0 ratings0% found this document useful (0 votes)

542 views23 pagesChapter 9 Issue of Debentures

Uploaded by

kalpana jadiyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

0 ratings0% found this document useful (0 votes)

542 views23 pagesChapter 9 Issue of Debentures

Uploaded by

kalpana jadiyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

You are on page 1/ 23

ia a Nts

1, Debenture

2. Debentureholder

Issue of Debentures for Cash

4, Issue of Debentures for

Consideration other than Cash

Issue of Debentures as

Collateral Security

6, Issue of Debentures at Par

Issue of Debentures at Premium

8, Issue of Debentures at Discount

9. Redemption of Debentures at Par

10, Redemption of Debentures

at Premium

1

). Interest on Debentures

yeamaa cnet

IN THE CHAPTER

Debentures a written acknowledgement of Debt issued by the

‘company.

‘According to Section 2(30) of the Companies Act, 2013,

‘Debenture’ includes debenture stock, bonds or any other

instrument of @ company evidencing a debt, whether

constituting a charge on the assets of the company or not.

Debentureholder is the person to whom debentures are

Issued,

It means issue of debentures against consideration being

receivedincash,

Itmeans issue of debentures against consideration not

bbeing received in cash but received in kind, ie, assets

or services.

It means that the debentures have not been issued for

consideration received in cash orn kind but have been issued as

2 security forloan taken.

‘It means that the issue price and the nominal (face) value of

debentures are same,

‘It means thatthe issue price ofthe debenture is higher than its

‘nominal (face) value.

| means that the issue price of the debenture is lower than its

‘nominal (face) value.

It means that the redemption value and the nominal (face)

value of debentures same.

It means that the redemption value of the debenture Is,

higher than its nominal face) value.

It is the cost of servicing the loans raised by the issue of

debentures

torent

+ Debenture: Debentureis a written acknowledgement of a debt by the company. It contains the terms for

the repayment of the principal debt on a specified date and for payment of interest at afxed per cent until

‘the principal sum is paid.

Disclosure of Debentures in Company's Balance Sheet: As per Schedule Ill of the Companies Act, 2013,

Debentures are shown in the Balance Sheet as Long-term Borrowings under Non-current Liabilities. But

debentures, shown a Long-term Borrowings and payable within 12 months from the date of Balance Sheet

Cr within the period of Operating Cycle is shown as Current Maturity of Long-term Debts under Short-term

Borrowings under the head Current Liabilities. Interest Accrued (due and not due) is shown as Other Current

Liability under Current Liabilities.

Characteristics of a Debenture

() Adebenture isa written document or certificate which acknowledges the debt by the company.

(i) The debenture certificate is issued under the common seal of the company, if the company has 2

common seal.

(i). Mode and period of payment of principal and interests fixed and is stated in the debenture.

(iv) Rate of interest is fixed and is stated in the debenture,

(W) The debt taken by issue of debentures is usualy secured by a charge on the asses ofthe company,

(ui) Its considered as an external equity or Long-term Borrowings of the company,

‘Types of Debentures

(i) Secured Debenturesare those debentures which are secured either ona particular asset or onallthe assets

(of the company in general.

(i) Unsecured Debentures are those debentures which are not secured by any charge on assets of.

the company.

(i). Redeemable Debentures are those debentures which will be repaid by the company at the end of

specified period.

(lv) redeemable Debentures ate those debentures which are not repayable during the if ofthe company.

(v) Registered Debentures are those debentures, where the name, address and number of debentures held

by the debentureholders are registered with the company.

(wi) Unregistered or Bearer Debentures are those debentures which can be transferred to any other person by

‘mere delivery. No record of such debentureholders is maintained by the company.

(ull) Fist Debentures are those debentures which are to be repaid before the other debentures.

(vii). Second Debentures are those debentures which are to be repaid after the first debentures.

(ix) Specific Coupon Rate Debentures are those debentures which cary specified rate of interest.

(0) Zero Coupon Debentures Bands) are those debentures which do not cary any rate of interest.

(i) Convertible Debentures are those debentures which can be converted into shares after a specified period.

(ai) Fully Convertible Debentures (FCD) are those debentures where the whole amount is tobe converted into

Equity Shares.

(xi) Partly Convertible Debentures (PCD) are those debentures where only a part ofthe amount of debenture

|s convertible into Equity Shares.

(xiv). Non-Convertble Debentures are those debentures that are not convertible into shares of the company.

+ Debentures Trust Deed isa document created by the company whereby trustees are appointed to protect

the interest of debentureholders before they are offered for public subscription,

2

+ Issue of Debentures: Debentures like shares, can be issued fori) cash and i) consideration other than cash.

“These debentures can be issued at: (a) par or (b) premium or (¢) discount.

‘Accounting for issue of debentures for cash is the same as the accounting for issue of shares with one

change, ie, the word ‘Share’ shall be replaced by ‘Debentures’ and ‘Share Capita’ by ‘Debentures! The

terms used forthe issue of shares willbe changed at the time of issue of debentures

Terms fr sue of Shares Terms for ksue of Debentures

1. Shares Application’ Allotments Call. etc. 1. Debentures Application/AlotmentFist Call etc.

2. Share Capital 2 Debentures

3. Discount ontssue of Debentures

Note: Premium on the issue of shares or debentures i called Securities

+ Premium on Redemption of Debentures: Disclosure in the

lance Sheet

(0 fdebentures are shown as ‘Long-term Borrowings; then its shown in the Equity and Liabilities Part of

the Balance Sheet under the head Non-Current Liabilities and sub-head ‘Other Long-term Liabilities.

