0% found this document useful (0 votes)

18 views9 pagesSubmitted To: Ma'Am Mehwish Aziz: Ssignment O

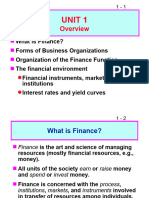

The document is a response to an assignment submission for a Financial Management course. It contains answers to 3 questions defining key financial terms. Question 1 defines terms like finance, financial management, investing decision, assets management, dividends, expenses, revenues, debt financing, equity financing and various financial instruments. Question 2 defines financial markets and its types like primary market, secondary market, money market, capital market, spot market and future market. Question 3 defines financial intermediaries and lists banks and credit unions as examples of financial intermediaries.

Uploaded by

Fahad khanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

18 views9 pagesSubmitted To: Ma'Am Mehwish Aziz: Ssignment O

The document is a response to an assignment submission for a Financial Management course. It contains answers to 3 questions defining key financial terms. Question 1 defines terms like finance, financial management, investing decision, assets management, dividends, expenses, revenues, debt financing, equity financing and various financial instruments. Question 2 defines financial markets and its types like primary market, secondary market, money market, capital market, spot market and future market. Question 3 defines financial intermediaries and lists banks and credit unions as examples of financial intermediaries.

Uploaded by

Fahad khanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 9