0 ratings0% found this document useful (0 votes)

969 views35 pagesChapter 22 (With Problems)

valix vol 3

Uploaded by

Abigail PadillaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

0 ratings0% found this document useful (0 votes)

969 views35 pagesChapter 22 (With Problems)

valix vol 3

Uploaded by

Abigail PadillaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

You are on page 1/ 35

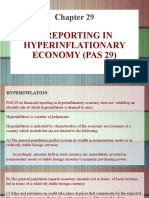

CHAPTER 29

HYPERINFLATION

TECHNICAL KNOWLEDGE

To know the characteristi.

‘ 7 cs that may indicate

hyperinflationary economy,

To know. the requirement for financial reporting in a

hyperinflationary economy.

To understand constant peso accounting.

To distinguish between monetary items and nonmonetary

items.

To know the procedures for restating historical financial

statements in terms of current price level.

To determine gain or loss on purchasing power.

671

HYPERINFLATION

rting in a hyperinflationary econo

PAS 29 on financial repo! psolute rate at which hyperinflation

does not establish an @

is deemed to arise.

Hyperinflation is a matter of. ‘judgment.

i ion is indi 5 Yr istics of the econom;

erinflation is indicated by characteris economia

eo tsoament of a country which include but are not limited )

the following:

lation prefers to keep its wealth in

a. The general popul: A

7 ets or in relatively stable foreign

nonmonetary ass

currency.

Accordingly, amounts held in local currency are immediately

invested in nonmonetary assets or stable foreign currency

to maintain purchasing power.

b. The general population regards monetary amounts not in

terms of local currency but in terms of a relatively stable

foreign currency.

c. Sales and purchases on credit take place at prices that

compensate for the expected loss of purchasing power

during the credit period even if the period is short.

d, Interest rates, wages and prices are linked to a price index.

e. Ae cumulative rate over 3 years is approaching or exceeds

0%.

Although PAS 29 sets out the characteristics that may indicate

hyperinglationary economy, it also states that judgment may

e used in determining wheth ial

stltohients is seaaina ler restatement of financl

672

Financial Yeporting in a

L

PAS 29, Paragraph 8, provi

an entity that reports j

t

economy, whether the

or a current cost appre

measuring unit current

Presentation of the inform

supplement to yn;

permitted,

———

inflationary economy

ides that the financial statements of

© currency of a hyperinflationary

ased on historical cost approach

» shall be stated in terms of the

at the end of reporting period.

ation required under PAS 29 as a

restated financial statements is not

by ciple ep inaneial statements of an entity that reports

by means of constant ypetinflationary economy is accomplished

_ ‘Pe80 accounting and current cost accounting.

Constant peso accoun

Constant peso accounting

iting

is the restatement of conventional

or justorteg! financial statements in terms of the current

purchasing power of the peso through the use of index number.

Constant peso accounting also known as purchasing power

or price level accounting.

‘The traditional concept of pi

on historical cost is known

Monetary items

reparing financial statements based

as nominal peso accounting.

PAS 21 defines monetary items as money held and assets and

liabilities to be received or paid in fixed or determinable amount

of money.

The essential feature of a monetary item is a right to receive

or an obligation to deliver a fixed or determinable amount

of money,

In simple language, monetary items refer to cash and assets

that represent a fixed amount of pesos to be received, or

obligations that represent a fixed amount of pesos to be paid.

Monetary assets and liabilities remain the same regardless of

‘he change in the general price level.

673

Nonmonetary items

ms, by the P’

items that cam

rocess of exclusion, may

Nonmonetary ite not be classified as monetary

defined as those i :

alled nonmonetary ecause their pe

he financial statements differ from 7

ly realizable or payable.

These items are 80 U

amounts reported in tl

amounts that are ultimatel

The essential feature ofa nonmonetary item is the absence of

a right to receive or an obligation to deliver a fixed o

determinable amount of money.

What items are restated?

Only nonmonetary items are restated when preparing constant

peso financial statements.

Monetary items are not restated anymore because they are

automatically stated in terms of current purchasing power of

the peso.

The objective of constant peso accounting is to report elements

of the financial statements in terms of pesos that have the same

purchasing power.