(if debentures are shown as Short-term Borrowings, then itis shown in the Equity and Liabilities part of

the Balance Sheet under the head ‘Curcent Liabilities’ and sub-head “Other Current Liabilities’

(if debentures are shown as'Current Maturities of Long-term Debts; then its shown under the head ‘Current

Liabilities and sub-head ‘Other Current Liabilities

+ Interest on Debentures is considered as an expense. It's a charge against the profit ofthe company and is

payable whether the company earns profit or not

+ Issue of Debentures for Consideration other than Cash: A company can issue debentures to the vendors

asa payment forthe purchase ofthe assets, such an issue of debentures is known as issue of debentures for

consideration other than cash,

+ Issue of Debentures as Collateral Security means issue of debentures as a subsidiary or secondary security.

Collateral security means additional security, ie, in addition tothe prime secur Itisonly to be realised when

the prime security fails to pay the amount ofthe loan.

Debentures issued as Collateral Security may or may not be recorded in the books of account. fan accounting

entry is not passed, itis disclosed under the loan fan accounting entry is passe, its shown below the loan

first as Debentures Issued and thereafter Debentures Suspense Account is deducted,

+ Writing off Discount or Loss on Issue of Debentures Discount or Loss on Issue of Debentures is written off

Inthe yearit is incurred, e, in the year debentures are allotted. It may be writen off from Securities Premium,

and/or from Statement of Profit & Loss. Accounting entry willbe as follows:

Securities Premium Ae Dr

Andlor

Statement of Profit & Loss De

To Discount or Loss on Issue of Debentures A/c

a

than cash | promotors or Undecwntars As Colors Secury

f 1

pa er a ee

eel ES eae Sewers &

“Journal ‘Journal Ent = aa

aowae De Bank Ale ” De oe Promoters Ae or

a eee) cs

erate a H Eater]

fest 2 | (imine eae

Siete | [amgeecane a

Ee mula

a a oe

se eS

—_

Te aT aa

ee & cae] Ee

: a — x

pean a

ee eee Oe Vendor's Ale .Or.| | Vendors Ale -Br.| | Vendor's Ae Dr

[loon some na Ft leet

“To Securit Premium A

“babes Ae

—

—

“i puraoo eonedaton gue are hn rl oan nrc osbioa f Goodwill

purchase conseraton pons se Menta, ton dans odtoaa Capa Reserve A|

2

(ins) (arene)

[Fae] [Eizwaten| ee ([fae=) [imanen]

| | | |

‘Alot Datentres and | [Alot Oabentaes andtanstor | [Alot Debentures and [ot Debentures and ranster | Aloe Deoortures and | [Alot Debentures and wantor

Tranter Apptesion || Apteaton Maney transfer Aoplcston Aopteatin Maney fraser Azpicaton || Apaton Money

‘anaAtoment Money —||0--s¢Dedortures At: andteemen Money oe 3 Debentures Ae JandAtoment Money | |t0"% Debentures Ae:

0. Debontses Ate |] Debenures AopicatonAe..0r| 0% Debeaures Ae: | | Debentures Application Ale..0r| |t..%6 Debentures Ae: || Dobotuos Apoteaton Aer

Debentures Appteaten ||""To xs Debentures Ne Debentures Aplin “ore bebertures Ne ||[DabartresApgeaton_| | Dactunt on tous ot

fandAlotment Alc Dr || ToDebentree AleimentAve ||adAlomentAec cr || ToBankAe! landAtoimentac Or] | Debentures Ae or

"o..tsbebentues Ac || To Bank Ale! “o.-% Deberies Ne Calsi-aavance Ne || Discounten suet "|| "To Debentures Ne

‘Cale Aavance Ale ‘ToSecuries Premium Ac’| | Gfeverubecrbed) DesonurosAte” — .0c|| To DaberaresAletment lc

roaaissEeh| ToBanine “Tom Debentues Ae || To Banke?

(oversubscribed) Todencale Caliradvance Ae

(overibsertes) || (foversbscrbed)

mi ale le

esd a Par [eet Prema] Teese at Oienint

(ietimesm] = estan] ce ee [eiinesom] = [naive]

7 T T T 7 T

‘it Daventres and | [Alot Dabantres and wanser | [Alot Debentures and | [Alt Dabantires and wanater | [Alot Dabentres and | [Alet Debentures and wanatar

frensterApotcaion | | Appicaion Nonoy lranstorApotcaton | | Apaleaton Morey IranstorAppicaton | | Applicaton Money

‘andalcmen Money | | ta” 3 Debanues Ate JandAtomentueney | |10-% Debortes Ae: [anaatoment Money | | os Debentures Ae

o..% Dabenures A: | | Debentures Apleaten Ne. |io.% Dabontres At: | |Debortures Appleton Nc .Or| |10..% Dsbontres At | | Detentuos Appleaton Ae.

Debentures Anpteaton | | Loesontssue of Desenures Apaieaton | |Loss on leew of Debentures Agteaten_ | | Daceuntoesonatue of

JandAiotnentAc De | Debentures Ae cr Jentalotment dle Dr| | Debentures le .0«| |andAtomenAc Dr | Debentures Ale be

Loss on ese of “To. Oabentros Ne Leeson ese o| “To. Debantres Ne DiscountRoss on sue | | To. % Debentures Ne

Desentures We On| | ToBebentaesatmentAc | [Debentures vo, or. | | ToGebentres tment Ac | |otDebertuas No -.| | To Debentures Alatment Ac

“o.s Debennuesc | |” (roversubsones) “o..%6 Debentures | | (oversubscribed) To..J6 Debentures Ae | | (foversbscrbos)

ToDebentios. ‘oPremumn Resemgton || To Secunies Premium | | ToPremum en Redemption || To remum an Res. | | To Premum on Res

‘Aetment Ae ‘of Debentures Ne Ae ‘of Debentures Ne of Debentures Ac ‘of Debentres Ae

(oversubserbes) ‘ToPremum on Re,

‘ToPremumon Re. ‘of Debentres Ae

ot Debentras Ne

—L — —

1 f

“iatant Maney Dos “Ga Recabng Alaina’ Money: “Ga Fat and Fl Ga Menay Dust “noun Received on Fa and Pal Ca

Debentures Asient Nc oe |_| Baneae or |__,J Seventies Fret ona Fina Cale Or | | Baniale OF

“po. % Debentures Ne “To Debentures Aletment Ne “ou % Debentures Ne “To Debentures First ang Final Callie

‘To Secure Premium Ne

oo

"sue al Searites Premium is recived long wih te Aplaion Maney.

