0% found this document useful (0 votes)

389 views18 pagesCommon Candlesticks and Patterns PDF

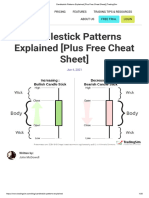

The document provides an in-depth overview of Japanese candlestick patterns and their meanings. It discusses the anatomy of candlesticks including body size and shadows. Long bodies indicate strong buying or selling pressure, while short bodies imply little activity. Shadows signify session highs and lows. Specific patterns are also examined, including hammers and hanging men as single candle reversals, and dojis, marubozus, and spinning tops as examples of basic patterns showing indecision between buyers and sellers.

Uploaded by

asadalirajpoot752Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

389 views18 pagesCommon Candlesticks and Patterns PDF

The document provides an in-depth overview of Japanese candlestick patterns and their meanings. It discusses the anatomy of candlesticks including body size and shadows. Long bodies indicate strong buying or selling pressure, while short bodies imply little activity. Shadows signify session highs and lows. Specific patterns are also examined, including hammers and hanging men as single candle reversals, and dojis, marubozus, and spinning tops as examples of basic patterns showing indecision between buyers and sellers.

Uploaded by

asadalirajpoot752Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 18