0% found this document useful (0 votes)

20 views2 pagesNew Client Document Checklist

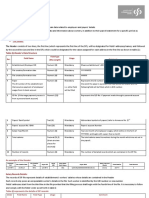

The document outlines the initial and ongoing documents needed for a new client's bookkeeping services. It lists tax returns, accounting software access, bank statements, payroll records, and documentation of expenses, deposits, and asset transactions as essential information.

Uploaded by

va.amazonsellercentralCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

20 views2 pagesNew Client Document Checklist

The document outlines the initial and ongoing documents needed for a new client's bookkeeping services. It lists tax returns, accounting software access, bank statements, payroll records, and documentation of expenses, deposits, and asset transactions as essential information.

Uploaded by

va.amazonsellercentralCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 2