0% found this document useful (0 votes)

311 views5 pagesPolicy Servicing for ULIP Holders

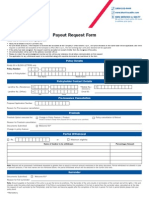

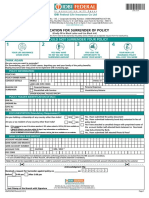

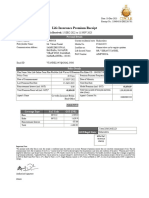

This document contains a policy servicing form for processing a payout or withdrawal from a life insurance policy. The form requests information such as policyholder details, bank account information, type of transaction, and includes declarations authorizing the transaction.

Uploaded by

MMayoor1984Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

311 views5 pagesPolicy Servicing for ULIP Holders

This document contains a policy servicing form for processing a payout or withdrawal from a life insurance policy. The form requests information such as policyholder details, bank account information, type of transaction, and includes declarations authorizing the transaction.

Uploaded by

MMayoor1984Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 5