Unit3-Development Frameworks (Blockchain)

Uploaded by

Savithri SubramanianUnit3-Development Frameworks (Blockchain)

Uploaded by

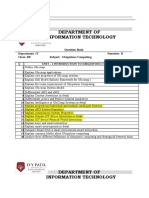

Savithri SubramanianMC4013- CNBT Unit - 3

Digital Tokens:Overview-Initial Coin Offering –OmiseGO–EOS–Tether.Meta

Mask:Wallet Seed – Meta Mask Transactions.Mist:Overview -Mist wallet.Truffle:

Features of Truffle –Development Truffle boxes - Community truffle box.

Digital Tokens

In simple words, digital tokens (and all other words) are digital assets that represent a certain value

and can be used for different purposes.

If speaking in terms of cryptocurrency, tokens can be:

intrinsic

asset-backed

Intrinsic (or native, or built-in) tokens are an integral part of a blockchain and fuel its performance.

They are not backed by any other asset and their value dependents solely on what someone is eager

to pay for it. All of us have heard about BTC on the Bitcoin blockchain or ETH on Ethereum,

which are good examples of such tokens.

3 Types of Digital Tokens

Digital tokens though can be categorized into three major types:

Currency tokens: Bitcoin is a type of currency token meant to pay for goods and services. Bitcoin

was, in fact, created to replace fiat (paper) money.

Utility tokens: Utility tokens are more than a means of payment. Specifically, they give users the

power to trade cryptocurrencies at lower fees since utility tokens provide them access to the

developers’ platforms. An example of a utility token is Ethereum, although it can also fall under the

currency token category. Ethereum, an example of a utility token, was intended for use on a single

platform.

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Asset or investment tokens: By the name itself, these tokens refer to assets that can give investors

a positive return on their investment. An example is The DAO, a blockchain company backed by

a smart contract.

How Do Digital Tokens Work?

A digital token facilitates real-world transactions via a decentralized technology—blockchain.

Users can make payments and keep money without going through third-party providers, so the

deals they enter into are more direct. This transaction method is often preferred because it doesn’t

require an intermediary, making it faster and more affordable for both parties.

How Can I Get a Digital Token?

Those interested in getting a digital token can participate in an initial coin offering (ICO). From

there, you can buy digital tokens from the organizing company following this process:

Register for an ICO via the company’s website.

Choose the digital token of your choice (i.e., Bitcoin or Ether).

Move the digital tokens you purchased to your wallet.

Buy ICO tokens by sending your tokens to the company’s wallet address.

Receive your ICO digital tokens in your wallet.

Store your ICO digital tokens in your preferred wallet.

How Do Digital Tokens Work?

Digital tokens are different from coins like Bitcoin and Dogecoin. They’re digital assets represented

on a blockchain by means of a smart contract, so they have greater utility than coins, which are

used solely as stores of value and currency.

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Even things that you might not think of as having a digital representation can be represented by

digital tokens. That includes things like artwork and consumables.

Types of Digital Tokens

There are two main types of digital tokens — fungible and non-fungible. Let’s take a deeper dive

into the differences between them and what each type is good for.

Fungible Tokens

Fungible tokens are essentially units of an account. For example, they can be security tokens that

work like shares of a company or project, or debt instruments to represent someone’s loan.

Fungible tokens are countable, so you can have a large number of them and stack them. Their value

is always equal — one Microsoft token is worth exactly the same as another, and 100 of them

would be worth one hundred times that.

Matthew compares them to stock certificates — they’re essentially just replicas of one another and

each represents an equal part of one account.

Non-Fungible Tokens (NFTs)

Non-fungible tokens are different, and this is where the concept of digital tokens starts to get really

interesting.

NFTs are any kind of asset that can be represented on a blockchain. Some of the most common

examples include artwork like CryptoPunks and collectibles like NBA Top Shot. Unlike fungible

tokens, each unit is often unique and has its own distinct value.

Matthew explains how NFTs can be used as digital representations of real-world things like houses

— unique objects where only one exists in the world.

Blockchain frameworks are systems that enable users to design and implement distributed

computing systems.

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Frameworks to build a blockchain network, including a transaction ledger, peer-to-peer messaging,

and consensus algorithms.

Hyperledger Fabric: Designed for creating highly scalable blockchain applications. It was created

by IBM and is the most popular Hyperledger framework.

Hyperledger Sawtooth: A blockchain suite based on the "proof of elapsed time” (PoET)

consensus algorithm.

The top three blockchain frameworks for these use cases are R3 Corda, Hyperledger and Ethereum,

with EOSIO and ConsenSys Quorum gaining ground.

What Is an Initial Coin Offering (ICO)?

An initial coin offering (ICO) is the cryptocurrency industry’s equivalent of an initial public

offering (IPO). A company seeking to raise money to create a new coin, app, or service can launch

an ICO as a way to raise funds.

Interested investors can buy into an initial coin offering to receive a new cryptocurrency

token issued by the company.

KEY TAKEAWAYS

Initial coin offerings (ICOs) are a popular way to raise funds for products and services usually

related to cryptocurrency.

ICOs are similar to initial public offerings (IPOs), but coins issued in an ICO also can have utility

for a software service or product.

A few ICOs have yielded returns for investors. Numerous others have turned out to be fraudulent or

have performed poorly.

To participate in an ICO, you usually need to first purchase a more established digital currency,

plus have a basic understanding of cryptocurrency wallets and exchanges.

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

ICOs are, for the most part, completely unregulated, so investors must exercise a high degree of

caution and diligence when researching and investing in them.

