0% found this document useful (0 votes)

409 views3 pagesFABM 1 5 Edited

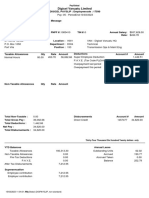

The document details the initial investment and various financial transactions of Gisel Ong starting an anime art gallery business over the month of May. It provides journal entries for investments, purchases, sales, collections and other events affecting the accounting equation of the business.

Uploaded by

awitakintoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

409 views3 pagesFABM 1 5 Edited

The document details the initial investment and various financial transactions of Gisel Ong starting an anime art gallery business over the month of May. It provides journal entries for investments, purchases, sales, collections and other events affecting the accounting equation of the business.

Uploaded by

awitakintoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 3