011.

The statement of financial position of the company at 30th September 2011 is as follows:

Statement of Financial Position as at 30 September, 2011

ACCUM. NET BOOK

COST DEPN. VALUE

GHS GHS GHS

Fixed assets

Property, plant & equipment 100,000 20,000 80,000

Plant and equipment 250,000 60,000 190,000

Vehicles 45,000 15,000 30,000

395,000 95,000 300,000

Current assets

Inventory 40,000

Trade receivable 30,000

Bank 10,000

80,000

Less

Current liabilities

Trade payables 140,000

(60,000)

Net assets 240,000

Page 9 of 12

� Financed By:

Stated capital

Issued and fully paid

100,000 7% preference shares of GHS1.00 per share 100,000

400,000 ordinary share of GHS0.75 fully paid 300,000

400,000

Income surplus (160,000)

Net assets 240,000

Additional information:

(i) The ordinary shares are to be written down to GHS0.25 per share and then to be converted

into new ordinary shares of GHS1.00 per share fully paid.

(ii) The preference shareholders are to receive 40,000 ordinary shares of GHS1.00 per share,

fully paid in exchange for their preference shares.

(iii) Dividends on 7% preference are two years in arrears. In consideration for waiving their

rights to arrears of preference dividend, the preference shareholders have agreed to accept

10,000 new ordinary shares of GHS1.00 per share, fully paid in final settlement.

(iv) The creditors have agreed to take 100,000 new ordinary shares of GHS1.00 per share, fully

paid in part settlement of the amounts due them.

(v) The balance on the income surplus account is to be written off.

(vi) Some assets of the company have been revalued and are to be incorporated in the accounts

as follows:

GHS

Freehold premises 100,000

Plant and equipment 125,000

Vehicles 25,000

Inventories 36,000

(vii) An allowance of GHS3,500 is to be made for doubtful debts.

(viii) The ordinary shareholders have agreed to inject additional GHS90,000 cash by acquiring

120,000 ordinary shares at GHS0.75 per share fully paid.

(ix) Reorganisation costs amounted to GHS7,500.

Required:

a. Prepare capital reduction account, stated capital account and bank account.

(7 marks)

b. Prepare statement of financial position of Malibu Limited after the reorganization.

(5 marks)

c. Identify any three (3) reasons for which a company may opt to carry out a capital reduction

scheme. (3 marks)

(Total: 15 marks)

Page 10 of 12

�QUESTION 5

(a) Drums Limited is engaged in the procurement of animal skins and tanning same for the

production of church drums, hats, shoes and wallets. At the annual general meeting to

consider the financial statements for the year ended 31st December 2010, some shareholders

agitated over what they perceived to be the declining fortunes of the company.

The financial statements of drums Ltd for 2010 and 2009 are as follows:

Statement of financial Position as at 31st December,

2010 2009

GHS GHS

Intangible assets - 380,000

Non-current assets 1,224,000 1,204,000

1,224,000 1,584,000

Current assets 288,400 300,250

Inventories 299,800 348,050

Receivables - 36,500

Marketable securities 60,000 108,000

Cash and bank 648,200 792,800

Current liabilities 504,900 480,700

Trade payable 264,000 240,600

Other payables 768,900 721,300

(120,700) 71,500

Net current (Liabilities)/Assets 1,103,300 1,655,500

36,000 60,000

12% Medium-term loan 1,067,300 1,595,500

Net Assets

Financed By: 500,000 500,000

Stated capital 227,500 154,800

Capital surplus 339,800 940,700

Income surplus 1,067,300 1,595,500

Statements of Comprehensive Income for the year ended 31st December:

2010 2009

GHS GHS

Turnover 2,280,000 2,400,000

Cost of sales 1,920,000 1,884,000

Gross profit 360,000 516,000

Less: Selling, General & Admin. Expenses 240,000 252,000

Earnings before interest & tax 120,000 264,000

Less: Interest 4,320 7,200

Profit before tax 115,680 256,800

Taxation 28,980 64,200

Page 11 of 12

� Profit attributable to shareholders 86,760 192,600

Dividend 65,070 96,300

Retained profit 21,690 96,300

Statement of Cash Flows for the year ended 31st December,

2010 2009

GHS GHS

Net cash inflow from operating activities 51,950 432,000

Investing activities (84,750) (2,150

Financing activities (15,200) 25,400

Net (Decrease)/Increase in cash & cash equivalents (48,000) 455,250

Cash & cash equivalents at beginning 108,000 (347,250

Cash & cash equivalents at 31st December 60,000 108,000

Additional information:

(i) Drums Ltd is registered with 500,000 ordinary shares of no par value out of which 200,000

shares were issued at GHS1.00 per share.

(ii) The company‟s shares are currently trading on the Ghana Stock Exchange at GHS2.50 per

share as at 31st December, 2010 (2009: GHS1.50).

(iii) Cost of sales includes depreciation of GHS32,400 (2009: GHS27,600).

(iv) Inventories at 1st January, 2009 were valued at GHS260,500.

Required:

Review the performance of Drums Limited for the year 2010.

Your review should include comments on the appropriateness of the level of dividend paid.

(15 marks)

Page 12 of 12