How an Initial Coin Offering (ICO) Works

When a cryptocurrency project wants to raise money through an ICO, the project organizers’ first

step is determining how they will structure the coin. ICOs can be structured in a few different ways,

including:

Static supply and static price: A company can set a specific funding goal or limit, which means that

each token sold in the ICO has a preset price, and the total token supply is fixed.

Static supply and dynamic price: An ICO can have a static supply of tokens and a dynamic funding

goal—this means that the amount of funds received in the ICO determines the overall price per

token.

Dynamic supply and static price: Some ICOs have a dynamic token supply but a static price,

meaning that the amount of funding received determines the supply.

These three different types of ICOs are illustrated below:

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

White Paper Release

Alongside structuring the ICO, the crypto project usually creates a pitchbook—called a white

paper in the crypto industry—that it makes available to potential investors via a new website

dedicated to the token.

The promoters of the project use their white paper to explain important information related to the

ICO:

What the project is about

The need that the project would fulfill upon completion

How much money the project needs

How many of the virtual tokens the founders will keep

What type of payment (which currencies) will be accepted

How long the ICO campaign will run

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

The project releases the white paper as part of its ICO campaign, which it designs to encourage

enthusiasts and supporters to buy some of the project’s tokens. Investors can generally use fiat or

digital currency to buy the new tokens, and it’s increasingly common for investors to pay using

other forms of crypto such as Bitcoin or Ethereum. These newly issued tokens are similar to shares

of stock sold to investors during an IPO.

What Happens to the Funds?

If the money raised in an ICO is less than the minimum amount required by the ICO’s criteria, the

funds may be returned to the project’s investors. The ICO would then be deemed unsuccessful. If

the funding requirements are met within the specified period, the money raised is spent in pursuit of

the project’s goals.

Who Can Launch an ICO?

Anyone can launch an ICO. With very little regulation of ICOs in the U.S. currently, anyone who

can access the proper technology is free to launch a new cryptocurrency.

But this lack of regulation also means that someone might do whatever it takes to make you believe

they have a legitimate ICO and abscond with the money. Of all the possible funding avenues, an

ICO is probably one of the easiest to set up as a scam.

Buying Into an ICO

If you’re set on buying into a new ICO that you’ve heard about, make sure to do your homework.

The first step is ensuring that the people putting up the ICO are real and accountable. Next,

investigate the project leads’ history with crypto and blockchain. If it seems that the project doesn’t

involve anyone with relevant, easily verified experience, that’s a red flag.

Special Considerations

There is no guarantee that an investor won’t be on the losing end of a scam when investing in an

ICO. To help avoid ICO scams, you can:

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Make sure that project developers can clearly define what their goals are. Successful ICOs typically

have straightforward, understandable white papers with clear, concise goals.

Look for transparency. Investors should expect 100% transparency from a company launching an

ICO.

Review the ICO’s legal terms and conditions. Because traditional regulators generally do not

oversee this space, an investor is responsible for ensuring that an ICO is legitimate.

Ensure that ICO funds are stored in an escrow wallet. This type of wallet requires multiple access

keys, which provides useful protection against scams.

Some ICOs require that another cryptocurrency be used to invest in an ICO, so you may need to

purchase other coins to invest in the project.

ICO Hyping

ICOs can generate a substantial amount of hype, and there are numerous sites online where

investors gather to discuss new opportunities. Famous actors, entertainers, or other individuals with

an established presence like Steven Seagal also have encouraged their followers or fans to invest in

a hot new ICO.4 However, the SEC released a warning to investors stating that it is illegal for

celebrities to use social media to endorse ICOs without disclosing what compensation they

received.5

Initial Coin Offering (ICO) vs. Initial Public Offering (IPO)

IPOs raise money for companies seeking funds from investors and result in the distribution of

shares of the company’s stock to investors. For ICOs, crypto companies raise funds through the

sales of coins or tokens. In both cases, investors are bullish about the company or the

cryptocurrency and invest based on the belief that the asset’s value will increase over time.

Advantages and Disadvantages of Initial Coin Offerings

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

What are the advantages of an ICO?

It’s a great way to invest/save/secure your cryptocurrencies

Anyone can buy tokens

Launching a token is different from selling capital in an initial public offering and launching

tokens can be equated with selling digital keys. Participation in an IPO is usually limited to

accredited investors with over one million dollars net worth. Although, tokens sold in the initial

coin offering can be sold to anyone, as most purchases are anonymous. Very few people reach over

a million dollars net worth in the USA, but since this is not the only prerequisite for buying tokens-

anyone can buy them.

Instant Buy-In, no Middleman

There are no blocks or intermediaries that exist between buyers and sellers of coins. Once a

cryptocurrency is created and launched, it can be sold immediately in the cryptocurrency market.

This is a fast and efficient process for companies. Shopping at ICO is as simple as getting the right

currency to buy and waiting for the launch.

What are the disadvantages of an ICO?

The large number of scams

Many investors buy ICOs in the hope that they will quickly get back what they invested. The most

successful ICOs in the last few years represent a kind of hope, because they have really brought a

huge return. Because they are largely unregulated, ICOs are scams and poorly informed investors

are victims of this scam. What is perhaps the biggest drawback is that funds lost due this scam

won’t be returned.

They are easy to hack

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

How do you know when new coins are launched?

Many exchanges, websites, and aggregators list new coins. Some examples are Coinbase, Gemini,

Kraken, CoinGecko, and CoinMarketCap. You can also find new coins announced on social media

platforms such as Twitter.

