CHAPTER 12: INVENTORY MANAGEMENT Suggested Solutions to Selected Questions

Question 12.5 This is EOQ with D = 19,500 units/yr; H = $4/unit/year; S = $25/order.

Summer II, 2009

(a) (b) Annual holdings costs = (c) Annual ordering costs =

Question 12.7 This problem reverses the unknown of a standard EOQ problem to solve for S. Given D = 240 units/yr; H = $4/unit/year; Q = 60. Therefore:

So, solving for S results in:

That is, if S were $30, then the EOQ would be 60. If the true ordering cost turns out to be much greater than $30, then the firms order policy is ordering too little at a time.

Question 12.9 This is EOQ with D = 15,000, H = $25/unit/year, S = $75 (a) EOQ

2DS H

2 15,000 75 25

300 units

25 = $3,750.00 75 = $3,750.00

(b) Annual holding costs = (Q/2) (c) Annual ordering costs = (D/Q) (d) ROP = d

H = (300/2)

S = (15,000/300)

15,000 units 300 days

2 days

100 units

BUS P301:01

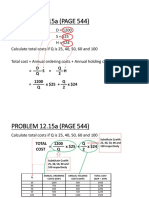

�Question 12.15 This problem meets EOQ assumptions with D = 250; H = $1/unit; S = $20/order. (a) The optimal order quantity is

EOQ

2DS H

2(250)20 1

100 units

(b) Number of orders per year = D/Q = 250/100 = 2.5 orders per year. Note that this would mean in one year the company places 3 orders and in the next it would only need 2 orders since some inventory would be carried over from the previous year. It averages 2.5 orders per year. (c) Average inventory = Q/2 = 100/2 = 50 units (d) Given an annual demand of 250, a carrying cost of $1, and an order quantity of 150, Patterson Electronics must determine what the ordering cost would have to be for the order policy of 150 units to be optimal. To find the answer to this problem, we must solve the traditional economic order quantity equation for the ordering cost. and;

As the calculations show, an ordering cost of $45 is needed for the order quantity of 150 units to be optimal. Question 12.17 This problem is a Production Order Quantity model, noninstantaneous delivery. (a) D = 12,000/yr H = $.10/light-yr S = $50/setup P = $1.00/light p = 100/day

(b) (c)

(d) Total cost (including cost of goods) = PD + $134.16 + $134.16 = ($1 12,000) + $134.16 + $134.16 = $12,268.32/year

BUS P301:01

�Question 12.22 This problem is a Quantity Discount EOQ model with D = 45,000; S=$200; I = 5% of unit price, H = IP. The best option must be determined first. At $1.80,

At $1.60,

At $1.40,

At $1.25,

Since all solutions yield Q values greater than 10,000, the best option is the $1.25 price.

(a) (b) (c) (d) Unit costs = P x D = ($1.25)(45,000) = $56,250.00 (e) Total annual costs = $530.33 + $530.33 + $56,250.00 = $57,310.66

BUS P301:01

�Question 12.26 This problem is a Quantity Discount EOQ model with D = 9,600; S=$50; I = 50% of unit price, H = IP. (a) Calculation for EOQ: Vendor 1: At $17.00, At $16.75, At $16.50, feasible not feasible not feasible

Vendor 2: At $17.10, At $16.85, At $16.60, At $16.25, feasible not feasible not feasible not feasible

(b), (c) Calculation of Total cost:

Qty 336 500 1000 335 400 800 1200 Price $17.00 $16.75 $16.50 $17.10 $16.85 $16.60 $16.25 Ordering $1,428.57 $960.00 $480.00 $1,432.84 $1,200.00 $600.00 $400.00 Holding $1,428.00 $2,093.75 $4,125.00 $1,432.13 $1,685.00 $3,320.00 $4,875.00 9600 50 0.5 Purchase $163,200.00 $160,800.00 $158,400.00 $164,160.00 $161,760.00 $159,360.00 $156,000.00 Total $166,056.57 $163,853.75 $163,005.00 $167,024.96 $164,645.00 $163,280.00 $161,275.00 Vendor 2

Vendor 1

BEST

Annual Demand Setup cost/order Holding cost/unit

(e) Other considerations include the perishability of the chemical and whether there is adequate space in the controlled environment to handle 1,200 pounds of the chemical at one time.

BUS P301:01

�Question 12.37 This problem is an EOQ production Order Quantity model. Given Annual demand, D = 8,000 Daily production rate, p = 200 Setup cost, S = 120 Holding cost, H = 50 Production quantity, Q = 400 (a) Daily demand, d = D/250 = 8,000/250 = 32 (b) Number of days in production run = Q/p = 400/200 = 2 (c) Number of production runs per year = D/Q = 8,000/400 = 20 Annual setup cost = 20($120) = $2,400 (d) Maximum inventory level = Q(1 d/p) = 400(1 32/200) = 336 Average inventory = Maximum/2 = 336/2 = 168 (e) Total holding cost + Total setup cost = (168)50 + 20(120) = $8,400 + $2,400 = $10,800.00 (f)

Q 2 DS H 1 d p 2(8,000)120 50 1 32 200 213.81

Total holding cost + Total setup cost = 4,490 + 4,490 = $8,980 Savings = $10,800 $8,980 = $1,820

BUS P301:01