VAT

Company A has some business activities as follows:

a. Import 100 cars, import price CIF 20.000 USD/unit. Those cars sold to commercial company B

with the price 980 million VND/unit (Tax excluded).

Import tax: 100*20,000*83% = 1,660,000 USD

SCT payable = (1,660,000 + 20,000*100) * 50% = 1,830,000

VAT payable = 1,830,000*10% = 183,000

b. Buy 200 tons of sugars from company C with the price of 3,3 mil VND/ton (tax included). The

company exports 50 tons with price FOB 360 USD/ton. The left is sold to company D with the

price of 4,6 mil VND/ton (tax included).

c. Authorised to export for the company D a garment container to the USA, FOB value is 80.000

USD, commission is 2% on the FOB value.

• Know that: Export tax rate for sugars 1%, garment 0%; Import tax rate for car 83%; SCT rate for car 50%,

VAT rate for all products 10%. Exchange rate 1 USD = 23,000 VND.

• Caculate the tax amount the company has to declare and pay for the government.

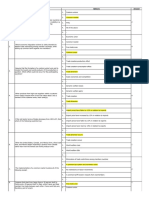

Exercise: VAT rate = 10%

Cotton farmer A B C D Consumers

Input price

100 130 200 250 300

(Giá mua đầu vào)

Input VAT

0 13 20 25 30

(Thuế VAT đầu vào)

Output price (without VAT)

100 130 200 250 300

(Giá bán chưa thuế GTGT)

Output VAT

0 (miễn thuế) 13 20 25 30

(Thuế GTGT đầu ra)

Sales price with VAT

100 143 220 275 330

(Giá bán có thuế GTGT)

Value added

100 30 70 50 50 0

(GTGT tạo ra)

VAT paid

0 13 7 5 5 0

(Thuế GTGT phải nộp)

VAT (in total)

30

Tổng số thuế GTGT

SCT

1. Thang Long Tobacco Factory sells a shipment of cigarettes to agents including 500 packs of cigarettes

for 15,000 VND/pack (price includes tax). Calculate the excise tax that the factory has to pay, knowing

the excise tax rate is 65%?

Price excluding VAT = 15,000/(1+10%) = 13,636

� SCT taxable price = 13,636/(1+65%) = 8,264

SCT payable = 8,264*500*65% = 2,685,800

2. An enterprise imports 300 bottles of wine at CIF 15 USD/bottle. Import tax 60%, SCT 50%. Exchange

rate 1USD = 23,000VND. Calculation of excise tax payable upon import?

SCT taxable price = 15 + 15*60% = 24

SCT payable = 24*300*50% = 3600

3. An imported car is priced at CIF: 20,000 USD; the import tax rate of this model is 70%; SCT rate is

45%; Assume the exchange rate to calculate import tax at the time of import is 22,500 VND/USD. The

selling price excluding VAT stated on the invoice of the importer is 1,164,712,500 VND. Calculation of

SCT This company is entitled to withhold and pay SCT when selling domestically.

Step Content Tax rate Amount (VND)

1 Import taxed price of the car 450.000.000

2 Import tax = (1) x import tax rate 70% 315.000.000

3 SCT of the imported car = ((1) + (2)) x SCT rate 45% 344.250.000

4 The cost of imported car = (1) + (2) + (3) 1.109.250.000

5 The selling price of the importer (VAT exclusive) 1.164.712.500

6 The SCT of the car at selling stage = (5)/(1+45%) 803.250.000

7 SCT at selling stage = (6) x SCT rate 45% 361.462.500

8 Payable SCT at selling stage = (7) – (3) 17.212.500

Tariff

Company A conducts some transactions as following, calculate the export/import tax the company A has

to pay as taxpayer?

1. Export 15,000 products at price of FOB 300 USD/product

Export tax = 300*15,000*2% = 90,000

2. Authorize to export 10,000 products at CIF price of 600 VND/product

Xuất khẩu ủy thác, Export tax = 0

3. Import 20,000 products at CIF price of 10 USD/product

Import tax = 10*20,000*10% = 20,000

4. Import 15,000kg raw material, FOB price at 14 USD/kg, international transportation & insurance

cost of 1USD/kg. Out of 15,000kg raw material, there are 5,000kg would be used for making

products according to signed exporting contract.

Import tax = (15,000 – 5,000)*(14 + 1)*1% = 1,500

5. Import 100 automobiles at CIF price of 20,000USD/unit. During transportation, there was 10

automobiles was broken and lost 30% value (according to inspection of customs).

Import tax = 20,000*(90*70%)*50% = 630,000

�Knowing that

Export duty rate of 2% for products,

Import duty rate of 10% for products and 1% for raw material; 50% for automobile

Exchange rate 1 USD = 23,500VND

CIT

ABC manufacturing-trading company in the period, there are the following activities:

- Selling 100,000 products to company X, with the VAT-exclusive price of VND 220,000 / product.

- Directly exporting 50,000 products under CIF term at the price of 240,000 VND / product, the cost of F and I

is 2% of the CIF price.

- Selling to enterprises Y in the EPZ 150,000 products at the price of USD 15 / product, the exchange rate of

16,000 VND / USD

- Selling to supermarket Z 80,000 products with VAT included price is 231,000 VND / product

- Exporting 20,000 products according to FOB price of 230,000 VND / product

- Received to process 100,000 products directly to foreign countries, the processing price was 10,000 VND /

product, in the period the company only completed 80% and the finished products were returned to foreign

countries.

- Loss from last year carried forward to this year is: 100 million VND

- Deductible administrative and sales expenses during the period are: VND 80,268 million

- Input VAT deductible during the period is: 3,260 million VND

a. Calculate the taxes ABC company must pay

Output VAT (thuế VAT đầu ra): 220,000*100,000 sản phẩm = 2.200.000 vnđ

Taxable export (Thuế xuất khẩu): 50,000 sản phẩm*(240,000*2%)*2% thuế XK= 235,200,000 vnđ

Export tax: 150,000*15*16,000* 2% = 720tr

Output VAT: 80,000* (231,000/(1+10%)) * 10% = 1,680,000

Export tax: 20,000*230,000*2%= 92,000,000

Receive to process (Nhận gia công): ko thuế

b. VAT calculation for company ABC must pay at the end of the period

Thuế VAT đầu vào (đề bài): 3,260 triệu

Thuế VAT đầu ra: 2,2+1,68= 3,880 triệu

Thuế phải nộp: output - input = 620 triệu

c. CIT payable by ABC company at the end of the period

Turnover (Doanh thu):

�(220,000*100,000) + (50,000*240,000) + (150,000*15*16,000) + (80,000*(231,000/1.1)) * 20,000*230,000 +

100,000*10,000*80% = 92.200 triệu

Deductible cost (Chi phí được trừ)

Thuế xuất khẩu: 235.2 (bước 2) + 720 (bước 3) + 92 (bước 4) = 1047,2 triệu

Phí vận chuyển và bảo hiểm quốc tế: 240,000*50,000*2% = 240 triệu

Tổng chi phí được trừ: 1047,2+240+80.268 (đề bài)= 81.555,2 triệu

Thu nhập chịu thuế: 92.200 -81.555,2 = 10.644,8 triệu

Thu nhập tính thuế: 10.644,8 - 100 = 10.544,8 triệu

Thuế TNDN phải nộp: 10.544,8 *22%= 2.319,856 triệu

Know that export tax is 2%