Is an initial coin offering (ICO) legal?

Initial coin offerings (ICOs) are legal. However, the ICO is illegal if the project and coin don’t pass

the Howey Test used by the U.S. Securities and Exchange Commission (SEC) to determine if an

offering is an investment instrument.

OmiseGo

What is OmiseGO (OMG) ?

OmiseGO is a decentralized network that wants to work with banks to promote financial inclusion.

OMG Network wants to bridge the gap between different payment providers, currencies and assets,

through the use of blockchain.

OmiseGO is a decentralized network offering a flexible and effective solution for payment

providers. It is built as a dApp for Ethereum.

OMG wants banks and other established financial services to use their network for transactions and

as a clearinghouse.

Who created OmiseGo?

Created by an established payments processing company called Omise, OMG Network, previously

known as OmiseGo, seeks to use the OMG cryptocurrency to streamline how electronic wallets

issue and exchange assets.

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Using Ethereum and OMG Network, Omise posits that e-wallet users could freely move and

convert these assets, whether they are loyalty points, government currencies or new crypto assets.

OmiseGo's decentralized exchange allows cross-chain transactions to take place

OmiseGo is an interoperable decentralized exchange and payment platform that allows value

transfers across blockchain networks and provides fiat-to-crypto and crypto-to-crypto investment

gateways.

OmiseGo core components

The Decentralized Exchange

OmiseGo’s decentralized exchange allows cross-chain transactions to take place; this means that

users are no longer limited to trading fiat/crypto pairs and BTC or ETH/ altcoin pairs, but instead,

will have the ability to trade altcoins for other altcoins directly across blockchain networks.

The transactions that pass through the decentralized exchange will be validated via a proof-of-stake

consensus, where OmiseGo users stake their OMG tokens to vote on the validity of blocks.

The Software Developer Kit

wallet providers that allow the tokens in the trading pairs to be safely stored and securely transacted

with. That is why OmiseGo provides users with the Software Developer Kit, a set of tools that they

hope will encourage developers to create user-friendly wallets on the OMG blockchain without the

need to have a deep understanding of the blockchain beforehand.

The Software Developer Kit also allows developers to integrate debit and credit account transfers

which will provide a gateway to deposit, withdraw, and convert fiat currency to digital assets.

Proof-of-Stake consensus

The primary purpose of the OMG token is to be used as a staking token for OmiseGo’s proof-of-

stake consensus. Users will have the opportunity to stake their funds on the validity of blocks on the

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

OMG network. And, if users stake their tokens actively and honestly, then they will be rewarded

with the transaction fees from the block they validate in an amount that is proportional to the

number of tokens they staked.

However, if users stake their tokens on invalid blocks, they will face the possible penalties of losing

all of their staked tokens (hard slashing) or losing their returns (soft slashing).

How does OmiseGO work?

Clearinghouse - OmiseGO is used for quick and easy asset transfers between two separate parties.

Banks and financial institutions use the network as a trustless intermediary that enables them to

transact with one another securely.

Decentralized exchange - If assets need to be exchanged, then an order is placed on the network

which can be filled by any other participant

The OMG Network

OMG Network is a proof-of-stake blockchain meant to clear and settle the movement of assets

between various e-wallets, without those e-wallets necessarily having to trust each other.

The network also includes a built-in trading engine where e-wallet providers can publish orders and

be matched with other parties seeking to trade various assets.

These orders can be programmed to complete within a given block on the Omise blockchain or can

be left open-ended based on available asset pricing.

The version of Plasma which is specific to the OMG Network makes use of a Proof of Stake (PoS)

consensus mechanism that involves three components namely smart contracts, operators, and

watchers.

The smart contract component of OMG Network delivers batches of transactional date to the core

Ethereum blockchain while operators are entities that provide computing power which is necessary

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

to aggregate transactions, produce blocks, and send blocks that have transactions to the smart

contract.

Watchers on the OMG Network are responsible for monitoring the network for irregularities in

addition to ensuring that information sent to Ethereum by Operators is correct.

The Ethereum blockchain currently has between 14 to 20 Transactions Per Second (TPS) whereas

OMG Network can process 4 000 TPS.

What’s so special about it?

Flexibility - OmiseGO’s main objective is to be a network where either party can transact in the

asset of their choice.

🌊 Liquidity - The reserves released from participating banks will create a pool large enough for the

provision of assets in demand. - Interoperability - The network can be used for any fiat currency

transactions as well as those in other cryptocurrencies, even ones that work on other blockchains,

such as Bitcoin

📈 Scalability - OmiseGO uses the plasma protocol to make the network fast and efficient,

potentially up to a million transactions per second.

🔒 Security - Being decentralized means there is no single pain-point for attackers. The network

relies on a team of validators who are paid in OmiseGO tokens to confirm transactions; these are

forfeited if they abuse their position.

Pros and Cons of OMG Network

Pros ❌Cons

OMG Network employs advanced Plasma OMG Network is centralised as result of

technology and has adapted a crucial component Operators and Watchers

Interoperable with the Ethereum blockchain, Development is slow

The OMG Network is trustless There are many successful competitors in the

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Pros ❌Cons

industry that outshine OMG Network

EOS (Electro-Optical System)

What Is EOS?

EOS is an acronym for Electro-Optical System. EOS is a decentralized operating system based on

blockchain technology.

EOS is a blockchain-based, decentralized platform used to develop, host, and run business

applications, or dApps.

EOS.IO is the system architecture.