Formula for restatement

Index number at end of reporting period

«Historical cost

Index number on acquisition date

For example, a land was acquired on January 1, 2019 for

P500,000 when the index number is 125.

If the land is to be restated on December 31, 2020 when the

index number iis 300, the restated amount is computed 4

follows:

Restated amount = 300/125 x P500,000

=. P1,200,000

674

y OO —_—

!

Examples of mo,

netary and nonmonetary items

Following is a list 7

with thei of statement of financial position items

ar Proper ifieati,

Per classification ag monetary or nonmonetary-

Cash Monetary Nonmonetary

Boancial a held for trading *

‘nancial assets at fai

other comprehensive wi trough

Financial assets at amortized cost

Accountsand notes receivable :

lowance for do

Ae aece doubtful accountsand notes >

balers toemployees a

Prepaid insurance, tax¢ eit

Prepaid interest es, advertising, rent x

Receivables under finance lease

Long boo Tecetvables

special deposits which are re

Flos kigeenereomeel

Consisting of financial assets at fair value x

Consisting ofbonds at amortizedcost x

Property, plant and equipment

Accumulated depreciation

Cash'surrender value i!

Advances to suppliers .

Discounton bonds payable .

Intangible assets

Goodwill

Accounts and notes payable

Accrued expenses

Cash dividend payable

Liability for refundable deposits

Advances from customers x

‘Accrued losses on firm purchase

commitments

Bondspayable

Obligations under finance lease

Pension benefits to be paid in cash

Provisions that are to be settled in cash

Deferred revenue

Noneontoling interest

Preference share capi

Ordinary share capital

ae

. ‘Retained earnings’ is residual and

should not be classified as either monetary

‘ornonmonetary.

iz

x

MM

me

“mM

HOM Perry

HOM MM

675

i , :

General price index

ment is known as generg)

4 tel

The index number used for restal Sentral ng Pilipinas,

price index constructed by the Bangko

index is desi Ih the overall }

dex is designed to show how muc’ level

A ee in aie occa has changed over time.

eneral price index means that the

i in the eae

Cachcung pole of money has decreased. This is popularly

known as inflation.

‘A decrease in the general price index means that the ‘purchasing

‘power of money hag increased. This is known as deflation.

Specific price index

A specific price index is the change in the price of a specific good

or service, such as food, clothing and car.

Specific price change occurs primarily because of change in

supply and demand for a particular good or service. The law of

supply and demand is in operation in the case of a specific price

change.

For example, if there is an increase in demand for cars, then

the specific price of cars will tend to increase.

The specific price of a good or service may change at a different

rate and even in the opposite direction from the general price

change in the overall economy.

Gain or loss on purchasing power

cee means the goods and services that money can

uy.

In a period of inflation or rising prices, a purchasing power loss

is incurred on monetary assets and i in is

realized on monetary Labilities, "| PTSBASiNE Power #2

In a period of deflation or falling prices, a purchasing powe

gain is realized on mone i purchasing .

Joss is incurred on Pasa Unblities = “

676

jilustration

eraon deposits P100,099;, . tte

Aho current year to eons savings account atthe beginning

Five years later, having withdrawn ither the principal nor

of O00, tae gepositor owns a passbook hat shows a balance

of Fall at 836 for Sroets: S™AUNE of 100,000 compounde

Obviously, there is a monetary j th

depositor now has more ene than ke of Ede because the

But economically speaking, is there Bain or toss?

If during the five-year period, the price level approximately

increased 100%, then to maintain the purchasing power of the

P100,000in the current year, the depositor should have P200,000

after 6 years.

But the depositor has only P146,930. Thus, there is an economic

Joss of P53,070. Clearly, when prices increase, the value of

money decreases,

Another illustration

Aperson borrows at the beginning of the current year P100,000

payable after 5 years at 7% interest compounded annually.

The table of amounts shows that the value of the P100,000 after

6 years at 7% compounded annually is P140,260. This is,

therefore, the amount to be paid by the debtor.

If during the five-year period the price level increased by

approximately 100%, then the creditor should receive at least

200,000 to maintain the purchasing power of the P100,000 in

the current year. But he receives only P140,260.

