0% found this document useful (0 votes)

60 views65 pagesSlide Chapter 2

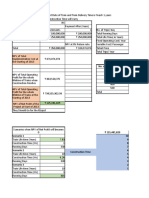

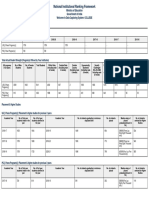

This document provides an introduction to basic cost terminology and purposes. It defines key cost terms like direct costs, indirect costs, variable costs, fixed costs, and period costs. It explains how costs are classified and accumulated for different cost objects like products, services, projects, customers, and activities. Direct costs can be easily traced to a specific cost object, while indirect costs require allocation. Variable costs change with activity levels while fixed costs remain constant. The document cautions that unit costs can be misleading without specifying an activity level, and that managers should generally consider total costs for decision-making.

Uploaded by

daoviethung29Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

60 views65 pagesSlide Chapter 2

This document provides an introduction to basic cost terminology and purposes. It defines key cost terms like direct costs, indirect costs, variable costs, fixed costs, and period costs. It explains how costs are classified and accumulated for different cost objects like products, services, projects, customers, and activities. Direct costs can be easily traced to a specific cost object, while indirect costs require allocation. Variable costs change with activity levels while fixed costs remain constant. The document cautions that unit costs can be misleading without specifying an activity level, and that managers should generally consider total costs for decision-making.

Uploaded by

daoviethung29Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 65