The EOS token is the network's cryptocurrency.

Its main competitor is the better-established Ethereum platform.

How EOS Is Different

EOS is seen as a direct competitor to Ethereum, with ambitions to be bigger, better, and faster.

Especially faster: while Ethereum reportedly can handle 15 transactions per second, EOS is aiming

for millions of transactions per second. Note that this is a goal, not a reality.

What is EOS.IO?

Most recent blockchain platform

Similar to the working of Ethereum

Still in production

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Native cryptocurrency - EOS

EOS team

Founded by Block.one

Based in the Cayman Islands

CEO - Brendon Blumer

Benefits of using EOS

Faster and more cost-effective transactions

High scalability when developing Dapps

Provides high-end OS for Dapps

Applications of EOS

Development of Dapps

Process millions of transactions per second

Helps eliminate transaction fees

Dapp and cryptocurrency development

Stay updated on latest technology and market trends

Hire skilled and experienced developers

Blockchain App Factory is a leader in this field

Understanding EOS

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

EOS supports core functionality that allows businesses and individuals to create blockchain-based

applications in a way that is similar to web-based applications. EOS provides secure access and

authentication, permissions, data hosting, usage management, and communication between dApps

and the Internet.

EOS is supported by a web toolkit store that aims at hassle-free app development.

The Basics of EOS.IO and EOS Tokens

The EOS ecosystem is composed of two key elements: the EOS.IO software and EOS tokens:

EOS.IO is akin to the operating system of a computer. It manages and controls the EOS blockchain

network. The software uses blockchain architecture for vertical and horizontal scaling of DApps.

The EOS token is the cryptocurrency of the EOS network.

A developer needs only to hold EOS coins, rather than spending them, to use network resources and

to build and run DApps. Token holders who are not running any apps can allocate or rent their

bandwidth to other participants who need it.

Characteristics of EOS.IO

EOS.IO claims to be able to support thousands of commercial-scale DApps without hitting

performance bottlenecks through its use of parallel execution and asynchronous communication

methodology across the network.

The efficiency is further boosted by separate modules that are involved in the working of DApps.

For example, the authentication process is performed separately from the execution process.

EOS has key usability features—including a web toolkit for interface development, self-describing

interfaces, self-describing database schemas, and a declarative permission scheme.

What Is the Purpose of EOS?

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

The EOS system was designed to support decentralized applications, commonly called dApps, on a

commercial scale. EOS provides the core functionality for businesses to build blockchain

applications in a way that is similar to building web apps.

Tether

What Is Tether (USDT)?

Tether (USDT) is a cryptocurrency stablecoin pegged to the U.S. dollar and backed "100% by

Tether's reserves," according its website.

Tether is owned by iFinex, the Hong Kong-registered company that also owns the crypto exchange

BitFinex.

Tether was launched as RealCoin in July 2014 and was rebranded as Tether in November 2014. It

started trading in February 2015.23 Originally based on the Bitcoin blockchain, Tether now

supports Bitcoin's Omni and Liquid protocols as well as the Ethereum, TRON, EOS, Algorand,

Solana, OMG Network, and Bitcoin Cash (SLP) blockchains.4

As of May 2022, Tether was the third-largest cryptocurrency after Bitcoin (BTC) and Ethereum

(ETH), and the largest stablecoin with a market capitalization of nearly $83 billion.5 In April 2022,

Tether's USDT accounted for two-thirds of exchanges out of Bitcoin by value.6

KEY TAKEAWAYS

Tether (USDT) is a stablecoin, a type of cryptocurrency pursuing a steady valuation.

Tether is used by investors who want to avoid the volatility typical of cryptocurrencies while

holding funds within the crypto system.

Tether's parent paid nearly $60 million in fines in 2021 to settle two regulatory probes alleging it

mishandled and misrepresented its reserves.

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Understanding Tether

Tether belongs to a fast-growing breed of cryptocurrencies called stablecoins, which aim to keep

the price of their tokens stable, most commonly by tying it to the price of a traditional currency like

the U.S. dollar. (Tether also issues tokens pegged to the euro, the offshore Chinese yuan, and gold,

none with more than a small fraction of the market cap of its U.S. dollar-pegged USDT tokens.)71

The peg to a traditional currency, often backed by collateral reserves made up entirely or mostly of

the pegged currency, is meant to ensure stablecoins aren't subject to the same price volatility as

more speculative cryptocurrencies like Bitcoin.

A stable value promotes the use of stablecoins as a medium of exchange like conventional money.

As noted above, in practical terms, stablecoins have made it easier to speculate in cryptocurrency

markets. Their rapid growth in popularity is also the result of stablecoins' use as collateral

by decentralized finance (DeFi) lending and staking protocols.8

How Is Tether Useful?

Tether helps investors move funds between cryptocurrency markets and the traditional financial

system, minimizing volatility as a result of its 1-for-1 peg to the U.S. dollar.

How Do I Buy USDT?

Tether tokens can be bought and sold on cryptocurrency exchanges including Binance, CoinSpot,

Bitfinex, and Kraken.

Is Tether a Stablecoin?

Yes, Tether is the first and best-known stablecoin in the crypto world. Other stablecoins include

True USD (TUSD), Paxos Standard (PAX), and USD Coin (USDC).

How Does Tether Stay at $1?

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

While Tether has dropped below $1 before (and risen above its peg) on occasion, it can remain near

that price so long as it continues to redeem USDT tokens for $1 each, and as long as investors

continue to believe issuance proceeds are fully reserved with liquid collateral assets.

