0% found this document useful (0 votes)

79 views22 pagesChapter 17

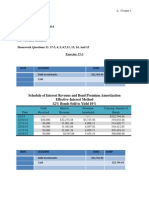

The document provides solutions to various exercises related to accounting for investments. It includes schedules and journal entries for different types of investments accounted for using different methods like effective interest, straight line and fair value. The exercises cover topics like interest revenue, premium/discount amortization and fair value adjustments.

Uploaded by

Sunny SunnyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

79 views22 pagesChapter 17

The document provides solutions to various exercises related to accounting for investments. It includes schedules and journal entries for different types of investments accounted for using different methods like effective interest, straight line and fair value. The exercises cover topics like interest revenue, premium/discount amortization and fair value adjustments.

Uploaded by

Sunny SunnyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 22