0% found this document useful (0 votes)

356 views13 pagesProblem Assignment

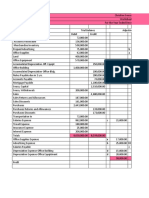

1. The journal entries record the transactions of Happy Tour and Travel for its first month of operations, including the initial investment, cash receipts and payments, purchases and expenses.

2. The ledger accounts show debit and credit balances for cash, accounts receivable, assets, liabilities, capital, revenue and expenses.

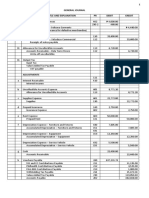

3. The unadjusted trial balance totals debits and credits at Rs. 951,000.

4. The income statement reports net income of Rs. 30,000 and the capital statement shows an increase in Gomez's capital to Rs. 830,000 after drawing a salary.

Uploaded by

Keana De GuzmanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

356 views13 pagesProblem Assignment

1. The journal entries record the transactions of Happy Tour and Travel for its first month of operations, including the initial investment, cash receipts and payments, purchases and expenses.

2. The ledger accounts show debit and credit balances for cash, accounts receivable, assets, liabilities, capital, revenue and expenses.

3. The unadjusted trial balance totals debits and credits at Rs. 951,000.

4. The income statement reports net income of Rs. 30,000 and the capital statement shows an increase in Gomez's capital to Rs. 830,000 after drawing a salary.

Uploaded by

Keana De GuzmanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 13