0 ratings0% found this document useful (0 votes) 20 views6 pagesDirector Report 2023

Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content,

claim it here.

Available Formats

Download as PDF or read online on Scribd

DIRECTORS’ REPORT

Dear Members,

‘The Board of Directors of ICMAI Management Accounting Research Foundation have

pleasure in presenting before you the 14* Annual Report of the Company together with

the Audited Statements of Accounts for the year ended 31% March, 2023.

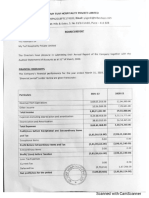

FINANCIAL HIGHLIGHTS:

(Amt. in thousand Rupees)

Total Expenses

Surplus/ (Deficit) Before Tax iz (4620) (65,53)

Current Tax : :

Earlier Year Tax - 1,05

Deferred Tax z =

Surplus/ (Deficit) after tax (46,20) (6658)

OPERATIONS:

During the year 2022-23, the business of the company picked up after the COVID-19

effect in India. Technical and Advisory Service project of Artificial Limbs Manufacturing

Corporation of India (ALIMCO) and examination project of V.0. Chidambaranar Port

‘Authority (VOCPA) have been completed successfully. Technical and Advisory Service

projects of Dedicated Freight Corridor Corporation of India Ltd (DFCCIL) and Airports

Authority of India (AAI) were on-going during the year and income has been booked upto

stages completed during the year.

During the year, the Company was awarded a prestigious 5 days’ Residential Training

Program by the Ministry of Finance, Department of Economic Affairs (DEA) which was

conducted and completed successfully in partnership with XLRI- Xavier School of

Management, Jamshedpur (Jharkhand) at Bhubaneswar. Apart from the above Training

Program, the Company has also conducted successfully the Training Programs on

Implementation of International Financial Reporting Standards (IFRS)/ Ind-AS &

Workshops on Contract Management / Safeguards to be taken in Tendering, Procurement

and Contracting; and GST- Registration etc. under RDC Scheme of Department of Public

Enterprises (DPE) for the executives of CPSEs; Contract Management and Arbitration

Programs for Indian Navy; Training Programs on Risk Based Internal Audit (1A), Forensic

Audit and Machine Based Learning in 1A for BHEL; Risk Management for DFCCIL;

Contract Management, Negotiation and Major Aspects of Procurement for Nepal

Electricity Authority, Kathmandu (Nepal).�BUSINESS OUTLOOK:

After COVID-19 pandemic, now there are rising opportunities for the Company in all

Business verticals: Technical & Advisory Services, Residential and Non-Residential

Management Development Programs, Training both offline & online & Workshops,

trainings and examinations for recruitment & promotions. Many projects in Technical &

Advisory Services have been achieved and some are in pipelines. Nomination from Public

Sector Undertakings (PSUs) for various Residential Management Development Programs

is picking up. All the business verticals will contribute to the company growth both in

turnover and profitability during financial year 2023-24.

FUTURE PROSPECTS:

During the year 2023-24, the company has already got two Technical and Advisory

projects from PSUs/Government. Indian Railways for whom the company designed its

Performance Costing System embedded with IT applications, is likely to award a project

for implementation of Performance Costing System starting with Northern Railway and

later its roll over on other Zonal Railways. The projects awarded during 2023-24 and on-

going will contribute towards high turnover and profitability for the company and it will

be able to wipe up some of the losses suffered in past.

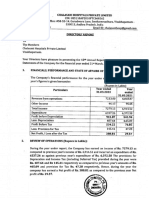

RESERVES & SURPLUS:

(Amt. in thousand Rupees)

Opening Balance 250,82 317,40

Add: Surplus/ (deficit) for the Current year (46,20) (66,58)

Balance carried forward 234,62 250,82 |

DIVIDEND

‘The Company being a Section 8 Company under the Companies Act, 2013, no dividend

could be declared.

PUBLIC DEPOSITS:

Your Company did not accept public deposits during the year under review.