“Assume thal discount alowed is along wih Appleton Money

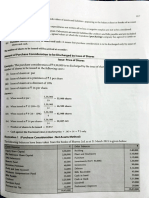

Mlustration 1.

A Ltd. issued 5,000; 9% Debentures of € 100 each at par and also raised a loan of & 80,000 from

bank, collaterally secured by % 1,00,000; 9% Debentures. How will be the Debentures shown

in the Balance Sheet of the company when the company has passed Journal entry for issue of

Debentures as collateral security in the books?

Solution: Alta.

[AN EXTRACT OF BALANCE SHEET as at.

Particulars Noten] &

EQUITY AND LIABILITIES

Non-Current Liabilities

Long-term Borrowings 1 580,000

Note to Accounts

1. Long-term Borrowings z

+5900; 9% Debentures of 100 each 500000

Loan from Bank 80000

1,000; 9% Debentures of 100 each sued as Collateral Securty

Less: Debentures Suspense A/c

580,000

Mlustration 2.

‘On Ist April, 2022, Welfare Ltd. took over assets of % 4,50,000 and liabilities of & 60,000 of

Himalyan Ltd. for the purchase consideration of € 4 40,000, It paid the purchase consideration

by issuing 8% Debentures of @ 100 each at 10% premium, On the same date it issued another

3,000, 8% Debentures of € 100 each ata discount of 10%, redeemable at a premium of 5% after

5 years. According to the terms of the issue 30 is payable on application and the balance on

the allotment of debentures.

You are required to pass Journal entries in the books of Welfare Ltd. to record the above

transactions.

Solution: JOURNAL OF WELFARE LTD.

Date | Particulars un] me@ | ce

22

‘Aptl 1 | Sundhy Assets Alc Dr. 450000

Goodwill Al (Balancing Figure) Dr. 50,000

To. Himalyan Ltd 440,000

To. Sundry Liabilities Ale 60000

(Assets and liabilities of Himalyan Ltd taken over for

net consideration of& 440,000)

Himalyan td Or 44000

To. BDebentues Ale 400,000

To. Secuties Premium Ale oco

(4000; 8% Debentures of 100 each issued ata

premium of 108)

2023

March 31

Bank Ale

To. Debentures Application Ale

(pplication money received fr 3000,

8% Debentures)

Debentures Application Nic

To. 8%Debentures Alc

(8,000; 8% Debentures allotted)

Debentures Allotment A/c

Losson sue of Debentures Alc

To 8% Debentures Alc

‘To. Premium on Redemption of Debentures Ac

(Allotment money due on 3,000; 8% Debentures at

10% Discount and redeemable at 5% premium)

Bank Arc

To. Debentures Allotment A/c

(Allotment money received)

Securities Premium Ne

Statement of Profit &Loss Finance Cost)

To. Losson ssue of Debentures Alc

(loss on ssue of Debentures written of)

De

Dr.

Dr

Dr.

Dr.

Dr.

Dk

90,000

90000

90,000

90000

1180000

45,000

210000

15000

11800000

180000

40000

5000

45000

Mlustration 3.

Lemon Tree Ltd. purchased a piece of land from JSS Ltd. and paid the consideration as follows:

(i) Issued a cheque for ® 10,00,000;

(ii) Issued a Bill of Exchange for 3 months for & 5,00,000;

iii) Issued 5,000; 9% Debentures of 100 each at par redeemable at 10% premium after 5 years.

Pass the Journal entries.

Solution: JOURNAL OF LEMON TREE LTD.

Date | Particulars oe | Ce

Land Ne De 20,00,000

To JSSutd 200,000

(Land purchased)

Asse, De 20,00,000

Loss on Issue of Debentures Alc Dx. 50000

To Bank Nc 100,000,

To Bills Payable Ale 390.000

To 9%5Debentures Ne 50,000

‘To. Premium on Redemption of Debentures Nc 50000

(Purchase consideration paid)

Statement of Profit & Loss Finance Cost) 5000

To Lossonlssue of Debentures A/c 50000

(Loss on issue of debentures written of)

Mlustration 4.

‘Good Blankets Ltd.’ are the manufacturers of woollen blankets. The company, to meet

the requirements of funds for starting its new factory, issued 50,000 equity shares of 810

‘each at par and 2,000; 8% Debentures of & 100 each to the vendors of machinery purchased

for & 7,00,000.

Pass necessary Journal entries for the above transactions in the books of the company.

Solution: In the Books of Good Blankets Ltd.

JOURNAL

Date_| Particulars Le] OF | GR

Machinery Ac 7.00000

To Vendor’ Alc 790,000

(Purchase of machinery from the Vendor)

‘Vendors Alc De 7.00000

To. Equity Share Capital 500000

To BY Debentures Ac 290,000

(sue of 50000 Equty Shares of 10 each and 2000; 8% Debentures

of 100 each at part the Vendor of Machinery

Mlustration 5 (Issue of Debentures at Par and Redeemable at Premium—Issue Price Payable

in Iustalments.

Adarsh Cosmetics Ltd. issued 5,000; 9% Debentures of € 100 each on Ist April, 2023 redeemable

at a premium of 8% after 10 years. According to the terms of prospectus @ 40 is payable on

application and balance on allotment of debentures.

Pass the necessary entries regarding issue of debentures.

Solution: JOURNAL OF ADARSH COSMETICS LTD.