Investing in cryptocurrencies and other Initial Coin Offerings (“ICOs”) is highly risky and

speculative, and this article is not a recommendation by Investopedia or the writer to invest in

cryptocurrencies or other ICOs.

Metamask

MetaMask is a popular cryptocurrency wallet that supports a broad range of Ethereum-based tokens

and non-fungible tokens (NFTs) on supported blockchains. While experienced crypto investors may

appreciate the speed and simplicity of the wallet, new investors may find it difficult to navigate. In

addition, the wallet does not support Bitcoin, making it a turn-off for investors whose primary

investment is Bitcoin.

Pros

Easy setup process

Earn rewards via staking and holding

Supports a broad range of Ethereum-based tokens

Central hub for dApp

Cons

No coin-to-fiat conversion

Absence of 24/7 live customer support

What is MetaMask wallet seed?

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

MetaMask uses BIP39 to generate a seed phrase for your wallet. Your seed phrase will cover every

token, address, and transaction generated by your wallet. Think of it as your backup master key.

You can think of your seed phrase as a master backup of all your cryptocurrency in this wallet.

Features

Security, anonymity, and decentralization are some of the most attractive features in the crypto

industry and MetaMask does not fail to exhibit these traits. Users can download the wallet software

or add it as a browser extension and install it without disclosing identifying data such as name,

email, social security number, and address.

Decentralization is a valuable feature that ensures transactions on the blockchain are visible to

connected nodes. It also prevents a single entity from having access to the entire wallet system.

Security

MetaMask's approach to security is through anonymity and entrusting private keys to users. Since

the wallet does not keep users' personal information, accounts are protected by a user-generated

password during installation and setup, or biometric data on mobile devices. The wallet can be

recovered via a 12-word mnemonic phrase as the wallet doesn't keep custody of private keys. It is,

therefore, necessary to keep this seed phrase safe as it will be essential if the device gets damaged

or stolen.

MetaMask has just one way of recovering a single wallet across multiple devices. This makes the

wallet susceptible to hacks and malware. Notable among these are Banker Trojan, social

engineering attacks, and other crypto scams. MetaMask wallet users can be attacked with phishing

scams that prompt them to reveal their seed phrases on suspicious websites, or by downloading and

installing a fake version of the wallet extension which hackers can leverage to steal users' assets

after gaining control of the wallet.

Privacy and Anonymity

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

One of MetaMask's priorities is anonymity. Unlike centralized crypto exchanges that require users

to meet Know Your Client (KYC) requirements, this wallet doesn’t require users to submit personal

information. However, the wallet warns that transactions are not solely anonymous, but classifies

exchanges as pseudonymous. Since transactions are recorded on the public blockchain, the wallet

ID acts as a pseudonym for the user.

Given that MetaMask does not support Bitcoin, CoinJoin transactions are not enabled. A CoinJoin

is a process in which different users mix their coins together before sending them to recipients,

ensuring that the senders and recipients remain anonymous.

Setup

The process of setting up MetaMask is easy. Users start by downloading the mobile app for

Android or iOS, or the browser extension for Brave, Google Chrome, Opera, Microsoft Edge, or

Firefox. After this, users will either be prompted to import an existing wallet using the 12-word

seed phrase or create a new wallet. New users can click “Create a Wallet” and will be asked

permission to gather anonymous usage data to improve the product. Users can opt out of those that

may seem privacy sensitive, such as requests for private keys, transaction data, or IP addresses, as

part of MetaMask’sprivacy policy.

Users can then proceed to set up their eight-character password and their 12-word seed phrase will

be presented. Users must keep these safe because should they go missing, access to the wallet will

be lost permanently. Once the seed phrase is confirmed, users can carry out transactions such as

send, buy, swap, and stake seamlessly.

Usability

MetaMask functions as an in-browser application for desktop or laptop computers, as well as a

smartphone app available on the Google Play Store and Apple App Store. The wallet can be

seamlessly integrated with various crypto websites such as OpenSea, Uniswap, and QuickSwap.

Desktop

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

The MetaMask wallet app allows users to send or receive coins with any other wallet or smart

contract provided a supported blockchain is used. Users also have the option of buying coins using

providers on the platform, such as MoonPay, Wyre, and Transak. While the wallet doesn’t require

users to meet KYC verification, these third-party providers do to remain compliant. The wallet is

compatible with hardware wallets such as Ledger and Trezor, giving users room to transfer crypto

and NFTs from a software-based hot wallet to a hardware-based cold wallet for safe storage.

While it is easy to use MetaMask on a connected website to send, swap, and receive tokens, users

cannot sell tokens on the wallet. As such, they will have to send their coins to an external wallet

before converting them to cash.

Mobile App

The MetaMask wallet mobile app is available on Google Play for Android and the Apple App Store

for iOS devices. The wallet has a 4.5 star rating on Google Play with pockets of complaints

centered on “bugs on the new version” and the slow speed of the browser extension.5

The mobile app also allows users to send and receive tokens and NFTs on supported blockchains. It

is expected that users have sufficient Ether (ETH) to cover gas fees during transactions. Users have

the opportunity of buying Ether using Transak on MetaMask mobile via bank transfer, credit cards,

or Apple Pay on iOS devices.

Customer Service

Despite being one of the most popular cryptocurrency wallets in the Ethereum ecosystem,

MetaMask’s customer support is limited to technical issues experienced when using the wallet on a

personal device. While support is not live, users can get help via the self-help center, community

message board, email, or ticket system.

