UNIT 9: CONSIGNMENT SALES

Case 1.

TRIPLE E consigned 10 units of 42” television sets to BRAD Appliances, Inc. The cost to TRIPLE E per set is P25,000 and

BRAD was instructed to sell each at P35,000 for a 10% sales commission to BRAD. Freight charges paid by TRIPLE E on the

delivery of the consignment to BRAD was P5,000. BRAD was able to sell 8 television sets and incurred delivery and installation

costs of P3,000 for the delivered units.

Required:

1. Prepare an account sales.

2. Compute the net profit of the consignor from the consignee sales.

3. Compute the cost of the unsold TV sets still held by the consignee.

4. Prepare journal entries in the books of the consignment parties assuming profits are not determined separately.

Case 2.

On August 1, 2019, SARITA Company consigned 20 units of gas oven to GIRLIE Store. The cost of each unit is P12,000 and

GIRLIE was instructed to sell each for P20,000 for a 5% commission. Shipping costs of P4,500 was paid by GIRLIE upon

receipt of the consigned goods from SARITA. Additional shipping cost by GIRLIE on the sale of 12 units was P5,000. Full

cash remittance was made by GIRLIE, net of commissions and reimbursable expenses, on December 31, 2019.

Required:

1. Prepare an account sales.

2. Compute the consignor’s profit from consignee sales for the month.

3. How much will be the debit balance of the Consignment-Out account after adjustments for the net profit assuming it is

kept separate for each consignee.

4. Discuss briefly the accounting difference, if any, between the reimbursable shipping costs of P4,500 and P5,000 paid

by GIRLIE.

5. Prepare journal entries in the accounting records of the participants for the above information.

Case 3.

The Consignment-Out ledger account for the month of July, 2019 in the accounting records of EDMOND COMPANY follows:

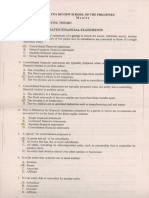

CONSIGNMENT –OUT of MYLENE, Inc.

Date Particulars Debits Credits Balance

July 4 Shipped 80 units P11,520 P11,520dr

4 Freight costs 936 12,456 dr

31 Charges by consignee:

Assembly costs 360 12,816 dr

Commissions on sale 2,625 15,441 dr

31 Selling price of 50units P13,125 2,316 dr

EDMOND COMPANY debited the Consignment-Out account for all costs relating to the consignment and credited the

Consignment-Out account for the selling price of units sold by the consignee.

Required:

1. Prepare the journal entry to record the consignment profit in the books of the consignor.

2. Prove the adjusted balance of the Consignment-Out account, after the recognition of profit, is equal with the cost of

unsold units still in held by the consignee.

3. Prepare a reclassification entry for the Consignment-Out account for financial statement purposes of the consignor.

MULTIPLE CHOICE

Jessie Corporation consigned 400 dresses to Anne Fashions at a suggested retail price of P500 each. Jessie paid freight

charges of P2,000 on the shipment on consignment. Anne paid delivery charges of P2,100 for units sold, subject to

subsequent settlement. Jessie and Anne agreed that any sales in excess of the suggested retail price will accrue to the latter.

Anne submitted an account sales on the sale of 215 dresses, 40% of which was sold at P580 each and the rest at P640 each,

All these sales were paid in cash. Jessie’s cost is P375 each dress, before any deferred costs on consignment are taken into

account.

1. How much should Anne remit to Bryan for the aforementioned sales to customers?

a. P105,400 c. P107,500

b. P130,340 d. P132,440

� 2. The journal entry to be recorded by Anne for the remittance to Jessie, assuming profits are separately determined and

Anne uses the Consignment-in account, will include

a. a debit to Consignment-in of P107,500

b. a credit to commissions revenue of P24,940

c. a credit to cash of P105,400

d. a credit to Consignment-in of P2,100

3. How much is the commission earned by Anne from sales of the consigned goods?

a. P 13, 236 c. P 24,940

b. P 49,800 d. P 82,560

4. The cost of consigned goods to Jessie for the units sold by Anne to customers was

a. P 81, 700 c. P 87,100

b. P100,654 d. P106,50

5. The cost of the unsold 185 dresses still held by Anne is shown at what amount in Anne’s Consignment-in account?

a. P69,375 c. P70,300

b. P81,700 d. P 0

6. The balance of the consignment-out account in the books of Jessie after adjustment for recognized profit will be

a. P 0 c. P70,300

b. P81,700 d. P69,375

Passionate Enterprises consigned 15 dozens of fine men’s suits with a cost of P800 a suit to Fashion Treats Company.

Passionate incurred freight cost of P35 per dozen. As required by the agreement, Fashion Treats reported sales of 8 dozens

at P1,200 a suit and reimbursable expenses of P2,500. Fashion Treats remitted the proceeds to Passionate, net of the

agreed 15% commissions on sale.

7. How much cash was remitted by Fashion Treats to Passionate Enterprises?

a. P139, 800 c. P 95,420

b. P142,500 d. P142,800

8. How much was the consignment profit to Passionate Enterprises?

a. P 55, 590 c. P 18,430

b. P 58,590 d. P 18,340

9. How much is the Inventory of consigned goods after the above mentioned sales?

a. P 67, 445 c. P 67,545

b. P 67,544 d. P 65,744

Aircon, Inc. consigned 10 one-horse power air conditioner units to Argy Trading and paid P2,000 freight out. Gross margin is

12.5% of sales. The consignee is allowed a commission of 5% on sales. Argy Trading submitted an account sales on

December 31, 2019 as follows:

Sales P 72,000

Less: Advances to consignor P 10,000

Selling expenses 800

Delivery and installation cost 1,200

Commission 3,600 15,600

Net remittance P 56,400

10. How much is the net profit or loss of Aircon, Inc. in the consignment?

a. P 1,400 profit c. P 2,200 profit

b. P 8,800 loss d. P 720 loss