Date [Particulars LE] ® | Ge

2023 | Bank Nc De 200000

‘Apt 1| To. Debentures Application Alc 290,000

(Aopicaion money received for 5,000 debentures © 40 per debenture)

‘Aptil_1 | Debentures Application Alc 200000

To 984 Debentures Ne 290,000

(Application money transfered to % Debentures Account)

‘Apt 1 | Debentures Allotment Vc De 300000

Loss on Issue of Debentures Alc De 40000

‘To. 9% Debentures Alc 300,000

‘To. Premium on Redemption of Debentures Ac 40000

(lotment of 9% Debentures at par and redeemable at 8% premium)

Bank Nec De 3.00000

‘To Debentures Allotment Nic 300,000

(llotment money received)

Mlustration 6.

KTR Ltd, issued 365, 9% Debentures of 1,000 each on 4th March, 2016. Pass necessary Journal

entries for the issue of debentures in the following situations:

(@ When debentures were issued at par, redeemable at a premium of 10%.

Gi) When debentures were issued at 6% discount, redeemable at 5% premium. (Delhi 2016)

Solution: (i) JOURNAL

Date | Particulars LE] @ | oe

2016

March 4) Bank Ac 365,000

‘To Debentures Application and Allotment Ac 365,000

(Application and allotment money received on 365; % Debentures

2 1000 each)

March 4) Debentures Application and Allotment A/c De 3.65000

Loss on issue of Debentures AC De 36500

‘To. 9% Debentures A/c 365,000

‘To. Premium on Redemption of Debentures A/c 36500

(265; 9% Debentures allotted and premium payable on redemption

2 10% provides)

(i, JOURNAL

Date | Particolars Le] ee | oe

2016

March 4) Bank Ac De 343,100

‘To Debentures Application and Allotment Ac 343,100

(Application and allotment money received on 365;9% Debentures,

(2 1,000 per debenture es 6 Discount)

March 4) Debentures Application and Allotment A/c De 343,100

Loss on issue of Debentures Nc De 40,150

‘To. 9% Debentures Alc 365,000

‘To. Premium on Redemption of Debentures A/c 18250

(265; 9% Debentures allotted at 6% Discount and premium payable

‘on redemption of debentures @ 5% provided)

Illustration 7.

During the year ended 31st March, 2023, Anderson Ltd. issued 12% Debentures of & 100 each,

as per the details given below:

(@) 900 Debentures issued as collateral security to a bank against a loan of & 60,000.

(b) The underwriters were to be paid a commission of & 48,000, 25% of the amount was paid

to them in cash and the balance was paid by the issue of Debentures at a discount of 10%

to be redeemed at par.

(©) A machine was purchased for 2,18,500. The vendor was paid by the issue of Debentures

at a premium of 15% to be redeemed at par.

4

(@) 5,000 Debentures were issued to the public at 5% premium, to be redeemed at a premium

of 5%.

‘The company wrote off all capital losses arising from the issue of Debentures at the end of the

year from its capital profits and if need be from its revenue profits.

You are required to Journalise the above transactions in the books of Anderson Ltd.

Solution:

JOURNAL

Inthe Books of Anderson Ltd,

Date

Particulars

Lr

0.8)

ce)

@

o

Bank Ne

To BankLoan Ne

{Bankloan raised)

Debentures Suspense Alc

‘To. 12% Debentures Alc

(900, 12% Debentures sued as Collateral Security)

Undernriing Commision Ale

To. Underwriters Nc

(Commission due to underwriters)

Underwiters’Ae

Discount on sue of Debentures A/c

To Bank Nc

To 12% Debentures Nc

(Cash paid and 400; 12% Debentures of 100 each sued ata discount of 10%)

Machinery Nc

To Vendor’ Alc

(Machinery purchased)

De

Vendor’ Nc

To 12%6 Debentures A/c (1,900 x 100)

To Securities Premium A/c (19008 15)

(1,900; 12% Debentures issue to Vendor a 15% premium)

Bank Nc

‘To Debentures Application and Allotment Ac

(Application money received for 5,000 debentures of € 100 each

ata premium of),

Debentures Application and Allotment A/c

Loss on sue of Debentures A/c

To. 12% Debentures A/c

To Secures Premium Alc

‘To. Premium on Redemption of Debentures Nic

(6000; 12% Debentures of 100 each issued at 5% premium and

redeemable at 5% premium)

‘Secuties Premium Alc

‘Statement of Profit &:Loss Finance Cost)

‘To Underwriting Commission Ac

To Discount on Issue of Debentures Nic

To. Loss on ksue of Debentures Nc

(Capital osses writen off)

‘60000

50,000

48000

48000

218500

218500

5.25000

5.25000

25000

53500

23500

0000

90000

48000

12000

40000

218500

190000

28500

525,000

590,000

25,000

25,000

48000

+4000

25,000

Mlustration 8.

On Ist April, 2022, Romi Ltd. issued % 10,00,000, 15% Debentures of € 100 each at 8%

discount payable:

740 on application, and

‘The balance on allotment,

‘These debentures were to be redeemed at a premium of 5% after five years. All the debentures

were subscribed by the public.

Interest on these debentures was to be paid half-yearly which was duly paid by the company.

You are required to:

(@)_ Pass Joural entries in the first year of debenture issue (including entries for debenture interest)

(ii) Prepare 15% Debentures Account for the year ending 31st March, 2023,

Solution: JOURNAL OF ROMI LTD.