Thus, there is an economic loss on the part of the creditor, and

&n economic gain on the part of the debtor, in the amount of

P59,740.

Clearly, when prices increase, it is more advantageous to incur

1 fixed obligations rather than hold monetary assets,

677,

Procedures for restatement

1. The items in the financial statements are classified into

monetary and nonmonetary.

i -estated because these are alr;

2. Monetary items are not resta t ead

capresued in terms of the monetary unit current at the

end of reporting period.

3. Nonmonetary items are restated by applying the generg}

price index from the date of acquisition to the end of

reporting period. Some nonmonetary items are carrie

at amounts current at end of reporting period, such ag

net realizable value and fair value.

4, Some nonmonetary items are carried at amount current

at date ‘other than acquisition date, for example, property,

plant and equipment are revalued. In such case, the

carrying amounts are restated from the date of

revaluation.

5. Ailitems in the income statement are restated by applying

the change in the general price index from the dates when

the items of income aud expenses were initially recorded.

However, for practical purposes, the average index may

be used.

6. The general purchasing power gain or loss is computed.

This pertains only to monetary items. The gain or loss on

purchasing power is included in profit or loss.

7 The restated amount of property, plant and equipment,

goodwill and other intangible asset is reduced when it

exceeds the recoverable amount.

8. An

elis

revaluation surplus recognized previously is

inated.

9. Retained earnings would be the balancing figure in the

restated statement financial position. ene

10. When comparative statements are prepared, the monetary

items of the preceding year are expressed in terms ©

index number at the end of the current year. |

678

Vana

f eee eee ear tete es

filustration

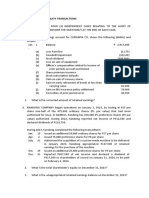

pxemplar Company 5

statements based on faces the following financial

torical cost:

State nEMPLAR COMPANY

‘ment of Financial Position

December 31, 2020

Assets 2020 2019

Cash :

‘Accounts receivable eapeea coo

‘allowance for doubtful accounts (20,000) (30,000)

Inventories 300,000 350,000

Land 200,000 200,000

Building _ 600,000 600,000

Accumulated depreciation ( 240,000) ( 200,000)

Equipment a 800,000 800,000

‘Accumulated depreciation (320,000) (_ 240,000)

2,370,000 2,330,000

Liabilities and Shareholders’ Equity

Accounts payable 250,000 300,000

Bonds payable 500,000 500,000

Share capital : 1,000,000 1,000,000

Retained earnings 620,000 530,000

2,370,000 2,330,000

679

EXEMPLAR COMPANY

Statement of Income and Retained Earnings

Year ended December 31, 2020

Sales 3,000,000

Cost of goods sold:

350,000

1 ,

oe 1,900,000

Goods available for sale ae ate) He

Inventory, December 31 (_ 300,000) 1,950,000

i 1,080,000.

Gross income 5

Expenses: Se

Distribution and administrative expenses 600,000

Depreciation — building 40,000

Depreciation - equipment 80,000

Interest expense 30,000 750,000

Income before income tax 300,000

Income before income tax 300,000

Less: Income tax 76,000

Netincome : 225,000

Retained earnings, January 1 530,000

Total ; 785,000

Less: Dividends paid on July 1 135,000

Retained earnings, December 31 620,000

The price index numbers prevailing at the date various assets

and equities arose are as follows:

Date Item . Index number

January 1,2014 Share capital 100

January 11,2014 Land ~ 100

January 1, 2014 Building 100

January 11,2016 Equipment 110

duly 1, 2020 Dividends - 150

December 31, 2020 Interest 160

680

additional information

| Prices rose evenly and

%* General price leve) ae index numbers expressing the

ges were:

January 1

, 2019

December 31, 2019 io

ecember 31, 2929 160

Average for ' 2019 135

Average for 2020 150

id purch:

p, Sales and p ‘aSes were made and expenses other than

depreciation were incurred evenly. ?

Inventories were reported i vert

oo! ed at cost using FIFO and average

index numbers for the year are applicable in restating

inventories.

The following is the restatement of the statement of financial

position and income statement.

