0% found this document useful (0 votes)

69 views8 pagesFINAL TEST DUM Example

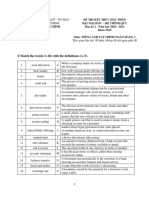

The document is a final test that assesses a student's grammar, vocabulary, listening, and reading skills related to banking. It contains multiple choice and fill-in-the-blank questions testing knowledge of banking terms and concepts, as well as passages to read and listen to involving common banking scenarios. The test covers areas such as completing sentences with banking words, choosing the correct answers about bank services and processes, matching vocabulary to definitions, and demonstrating comprehension of conversations between bank employees and customers.

Uploaded by

Aryanie TlonaenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

69 views8 pagesFINAL TEST DUM Example

The document is a final test that assesses a student's grammar, vocabulary, listening, and reading skills related to banking. It contains multiple choice and fill-in-the-blank questions testing knowledge of banking terms and concepts, as well as passages to read and listen to involving common banking scenarios. The test covers areas such as completing sentences with banking words, choosing the correct answers about bank services and processes, matching vocabulary to definitions, and demonstrating comprehension of conversations between bank employees and customers.

Uploaded by

Aryanie TlonaenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 8