Date | Particulars up] me | ce

202

‘Apil 1) Bank Alc Dr 400,000

To. Debentures Application Ale 490,000

{pplication money received for 10,000,

158 Debentures @ €40 per debenture)

Debentures Application A De 400000

To. 15%Debentures Ale +490,000

(10000, 15% Debentures allotted)

Debentures Allotment Alc De 520000

Loss Isue of Debentures A/c De 4,30,000

To 15% Debentures Alc 690,000

‘To. Premium on Redemption of Debentures Ac 30000

(Ailoument money due on 10000, 15% Debentures

Issued at 85 dlscount and redeemable at 5% premium)

Bank Ale De 5.20000

To Debentures Allotment A/c 520000

{Allotment money received)

Sept. 30) Debentures'iterest Ac De 75900

To. Debentureholders' Ac 75000

(intrest payable @ 15% pa, on debentures for 6 months)

Debenturehoides Alc De 75900

To Bank Alc 75000

(interest paid to debentureholdes)

208

March 31) Debentures Interest Nic De 7500

To. Debentureholders' Ac 75000

Ainterest payable @ 15% pa. for 6 months)

‘Debentureholdes A/c Dr 75,000

To BankAlc 75000

(interest paid to debentureholdes)

‘Statement of Profit & Loss Finance Cost) De 1130000

To. Losson sue of Debentures Ac 130000

(oss on ssue of Debentures written of)

by 15% DEBENTURES ACCOUNT

Date [Particulars © [Date | Particulars x

003 202

March 31 To Balance cid 1099000 | Apsl 1 By Debentures Application Alc | 400.00,

By Debentures Allotment Alc | $,20000

By Lossonisve of

Debentures Alc 30,000

70001000 [1970000

203

‘Aptil_1/ By Balance bid 100,000,

Mlustration 9.

Pilot Pens Ltd. issued 50,000, 6% Debentures of @ 100 each at a discount of 20%. It had balance

in Securities Premium of % 6,00,000 and % 1,00,000 in Surplus, ie,, Balance in Statement

‘of Profit & Loss, Profit for the year before writing off balance of Discount on Issue of Debentures

is &2,00,000.

Show the Notes to Accounts writing off the Discount on Issue of Debentures.

Solution:

Note to Accounts

Particulars z z

1. Reserves and Surplus

Securities Premium

Opening Balance 600000

Less: Discount onlsue of Debentures written off

Surplus, e, Balance in Statement of Profit & Loss

‘Opening Balance 100,000,

‘Ad: roft fr the year before writing off Discount on Issue of Debentures 200,000

3,00,000

Les: Balance Discount on lssue of Debentures 400000

Note: Balance amount of Discount on Issue of Debentures (€ 400,000) is written off fom Statement of

Prof & Loss. Hence the balance in Surplus, ie, Balance in Statement of rot & Loss shows negative

balance of 100,000,

lustration 10 (Issue of Debentures to Vendors at Discount with Part Payment in Cast).

Blue Ltd. purchased from HCL Ltd, computers of €3,00,000 and software for 5,00,000 payable

80,000 by cheque and balance by issue of 7% Debentures of € 100 each at a discount of 10%

‘The company has balance in Securities Premium of % 40,000,

Pass the Journal entries in the books of Blue Ltd

7

Solutio: JOURNAL OF BLUELTD.

Date | Particulars ur] oe | ae

‘Computers Ale De 300000

Software Nc “De. 5.00000

To HCL. 800,000

(Computers and Software purchased from HCL Ltd)

HeLa De 300000

Discount on sue of Debentures AYe De 20.00

To Bank Ac 80000

To 79Debentures Ne 800,000

(Cheque for ® 80,000 and 8,000, 7% Debentures issued at discount

of 10%)

‘Secures Premium Ac 40000

‘Statement of Profit &:Loss (Finance Cost) 40,000

Ta. Discount on Issue of Debentures Alc 80000

(Discount on Issue of Debentures written off)

Notes:

1. Discount on Issue of Debentures is written offin the year debentures are alloted,

2. Itis written off from Securities Premium and Statement of Profit & Loss in that order

7,20,000

3. Number of Debentures Issued = =8,000 Debentures

790

[Nominal Value of Debentures Issued =8,000 Debentures x € 100 = 8,00,000.

Mlustration 11.

Alok Ltd. issued 7,000, 10% Debentures of % 500 each at a premium of & 50 per debenture

redeemable at a premium of 10% after 5 years. According to the terms of issue, 200 was

payable on application and balance on allotment.

Record necessary Journal entries at the time of issue of 10% Debentures. (0D 2015.0)

Solution: In the Books of Alok Ltd.

JOURNAL

Date | Particulars Lr] ee | ee

Bank Nc 1400.00,

To. Debentures Application Ni 1400.00,

(Debentures aplication money received fr 7,000;

10% Debentures @ 200 each)

Debentures Application Ale 14000000,

To 10% Debentures A/c 1400.00,

(Application money adjusted on allotment)

Debentures Allotment Alc De 2450000

Loss on issue of Debentures Ac De 350,000

To. 10% Debentures A/c 200,000

To Secures Premium Ne 350,000

‘To. Premium on Redemption of Debentures Alc 350,000

(Amount due on 7,000; 108 Debentures of 500 each on allotment

(@ 8350 per debenture including premium of €50 each and

redeemable at 10% premium)

Bank Nc 2450000

To Debentures Allotment A/c (21,0900 + 3.50000) 245,000

(Amount received against allotment)

Ilustration 12.

Vijay Laxmi Ltd. invited applications for 10,000; 12% Debentures of @ 100 each at a premium

‘of 70 per debenture. The full amount was payable on application.

Applications were received for 13,500 debentures. Applications for 3,500 debentures were

rejected and application money was refunded. Debentures were allotted to the remaining

applications.

ass necessary Journal entries in the books of Vijay Laxmi Ltd. for the above transactions,

(Foreign 2012)

Solutio: In the Books of Vijay Laxmi Ltd.

JOURNAL

Date | Particulars LE] &@ | ae

Bank A/c (13,500 x 8170) 22.95,000

‘To Debentures Application and Allotment A/c 22,95,000

(Application money received on 13,500 debentures @ 170 per

debenture including ® 70 per debenture as premium)

Debentures Application and Allotment A/c 295,000

To. 12% Debentures A/c (10,000 x 100) 1000,000

“To. Securities Premium Alc (10,000 x 70) 790,000

To. Bank A/c (3,500 170) 595,000

(Application money adjusted and surplus refunded on allotment)

1. Complete the following Journal entries:

Date | Paticlars LE] cm | oe

‘Sundty Assets Ale De 25.00.00

? De. 200000

‘To. Sundry Liabilities Alc 50,000

To? 500000

To BSRLd, ?

