0% found this document useful (0 votes)

19 views26 pagesMarket Profile Trading Basics

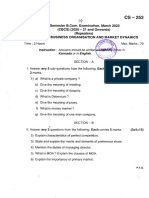

The document provides an overview of Market Profile (MP) concepts and how it can help traders. It discusses how MP organizes trading data based on price and time. MP identifies three core concepts - price as an advertising mechanism, time as a regulator, and volume measuring auction success. It outlines different day types based on balance/imbalance and acceptance/rejection. Examples are given on structural elements like the point of control and how to assess position risk by analyzing profile structure and market behavior over time. The presentation aims to cover MP basics, identify patterns using structure, and demonstrate evaluating risk through continuous market development analysis and longer-term profiles.

Uploaded by

Varun VasurendranCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

19 views26 pagesMarket Profile Trading Basics

The document provides an overview of Market Profile (MP) concepts and how it can help traders. It discusses how MP organizes trading data based on price and time. MP identifies three core concepts - price as an advertising mechanism, time as a regulator, and volume measuring auction success. It outlines different day types based on balance/imbalance and acceptance/rejection. Examples are given on structural elements like the point of control and how to assess position risk by analyzing profile structure and market behavior over time. The presentation aims to cover MP basics, identify patterns using structure, and demonstrate evaluating risk through continuous market development analysis and longer-term profiles.

Uploaded by

Varun VasurendranCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 26