0% found this document useful (0 votes)

214 views3 pagesPartnership Formation Journal Entries

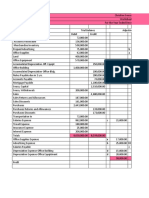

1. Mulles, the owner of a fertilizer business, formed a partnership called Mulles & Lucena Storage and Sales with Lucena, the owner of a nearby warehouse, to expand operations.

2. The partners agreed to share profits and losses equally and invest equal amounts in the partnership. Lucena contributed land worth $500,000 and a building worth $1,450,000.

3. Journal entries were made to transfer Mulles' assets and liabilities into the new partnership books at agreed upon values, and to record Lucena's capital contribution in cash of $2,393,000 resulting in equal partner capital balances.

Uploaded by

aicsrlcabornayCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

214 views3 pagesPartnership Formation Journal Entries

1. Mulles, the owner of a fertilizer business, formed a partnership called Mulles & Lucena Storage and Sales with Lucena, the owner of a nearby warehouse, to expand operations.

2. The partners agreed to share profits and losses equally and invest equal amounts in the partnership. Lucena contributed land worth $500,000 and a building worth $1,450,000.

3. Journal entries were made to transfer Mulles' assets and liabilities into the new partnership books at agreed upon values, and to record Lucena's capital contribution in cash of $2,393,000 resulting in equal partner capital balances.

Uploaded by

aicsrlcabornayCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 3