(Business of SR Ltd purchased and ised a cheque for® 5.00000)

To s%Debentures Alc ?

@

Solutio

Date | Particulars Le] em | oe

‘Sundty Assets A/c De 25,0000

Goodwill Ae De 200000

‘To. Sundry Liabilities Ale 500000

‘To Bank Alc 0,000

To BSR, 170,000

(Business of SR Ltd purchased and isued a cheque for 5.00000)

BSR Ltd, 1¥7,00,000

‘To s¥Debentures Alc 117.0000

(mount due to BSRLtd settled by issue of 9% Debentures)

2. Perfect Barcode id, purchased computes om WV Computer Mart and pad the consideration as follows

(2) 1000, 10% Debentures of & 100 each ata discount of 108 and

(0) sued a cheque for 80,00 forthe balance amount

ass the Joural entry inthe books of Perfect Barcode ltd,

(Ans. 0x Computers Ale 1,70,000 and Discount on ssue of Debentures A/e—t 10.000;

10% Debentures A/c—R 100000 and Bank A/e—R 80000}

3. Lotus Lid. took over assets of 250,000 and liabilities of ® 30,000 of Goneby Company forthe purchase consideration

‘of 330,000 Lotus Ltd. pad the purchase consideration by issuing debentures of € 100 each at 10% premium.

‘Give Jounal entries inthe books of Lotus td. (Ans: GooduilX 1.10000)

4, Pass Journal entries inthe allowing cass:

(2) ACo. Lid. ssued® 40,00; 12% Debentures ata premium of 59% redeemable at pa.

(b) Ao. tt issued€ 40.000; 12% Debentures at a discount of 1% redeemable at pa.

(©) A Co.Ltd issued 40,000; 125 Debentures at par redeemable at 10% premium.

(@) Ao. tt. issued% 40000; 1295 Debentures at a discount of $8 and redeemable at 5% premium.

(@) ACo.ttdissued€ 40.000; 12% Debentures at a premium of 10% redeemable at 110%.

5. Pass necessary Journal entries and prepare 9% Debentures Account for the isue of 7,500, 9% Debentures

‘of @ 50 each ata discount of 6%, redeemable at a premium of 10%. (ase2019

1

6. ‘Sangam Woollens Ltd: Ludhiana, are the manufacturers and exporters of woollen garments. The

company decided to distribute free of cost woollen garments to 10 villages of Lahaul and Spiti District of

Himachal Pradesh. The company also decided to employ 50 young persons from these villages in its newly

established factory. The company isued 40,000 Equity Shares of & 10 each and 1,000, 9% Debentures of

100 each tothe vendor forthe purchase of machinery of ®5,00,000.

Pass necessary Journal entries. (Dabi2015, Mees)

{Ans.:() Dr. Machinery A/c and Cr. Vendors A/c by&5,00,000.

(i) Dr. Vendors A/c by&5,00,000: Cr. Equity Share Capital A/c by&4,00,000 and

996 Debentures A/c by 8 1,00,000}

7. ass Journal entries in the following cases:

(a) Rohit Ltd issued ® 40,000; 12% Debentures ata premium of 5% redeemable at par

(6) Virat Lt. issued & 40,000; 12% Debentures at a discount of 108% redeemable at par.

(0) Rahul Ltd. issued ® 40,000; 12% Debentures at par redeemable at 10% premium.

(d) Prithvi Ltd. isued ® 40,000; 12% Debentures ata discount of 5% and redeemable at 5% premium.

(e)_Shikhar Ltd. issued € 40,000; 12% Debentures ata premium of 10% redeemable at 110%.

8. Ltd. issued 1,000, 9% Debentures off 100 each ata discount of 6% These Debentures were redeemable

‘ata premium of 1036 after five years.

Pass necessaty Journal entries for issue of debentures and prepare 9% Debentures Account. (C85E2019)

9. Pass necessary Journal entries for the issue of Debentures inthe following cases

(a) © 40,000; 15% Debentures of 100 each issued ata discount of 10% redeemable at pa.

(0) ® 80,000; 15% Debentures of % 100 each issued at a premium of 10% redeemable at a premium

of 10%, 2013)

10. XYZ Ltd. sted 5,000, 10% Debentures of & 100 each on 1st April, 2022 at a discount of 10% redeemable

‘ata premium of 10% after 4 years. Give Journal entries forthe year ended 31st March, 2023, ifnterest was

payable half-yearly on 30th September and 31st March. Taxis to be deducted @ 10%,

11. Office Products Ltd issued on Ist Apri, 2019, 20,000, 9% Debentures of & 100 each at a premium of

10% redeemable ata premium of 5% after 5 years. Issue price was payable along with application.

Pass the necessary Journal entries.

Aen Rel Sey eae ue RLU RUE INR ZU}

1. Fill the missing values in the following:

JOURNAL OF ABLTD.

Date [Particulars Le] om | ce

To? 2

Apelication money received on 2000; 1294 Debentures of 100 each

Issued ata premium of 10% and redeemable at premium of 10%)

? De ?

7 De ?

To? z

To? z

To? ?

Kota

(0D 2016 €)

Solution: JOURNAL OF AB TO,

Date | Particulars

LE] DER)

Bank Alc

‘To Debentures Application and Allotment lc

(Application money received on 2,00; 12% Debentures of 100 each

issued ata premium of l0%and redeemable at premium of 10%)

Debentures Application and Allotment A/c

Loss on issue of Debentures A/c

“To. 129% Debentures Alc

“To Securities Premium Ale

‘To Premium on Redemption of Debentures Alc

(issue of 2,000; 12% Debentures of 100 each ata premium of

10% and redeemable at a premium of 10%)

2,20,000

2,20,000

20,000

200,000

20,000

20,000

2. Complete the following Journal entries:

Date | Particulars

LE] De)

2021

‘Aptil 1 | Sundey Asets A/c

To Sundry Liabilities Ne

To ShivShankar Ltd.