Cost & Fees

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Transaction fees on MetaMask are the sole responsibility of the users. Charges are mainly for gas

fees which are paid to the blockchain service. When buying crypto, users may be expected to pay a

processing fee, a base fee, and a gas limit. Users will also pay a service fee of 0.875% for any

swaps.

Users can customize their gas fees depending on how fast they want the transaction to be processed.

These fees, which are quite higher than the standard fees, are called high-priority fees. The model

behind this strategy is that miners are enthusiastic to process transactions that come with higher

fees. So paying higher fees will prompt them to process transactions faster.

Final Verdict

MetaMask is a decentralized wallet with vast features and Web3 applications that make it a central

hub for NFT and Web3 enthusiasts who desire to build decentralized applications on the Ethereum

blockchain. The wallet exists as a web browser application and mobile app.

While this wallet has vast features, it cannot be used as a primary wallet because it does not support

Bitcoin, the most-held digital asset in the crypto industry. With technical features being dominant,

the wallet is suitable for intermediate and advanced crypto investors.

Methodology

One of the most important things to consider before you transact in and store cryptocurrencies is

that you have a suitable crypto wallet in place. To help determine the wallet that works best for you,

we conducted a comprehensive review process of the top cryptocurrency software wallets.

Our review process is built around a quantitative ratings model that weighs key factors like

security, costs, privacy, usability, customer support, and features according to their importance. Our

team of researchers gathered over 40 data points and conducted extensive research for each of the

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

19 companies we reviewed. Our team of writers, who are experts in this field, then test drove each

wallet to lend their qualitative point of view.

Our model gave preference to companies with the strongest security measures and

reputations. Companies with rich features, such as supporting a large number of crypto assets,

giving users the ability to sync with hardware wallets, and allowing for fee customization, also

ranked highly.

MetaMask uses BIP39 to generate a seed phrase for your wallet. Your seed phrase will cover every

token, address, and transaction generated by your wallet. Think of it as your backup master key.

You can think of your seed phrase as a master backup of all your cryptocurrency in this wallet.

With MetaMask, control over your wallet belongs to the holder of a master key (that’s YOU!).

The Secret Recovery Phrase is a unique 12-word phrase generated when you first set up

MetaMask. Again, this is the same thing as a seed phrase. Your funds are connected to that phrase.

If you ever lose your password, your Secret Recovery Phrase allows you to recover your wallet and

your funds. Write it down on paper and hide it somewhere, put it in a safety deposit box, or use a

secure password manager. Some users even engrave their phrases into metal plates!

Not even the team at MetaMask can help you recover your account or wallet if you lose your Secret

Recovery Phrase. As long as you keep this phrase safe and sound, your wallet will be secure.

Never ever share your Secret Recovery Phrase with anyone. Sharing your Secret Recovery Phrase

with someone would be like handing over the pin code to your bank card or the keys to your house.

It would give that person the ability to access and transfer all of your funds. The MetaMask team

will never ask you for it. If anyone or any website asks you to share it, they’re trying to scam you.

Here are a few essential security tips to help you keep your wallet secure

What’s the difference between a Secret Recovery Phrase and a password? Why do I need both?

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

MetaMask locally encrypts your secret recovery phrase with your password. That means that no

one can use your funds when you lock your wallet until you enter your password again. If you

forget your password, you can regain access to your account with the Secret Recovery Phrase, as

it’s the key to access your wallet that only you hold. It’s important to know that neither MetaMask

nor anyone else can change or recover your seed phrase if it’s lost. Please guard it well!

How To Reveal (and Recover) Your Secret Recovery Phrase

You’ll be prompted to set your Secret Recovery Phrase and password when you first log in to

MetaMask. If you lose it, you should be able to recover it if you remember your password, AND

you have a copy of your vault data. You can attempt to find your vault data (either locally on your

computer or on a backup of the computer) using these instructions:

For Chromium-based browsers (Chrome and Brave) 1.0k

Vault decryptor (use it if you find your vault data) 306

If you lose your Secret Recovery Phrase AND forget your password, there is no way to recover the

phrase and access your account.

Don’t share your secret recovery phrase and private keys

This has been mentioned already, but it doesn’t hurt to be thorough: anyone who has your Secret

Recovery Phrase or private keys could send Ether or tokens out of your accounts. Never share your

Secret Recovery Phrase or private keys with anyone - not even the MetaMask team. We will never

ask you for this information. If anyone claims to be a MetaMask team member and asks you for this

information, please report them immediately via: support@metamask.io.

If you have a large amount of ETH/token in your accounts, consider getting a hardware wallet.

Hardware wallets, like Trezor and Ledger, are commonly thought to be a safer way to store your

Ether or tokens. It signs transactions through the private keys, which are stored offline.

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

These are essential tips but are by no means an exhaustive list of security options. Keep on top of

token security trends and updates by learning from the Ethereum community, reading helpful

material (like this post) and joining discussion channels like this

When you set up a Metamask wallet (other options are available), you will be asked to note down

and then re-enter 12 words. These words are your mnemonic seed phrase and can be used to

recover access to your wallet if you forget your password or need to restore on another device.

BIP39

The implementation of the mnemonic seed phrase was introduced within BIP39 (N.B Bitcoin

Improvement Proposals are suggested upgrades to bitcoin’s functionality which are peer reviewed

and can be implemented with consensus from the wider community) in September 2013 and aimed

to provide an easier to remember way for bitcoin users to back up access to their wallets.