DIRECTORS:

‘As on 31% March 2023, the Board consists of following directors on its Board as

nominated by its Promoter - The Institute of Cost Accountants of India:

1. Shri Vijender Sharma

2. Shri Rakesh Bhalla

3. Shri H, Padmanabhan

4.

5.

|. Shri Biswarup Basu

Dr. KChAVSN Murthy�6. Shri Chittranjan Chattopadhyay

7. Shri Chandra Wadhwa

8, Shri Kunal Banerjee

MEETINGS OF BOARD:

The Directors of the Company met 4 times during the financial year 2022-23 on 27 June

2022, 4% August 2022, 29 September 2022 and 7** March 2023. The intervening gap

between the Meetings was within the period prescribed by the Articles of Association of

the Company. The details of the meeting along with their attendance in the Board

meetings are as follows:

S. | Name of Directors | 27.06.2022 | 04.08.2022 | 29.09.2022 | 07.03.2023

Shri P.Raju lyer

Shri Vijender Sharma

Shri Biswarup Basu

[Dr. KCh AVSN Murthy

Shri Ashwin G Dalwadi

‘Shri Chittranjan

Chattopadhyay

1

2

3

4 _| Shri Balwinder Singh

5

6

7

3|>|~/>|-~) |

|<] 0/0] >| 0) >

=|~]>|>|-)-0 >

2|>|| >|] >| >

8 | Shri Chandra Wadhwa

~

~

7

7

CORPORATE SOCIAL RESPONSIBILITY COMMITTEE:

‘The provisions of Section 135 and schedule VII of the Companies Act, 2013 are not

applicable to the Company as the net worth, turnover and net profit during the financial

year is less than the stipulated amount. Accordingly, no policy has been framed by the

company on Corporate Social Responsibility and there is no reporting requirement

pursuant to provisions of Section 134(3) (0) of the Companies Act, 2013.

RISK MANAGEMENT:

As per requirement of Section 134(3)(n) of the Companies Act, 2013 the Board of

Directors has approved the Risk Management Policy. Presently the Company does not

have any operations or any employees or assets as such to identify risks.

INTERNAL CONTROL SYSTEMS:

‘The Company has in place proper and adequate internal control systems commensurate

the nature of its business and size and complexity of its operations, Internal control

systems comprising of policies and procedures are designed to ensure reliability of

financial reporting, timely feedback on achievement of operational and strategic goals,

compliance with policies, procedure, applicable laws and regulations, and that all assets

3�and resources are acquired economically used efficiently and adequately protected.

SUBSIDIARIES, JOINT VENTURES OR ASSOCIATE COMPANIES:

During the year none of Company become or ceased to be its Subsidiaries, joint ventures

or associate.

COST AUDIT/ COST AUDITORS: Not Applicable

‘SECRETARIAL AUDIT REPORT:

The Company does not fall within the purview of provisions of Section 204(1) of the

Companies Act, 2013 read with Rule 9 of the Companies (Appointment and

Remuneration of Managerial personnel) Rules, 2014.

LOAN, GUARANTEE OR INVESTMENTS:

‘The Company has not given any Loan, Guarantee or made any Investment in any other

Body Corporate or to any person beyond the limit prescribed under Section 186 of the

Companies Act, 2013. Hence there is nothing to report in respect of the requirement of

Section 134(3) (g) of the Companies Act, 2013.

RELATED PARTIES TRANSACTIONS:

The Company has not entered in any transaction/contract or arrangement with the

Related Parties as per Section 188 of the Companies Act, 2013, hence there is nothing to

report in respect of requirement of Section 134(3) (h) of the Companies Act, 2013.

CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION AND FOREIGN EXCHANGE

EARNINGS AND OUTGO:

As the nature of business of the Company being research, technical & Advisory services,

Management Development Programmes, the information as required under Section

134(3) (m) of the Companies Act 2013 read with Rule 8 of the Companies (Accounts)

Rules 2014 is regarded as Nil

‘There was no Foreign Exchange Earnings or Outgo during the financial year.