(shiv Shankar Lt. taken over by Parvati ltd fora purchase

consideration of €1820,000)

‘pil 1 Shiv Shankar Ltd.

To?

“To S%Debentures Alc

(Shiv Shankar Ltd. paid by issuing abil of € 20,000 andthe balance

pad by Issue of 8% Debentures of 100 each ata discount of 10%)

25.00.00

1820000

7

780,000

1820000,

Solutio JOURNAL

(Sample Paper 2018-19)

Date | Particulars

LE] De)

ce

2021

‘Aptil 1 Sundry Assets Alc

‘Goodwill Alc (Balancing Fig

To Sundry Lialities Ale

To Shiv Shankar Lid

(Shiv Shankar Lt. taken over by Parvati Ltd fora purchase

consideration of 1820,000)

‘Aptil 1 | Shiv Shankar Lt

Discount on Issue of Debentures Alc

“To BillsPayable Alc

‘To B¥Debentures Alc

(Shiv Shankar Lt. paid by issuing abil o€ 20,000 an the balance

pad by issue of 8% Debentures of € 100 each at a discount of 10%)

De.

25,00,00

100,000

1820000

2,00,000

780,000

18200000,

20000

20,00,000

Working Note:

No, of Debentures Issued = %18,00,000 + €90 = 20,000,

3

Se,

@ ANSWERS

Le)

2

3. id)

40)

5. id)

6 6

ne

a

9.)

a)

no)

ne

3 ©

we

Working Note:

Interest on Debentures

55,000,

© 10,00,000 x

So

100

15. (a)

Working Note:

%8,10,000

No. of Debentures to be issued = "S200

Debentures Account will be credited with & 9,00,000 (90,000 x ® 100).

90,000 Debentures

16. (b)

Working Note:

450,000

No of Debentures to be issued = © 450.000

° * 120

Debentures Account will be credited with € 375,000 (3,750 x € 100)

= 3,750 Debentures

©

Working Note:

Premium payable at the time of redemption @ 1096 = € 10,00,000, out of this amount € 400,000 have

been debited to Statement of Profit & Loss It means & 6,00,000 (ie, € 10,00,000 ~ 8 4,00,000) have been

written off from Securities Premium.

6,00,000

7,00,00,000

Rate of Premium on Isue of Debentures = x 100 = 6%,

1

©

Working Note:

Premium payable on Redemption @ 20% = 1,60,000 x & 20 =

32,00,000

Total loss written off from Secures Premium = 500,000 ~ ¥10,00,000 = & 40,00,000

Discount on lsue of Debentures = & 40,00,000 - & 3200.00 = &8,00,000,

Rate of discount on isue of debentures = =€ 800000 x 199 = 556,

1,60,00,000

19. 0a)

20.

JOURNAL OF CHROME LT.

Date | Parculas LE] ee | GR

Sundry Assets Ale Dx | | 600000

‘oodwil A Balancing ure) De 70000

To Sundry Liabiltes Ale 40000

To olymerttd 30000

(Assets an bites tok over of Polymer td)

Polymer itd Dr) 630000

Discount on sue of Debentures Ac Or 71,000

To 10% Debentures A 7790000

{7000 e, 630,000 +€ 50, 10% Debentures of 100 each

‘ssued at 90 each nfl satisfaction

Statement of Poi Loss Finance Cost) De 71,000

To Discount on sue of Debentures Ale 70000

(Ciscount on issu of Debentures writen of

Discount/Loss on Issue of Debentures is writen off in the year debentures ae allotted from Securities

Premium and Statement of Profit & Loss, in that ordtIn the absence of balance in Securities Premium,

it is written off form Statement of Profit & Loss.

21. JOURNAL OF SUNDER LTD.

Date | Particulars LE] oem | cee

Builaing Ne Oe 3300000

Plant and Machinery Ale i 100000

Stock le re 200.000

Sundry Debtors Ac =o.) | 100000

To Sundry Creditors Ne 0000

To India Bulls Ld 600000

To Captl Reserve Ae (Balancing Figure} 20000

[Purchase of business fom India Bulls td)

Ind Bulls Ld Oe 0000

To Bank Ne 60.000

[Pact payment made to vendor by cheque)

Ind Bulls Ud 540000

To 10% Debentures Nc 450000

To Secures Premium Ale 90.000

{issue of 4500 debentures t 20% premium to India Bulls Ltd)

No, of Debentures to be issued = 5,40,000/% 120

2

500 Debentures.

22.

@ JOURNAL OF 200M LTD.

Date

Particulars

Lr.

De®)

ce)

Bank A (6,000 x & 100)

“To Debentures Application and Allotment Ac

(Debentures application money received)

Debentures Application and Allotment Alc

“To 10% Debentures Alc

(6,000; 10% Debentures of € 100 each issued at par)

1600000

600000

600,000

00,000

) JOURNAL OF ZOLA LTD.

Date

Patiulars

Lr

De®)

eR

Bank Ae

‘To Debentures Application and Allotment Ac

(Debentures application money received)

Discount on Issue of Debentures A/c De

To 10% Debentures Alc

(sue of 000, 10% Debentures of & 100 each ata dscount of 198)

Debentures Application and Allotment A/c De

‘Statement of Profit & Loss (Finance Cost)

To. Discount on fsue of Debentures Ac

(Discount on isue of Debentures written off)

450000

450000

50000

0900

450,000

590,000

0,000

o JOURNAL OF ZUBIC LTD.