Generating the Mnemonic

To create the mnemonic phrase;

1) Generate 128–256 bits of entropy (a random hash). The longer the entropy the more secure it is

however using 256 bits of entropy will require 24 words in the mnemonic seed phrase vs 12 for 128

bits.

Example of 128 bit entropy: da9d114afde92daf44a36c55bdb05787

2) Each character can then be represented in binary form

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

3) We then generate a check sum by running our above entropy through the SHA256 algorithm

(this hashing algorithm is also used in bitcoin address generation)

result: fe4eed23f29e9eb256a2fbce9a07a230589ded811f3ea8031c8a57c403fe8d93

and taking the first ` n` bits where n is calculated as ` the length of our entropy/32`. So as 128/32=4

we’re taking the first 4 bits which is equivalent to the first character ` f`. This is represented as

` 1111` in binary, so we append this to the end of our entropy:

1101 1010 1001 1101 0001 0001 0100 1010 1111 1101 1110 1001 0010 1101 1010 1111 01 00

0100 1010 0011 0110 1100 0101 0101 1011 1101 1011 0000 0101 0111 1000 0111 1111

4) We then need to split into groups of 11 and convert to decimal as this is going to allow us to

match these up to our wordlist!

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Each of these 12 11-bit groups are now represented by a number between 0 and 2047 which acts as

an index to a word list of 2048 unique words which make up the seed phrase.

The english wordlist can be found

here: https://github.com/bitcoin/bips/blob/master/bip-0039/english.txt

We have therefore created the 12 word mnemonic which can be used to restore access to our wallet.

In the case that we need to regenerate the entropy from the seed phrase we simply do the whole

process backwards!

Mist

Mist is an Electron framework based application which is used for the management of Ethereum

wallet and Ethereum applications. More specifically, it is a hybrid desktop application with a web

interface to manage Ethereum DApps (Decentralized Apps). Mist is similar to a web browser like

Chrome or Firefox, but a Web 3.0 edition. Mist is an all in one software to manage all the assets

and contracts of an individual in the Ethereum Blockchain. Mist can browse DApps, manage

contracts, manage ether and other digital assets etc. It acts like a window to the Blockchain network

and access different Apps and Services provided in the network. Mist is also the official wallet of

Ethereum blockchain to manage ‘Ether’. Mist is developed and maintained by Ethereum team and

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

it is still in beta stage, hence it may have problems. It is recommended to use the latest and updated

version of the official Git repository of Mist.

Mist installation is similar to any other software. Download the ‘Mist’ executable file appropriate to

your operating system from Git repository and install it like any other application. Since Mist is a

client based application, it has to download and save the entire Ethereum Blockchain to the local

system. As of now, there is at least 5GB of data and it will increase as the chain grows. So the

downloading and installation process is a big task.

Mist wallet

Mist wallet is the official wallet of Ethereum Blockchain so the Ethereum currency Ether can be

stored and managed with it. Since Mist can serve both as a wallet and asset management tool it is

easy to engage in Ethereum transac- tions using mist. Another advantage of using Mist is the

security. The wallet is purely designed and developed by Ethereum itself not by any third party.

Mist wallet provides two type of service namely ‘Simple Wallet’ and ‘Multisignature wallet’. In

Both services, the users can manage their funds, ethers, as well as the contract in simple steps. But

the ‘Multisignature wallet’ can provide some extra layer security to its user.

An important thing to note while using a Mist wallet is about syncing process. Always ensure that

the entire Blockchain is synced with the local system. Incomplete syncing may invite critical

problems during the transaction.

Truffle

Truffle is a blockchain development framework dedicated to Ethereum blockchain platform. This

open source framework was developed by Consensys with an objective to simplify the blockchain

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

and DApp development in Ethereum plat- form. Truffle is a well-equipped framework which makes

Ethereum platform more user-friendly and interactive. Following features of truffle make it the best

choice for developments in Ethereum.

Features of Truffle

Automated tools

Truffle provides built-in smart contract creation tools, which will perform com- pilation, linking,

deployment and binary management of the smart contracts. It offers a development environment

with a testing framework and digital asset pipeline. The truffle reduces the complexities of team-

based development, testing, deployment, and migration activities in an Ethereum project. In total,

smart contract creation and testing which are two tedious tasks in blockchain development have

become easier with truffle.

Scriptable

Along with those automated tools available, the truffle is scriptable too. Which means the developer

is allowed to add more scripts to the project during the development. For running these scripts a

‘script runner’ is also available in truffle, which can run both external and internal scripts.

Networking

As the blockchain is growing day by day extensions and migrations have become a frequent

requirement in the development environment. The truffle framework is fully capable of integrating

an infinite number of networks to it and will completely support migrations and extensions of

networks. The configurable build pipeline in truffle supports tight integration within the network.

Package support

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Truffle provides two package management tools, Ethpm & Npm. Ethpm is the Ethereum Package

Manager and Npm is Node Package Manager These package includes several modules and set of

predefined codes which can be utilized while scripting.

User interaction

Truffle has an interactive console for the direct contract communication. Through

this console, the developer can create, compile and test the smart contracts.

The console also manages the communications between the user and smart contracts.

Another interaction environment available in truffle is the browser portal. The developer can use

the default account in truffle to use the browser environment. It is possible to see the local

transactions, pending requests etc. from there.

Development-Truffle boxes

Before installing a truffle environment owe must install an Ethereum client like ‘Geth’,

‘WebThree’, Parity’ or any other. Truffle is installed as a separate project above Ethereum client

and it can be deployed on it without any extra configuration.