PARTICULAR OF THE EMPLOYEES:

‘There being no employees in the Company who is covered under Section 134(3) (e) of

the Companies Act, 2013, read with Companies rules made thereunder and accordingly

there is information to be given.

DETAILS OF SIGNIFICANT AND MATERIAL ORDERS PASSED BY THE REGULATORS

OR COURTS OR TRIBUNALS IMPACTING THE GOING CONCERN STATUS AND

COMPANY'S OPERATIONS IN FUTURE:�No material orders have been passed by the regulators or Courts or Tribunals, which

could impact the Company's going concern status.

MATERIAL CHANGES AND COMMITMENTS OCCURRED BETWEEN THE END OF THE

FINANCIAL YEAR OF THE COMPANY TO WHICH THE FINANCIAL STATEMENTS

RELATE AND THE DATE OF THE REPOR’

There are no material changes and commitments affecting the financial position of the

Company between the end of the financial year and the date of this Report.

DIRECTORS RESPONSIBILITY STATEMENT:

Pursuant to section 134(3) (c) of the Companies Act 2013, your Directors, based on the

representations received from the operating management after due enquiry, confirm

thats

a) In the preparation of annual accounts applicable accounting standards have been

followed along with proper explanation relating to material departures.

b) The directors had selected such accounting policies and applied them consistently

and made judgments and estimates that are reasonable and prudent so as to give a

true and fair view of the state of affairs of the Company at the end of the financial

year and of the profit and loss of the Company for that period;

©) The directors had taken proper and sufficient care for the maintenance of

adequate accounting records in accordance with the provisions of this Act for

safeguarding the assets of the Company and for preventing and detecting fraud

and other irregularities;

4) The directors had prepared the annual accounts on a going concern basis; and

e) The directors, in the case of a listed Company, had laid down internal financial

controls to be followed by the Company and that such internal financial controls

are adequate and were operating effectively - Not Applicable.

f) The directors had devised proper systems to ensure compliance with the

prop

provisions of all applicable laws and that such systems were adequate and

operating effectively.

COMPLIANCE WITH ALL LAWS

‘The Company has appointed Ms Rashmi Gupta, Joint Director as Company Secretary and

Compliance Officer with effect from 1* May 2023. During the year 2022-23, Shri Pardeep

Khaneja, Joint Director worked as Company Secretary and Compliance Officer. Both the

officers are responsible during their period to ensure compliance with the provisions of

all applicable laws and that the system was adequate and operating effectively.�STATUTORY AUDITORS:

M/s Yogesh & Jain, Chartered Accountants (Firm's Registration No. 008734N, PAN:

AABFY9981D) was appointed as Statutory Auditors of the Company by the Board during

2020-21 for a period of five years to hold office from the conclusion of the 11" Annual

General Meeting to be held in 2020-21 and same was ratified by Annual General Meeting.

M/s Yogesh & Jain, Chartered Accountants will hold office till the conclusion of 16"

Annual General Meeting of the Company to be held during 2024-25. They are eligible for

re-appointment for the next term of five years from the conclusion 16" Annual General

Meeting of the Company to be held in 2024-2025.

AUDITOR'S OBSERVATION:

There are no adverse remarks/ observations set out in the Auditor’s Report of the

Company.

ACKNOWLEDGEMENT:

Your Directors convey their sincere thanks to the various agencies of Central

Government, Regulators, Financial Institution, Banks and other concerned agencies for

the continued co-operation, help and encouragement extended to the Company during

the period under review.

Your Directors also thank the members of Board for their support. Your Directors also

wish to place on record their deep appreciation for the officers, staff and workers of the

Company at all levels.

For and on behalf of the Board

ICMAI Management Accounting Research Foundation

>

(Vijender Sharma)

Chairman

DIN: 07565928

Place: N@W Be bh’

Date: 17742022