Date

Particulars

LF

De®)

R)

Bank Ale

‘To Debentures Application and Allotment Ac

(Debentures application money received)

Debentures Application and Allotment A/c

“To 10% Debentures Alc

“To. Securities Premium Alc

(sue of 10% Debentures ofthe value of € 1200000 a a premium of 5%)

120,000,

260,000,

1260,000

12,.00,000

0,000

JOURNAL OF RUBY LTD.

Date

Patiulars|

Lr.

De®)

ae

Bank A 5.00000 + 5% of ® 5.00000)

‘To Debentures Application and Allotment Ac

(Debentures application money received)

Debentures Application and Allotment A/c De

Loss on issue of Debentures Ac De

“To 10% Debentures Alc

‘To_Premium on Redemption of Debentures Nc

“To Securities Premium A

(ssue of 10% Debentures of ® 500,00 ata premium of

'5% and redeemable a a premium of 10%)

‘Statement of Profit & Loss (Finance Cost) De

Ta. Loss on Issue of Debentures Ne

(Loss on issue of Debentures writen off)

‘Securities Premium Ae De

525,000

525000

50,000

25000

25000

525,000

590,000

50000

25,000

50000

Note: Discount/Loss on Issue of Debentures is written off at the end of the financial year. At the end of the

financial year, balance in Securities Premium Account was & 25,000 due to issue of debentures. Its

used for writing off Loss on Issue of Debentures and balance Is writen off from Statement of Profit

& Loss as Finance Cost.

wo) JOURNAL OF EMERALD LTD.

Date

Particulars

Le

De®)

R)

Bank Alc (000 x € 93)

‘To Debentures Application and Allotment Ac

(Debentures application money received)

Debentures Application and Allotment Ae

Loss on issue of Debentures Ac (€ 21,000 + 30,000)

To. 9% Debentures Alc

‘To_ Premium on Redemption of Debentures Nc

(ssue of 3,000; 9% Debentures of € 100 each ata discount

‘of 7% and repayable at a premium of 105)

‘Statement of Profit Loss (Finance Cost)

Ta Loss on Issue of Debentures Ne

‘oss on Issue of Debentures written off

279000

279000

51,000

51,000

279000

300,000

30000

5,000

o JOURNAL OF NEWBIE LTD.

Date

Particulars

o@)

ce)

Bank Alc 000 x ® 94)

To Debentures Application and Allotment Nic

(Debentures application money received)

Debentures Application and Alotment Alc

Discount on sue of Debentures Ac

To 9% Debentures Ne

{Debentures issued at a discount of 6% and redeemable at par)

ee

‘Statement of Profit & Loss (Finance Cost)

To Discount on ssue of Debentures Ac

{Discount on issue of debentures writen off)

188}000,

188,000,

12000

12000

188.000

200000

12000

24,

JOURNAL OF JAYPEE LTD.

Date

Particulars

m8)

c.®)

Bank Nc

To Debentures Application and Allotment Ac

(Debentures application money received)

Debentures Application and Alotment Alc

To 9% Debentures Ac

{issue of 5000, 9% Debentures of & 100 each at par)

Dr

Debentures Suspense Ni

To 9% Debenture Ale

loan from bank SB)

{issue of 1,000, 3 Debentures of @ 100 each as collateral security for a

500,000,

+5,00000

100,000

500,000

500.000

4

[AN EXTRACT OF BALANCE SHEET OF JAYPEE LTD,

asat

Particulars Note No] &

|. EQUITY AND LIABILITIES

‘Non-

You might also like

- BCN-1310A-8001-1 - 1310A Quick Start GuideNo ratings yetBCN-1310A-8001-1 - 1310A Quick Start Guide2 pages

- The Challenge of Digital Transformation in The Automotive Industry-2020No ratings yetThe Challenge of Digital Transformation in The Automotive Industry-2020180 pages

- Axon Wires Cables Challenging Markets - BRNo ratings yetAxon Wires Cables Challenging Markets - BR44 pages

- 4 2023 24PJ Fractional Integration and Volatility TransmissionNo ratings yet4 2023 24PJ Fractional Integration and Volatility Transmission24 pages

- PG M.com Commerce (English) 31034 Corporate Accounting100% (1)PG M.com Commerce (English) 31034 Corporate Accounting284 pages

- Crisil Yearbook On The Indian Debt Market 2018 PDFNo ratings yetCrisil Yearbook On The Indian Debt Market 2018 PDF108 pages

- Accounting For Liabilities, Provisions and Contingencies LiabilityNo ratings yetAccounting For Liabilities, Provisions and Contingencies Liability13 pages

- Nuclear Weapons and International Conflict - Theories and Empirical EvidenceNo ratings yetNuclear Weapons and International Conflict - Theories and Empirical Evidence35 pages

- 1654557191.969365 - Signed Contract Application 212143No ratings yet1654557191.969365 - Signed Contract Application 21214311 pages

- Chapter 10 - Risk and Term Structure of Interest RatesNo ratings yetChapter 10 - Risk and Term Structure of Interest Rates28 pages

- Asterisx Limpio Results - Fortify Security ReportNo ratings yetAsterisx Limpio Results - Fortify Security Report46 pages

- Global Financial Crisis (GFC) Is A One-Off EventNo ratings yetGlobal Financial Crisis (GFC) Is A One-Off Event15 pages

- Selection - Memory - DR Monika - 22.03.23No ratings yetSelection - Memory - DR Monika - 22.03.238 pages

- Question 2 2.1 Analyze The Different Sources of ...No ratings yetQuestion 2 2.1 Analyze The Different Sources of ...2 pages

- Heads of Accounts Side of Trial Balance Reasons: Illustration 13No ratings yetHeads of Accounts Side of Trial Balance Reasons: Illustration 13133 pages

- Computation of Taxable Income and Tax LiabilityNo ratings yetComputation of Taxable Income and Tax Liability9 pages

- Accounting For Corporation - Basic ConsiderationsNo ratings yetAccounting For Corporation - Basic Considerations49 pages