After installing the Ethereum client, create a project directory for truffle using the command

mkdir projectfolder’

To initialize the project (i.e. truffle) navigate to the created directory

cd projectfolder

And run following command.

init truffle

If the initialization is complete then the following project structure will be created

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Contracts

Migrations

test

truffle.js

By default, there will be some sample contracts and set of sample projects in truffle environment to

get acquainted with the truffle environment.

Truffle Box

In truffle, each individual project is called truffle boxes. The

truffle box will contain required modules, front end views, solidity smart contract libraries of a

project etc..

As mentioned earlier, Truffle comes with some sample Truffle Boxes available. The user can unbox

and run them in the test environment.

Creating a Truffle Box

Users can create their own truffle boxes in the truffle environment. They can either create truffle

from scratch or can add an existing project to the box and develop from it. If the project is starting

from scratch a ‘blueprint truffle box’ is readily available in the truffle. The ‘blueprint truffle box’

will contain all the necessary configuration files and common values for a truffle box.

For developing truffle boxes the user need a

Github repository,

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

MC4013- CNBT Unit - 3

Configuration file,

Optionally small and large images for the boxes listing.

The truffle configuration file name is truffle-box.json. It contains 3 attributes ignore, commands

and hooks

Ignore: An array attribute contains the list of files to be ignored while unboxing. Commands:

Object attributes of a key-value pair, contains the list of files to be compiled or migrated. After

unboxing these files are visible to users.

Hooks: Object attribute which contains a list of commands need to be executed when unboxing.

The blueprint contains all the basic components needed for developing a truffle box. The developer

can delete the default sample files and images from the box and can create new files. The

configuration file is also customizable.

Community truffle box

Truffle is already providing several official truffle boxes developed by the truffle developers. Along

with that a vibrant truffle community is also actively contributing new truffle boxes. Any individual

can contribute to the community by sending the developed truffle details and GitHub repository

details to truffle community. The Box will undergo a screening and if it is compatible with truffle

then it will be published as a community truffle box.

Prepared by : Savithri S, AP/MCA, DSCET- Mamallapuram

You might also like

- CS378: Computer Networks Lab: Topic 01: OverviewNo ratings yetCS378: Computer Networks Lab: Topic 01: Overview22 pages

- Blockchain Syllabus - Sem VII - Mumbai UniversityNo ratings yetBlockchain Syllabus - Sem VII - Mumbai University3 pages

- Week 11: Assignment 11: Assignment Submitted On 2024-10-09, 22:43 ISTNo ratings yetWeek 11: Assignment 11: Assignment Submitted On 2024-10-09, 22:43 IST3 pages

- IEC121 Digital Design and Electric Circuits L-T-P-C: 3-1-2-5No ratings yetIEC121 Digital Design and Electric Circuits L-T-P-C: 3-1-2-524 pages

- JavaScript: Syntax and Practices 1st Edition Tomar PDF Download100% (2)JavaScript: Syntax and Practices 1st Edition Tomar PDF Download47 pages

- IoT Exam Guide for B.Tech/M.Tech StudentsNo ratings yetIoT Exam Guide for B.Tech/M.Tech Students3 pages

- CS3551 DC - Int - I - Answer Key 7.9.23No ratings yetCS3551 DC - Int - I - Answer Key 7.9.2368 pages

- Problem Statement: Aim Theory:: Assignment No-1No ratings yetProblem Statement: Aim Theory:: Assignment No-133 pages

- Department of Information Technology: Question Bank Department: IT Semester: II Class:-BE Subject:-Ubiquitous ComputingNo ratings yetDepartment of Information Technology: Question Bank Department: IT Semester: II Class:-BE Subject:-Ubiquitous Computing4 pages

- Concurrency Control in Distributed Databases100% (1)Concurrency Control in Distributed Databases12 pages

- Prepared By, Savithri.S Department of Mca DscetNo ratings yetPrepared By, Savithri.S Department of Mca Dscet15 pages

- Webservice Security Using UsernamePasswordNo ratings yetWebservice Security Using UsernamePassword8 pages

- Business Plug-In B6 Information Security: Learning OutcomesNo ratings yetBusiness Plug-In B6 Information Security: Learning Outcomes7 pages

- Oracle Fusion GL Configuration Thrive AcademyNo ratings yetOracle Fusion GL Configuration Thrive Academy64 pages

- 12 Minute Affiliate System - Rev 2020-08-25aNo ratings yet12 Minute Affiliate System - Rev 2020-08-25a99 pages

- Konica Minolta Bizhub Pro C6501 User Manual SecurityNo ratings yetKonica Minolta Bizhub Pro C6501 User Manual Security32 pages

- Store Passwords Securely in Database Using SHA256 - ASP .NET Core - by Juldhais Hengkyawan - MediumNo ratings yetStore Passwords Securely in Database Using SHA256 - ASP .NET Core - by Juldhais Hengkyawan - Medium31 pages

- LogRhythm NDR User Guide (New UI) RevD 1No ratings yetLogRhythm NDR User Guide (New UI) RevD 175 pages

- Level 1 Documentation For NCR Aloha Troubleshooting100% (2)Level 1 Documentation For NCR Aloha Troubleshooting11 pages

- PI Messages Are Not Delivered To SAP NetWeaver BPM - Technology Troubleshooting Guide - SCN Wiki PDFNo ratings yetPI Messages Are Not Delivered To SAP NetWeaver BPM - Technology Troubleshooting Guide - SCN Wiki PDF6 pages