0% found this document useful (0 votes)

2K views8 pagesCPA Exam: Home & Branch Accounting

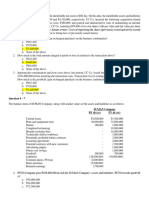

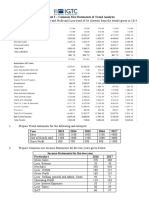

1. The document provides information on home office and branch accounting procedures, including transactions between the home office and branch that require entries on both sets of books.

2. It discusses determining the branch and home office net income from separate operations as well as their combined net income based on transaction details.

3. Procedures for reconciling reciprocal accounts between the home office and branch using the adjusted balance method are outlined, including example journal entries impacting the Investment in Branch and Home Office Current accounts.

Uploaded by

MABI ESPENIDOCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views8 pagesCPA Exam: Home & Branch Accounting

1. The document provides information on home office and branch accounting procedures, including transactions between the home office and branch that require entries on both sets of books.

2. It discusses determining the branch and home office net income from separate operations as well as their combined net income based on transaction details.

3. Procedures for reconciling reciprocal accounts between the home office and branch using the adjusted balance method are outlined, including example journal entries impacting the Investment in Branch and Home Office Current accounts.

Uploaded by

MABI ESPENIDOCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 8