Cash

Cash on December 31, 2020 would remain at 450,000

Cash on December 31, 2019 should be restated

in terms of the December 31, 2020 price

level because a comparative statement of

financial position is prepared. The amount

should be (400,000 x 160/140) 457,143

Accounts receivable

Balance on December 31, 2020, no change 600,000

Balance on December 31, 2019

(450,000 x 160/ 140) 614,286

Allowance for doubtful accounts

20,000

December 31, 2020, the same

December 31, 2019 (30,000 x 160/140) 34,286

|

|

hventories

The restatement of inventories requires knowledge of the

ates of a¢quisition and the historical cost.

681

iti ‘IFO method is 7

In the example, it is assumed that the F 8 applieg

and average index numbers for the year are applicable i

restating inventories. Accordingly, the inventories arg

restated as follows:

December 31, 2020 (300,000 160/150) 820,009

December 31,2019 (350,000x 160/135) 414815 |

Land

December 31, 2020 (200,000 160/100) — 820,009

December 31, 2019 (200,000x 160/100) - 320,009

Building

December 31, 2020 (600,000x 160/100) 960,000

December 31, 2019 (600,000x 160/100) —_ 960,000

Accumulated depreciation - building

December 31, 2020 (240,000x 160/100) 384,000

December 31,2019 (200,000x 160/100) — 320,000

Equipment

December 31, 2020 (800,000x 160/110) 1,163,636

December 31,2019 (800,000 160/110) 1,163,636

Accumulated depreciation - equipment

December 31, 2020 (320,000x 160/110) 465,453

December 31, 2019 (240,000 160/110) 349,091

Accounts payable

December 31, 2020, the same 250,000

December 31, 2019 — (300,000x 160/140) 342,857

Bonds payable

December 31, 2020, the same 500,000

December 31, 2019 = (500,000 x 160/140) . 571,429

Retained earnings

The tetained earnings balance is the amount needed

balance the statement of financial position, It is therefor

the residual amount or “balancing” figure.

682

- —_

gales

Inasmuch as sales are

r r, Spread e

over the year, the average index for 2000

jg used in converting thi

esos. The amount show we to 2020

(3,000,000 x 160 / 150) 3,200,000

purchases

The average index for 2020 i

used because the purchases ste vade

evenly throughout the year, The amount

should be (1,900,000) x 160/ 150) 2,026,667

pistribution and administrative expenses

The average index for 2020 is al: d

(600,000 x 160 / 150) are es 640,000

Depreciation — building

40,000 x 160/100 64,000

Depreciation — equipment

80,000 x 160/110 116,364

Interest expense

Same amount as reported because it is

paid on December 31, 2020 30,000

Income tax i

‘The income tax is assumed to be incurred

evenly throughout the year

(75,000 x 160 / 150) 80,000

| Dividends

| Since the dividends are paid on July 1, 2020, .

| the index on that date is used

144,000

(135,000 x 160 / 150)

683

-—

000‘0EE's = LBI'bY6S

oo0‘oze's

£09'921'E

L1Z'8T9 000°0Es T81‘¥6S 00°09

000‘009'T 001/091 000'000'T + 000'009'T 00T/09T —000'000"T

6ZrILG OFL/09T 00°00 000'003 000‘00S

LSB'svE OFT /09T —000‘00E o00'0sz 000'0Sz

S0S‘9ZT'E , 000'088'S = IST'PhE'S 000‘0Le's

(l6o'6vE ) OTT/O9T (O00'OVZ ) (Ga¥'sov ) OLT/O9T (OOO‘OzE )

QENEITT OTT/O9T — 000'008 QE9'EOT'T OTT/O9T- 000'008

(Q00'0ZE ) OOT/O9T (000'00Z ) (OOO'PEE ) OOT/O9T- (OO0'OrZ )

00T/09T —000'009 000096 ©. 00T/09T - 000'009

o00'0ze —80T /09T ~—_000'00% 000'0ZE OT /09T —000'00%

GIS'PIy GET/O9T: 00'0SE 000'0ZE —OST/09T —_000'00E

(9gz've- ) OFT/O9T (O0O'0E ) (O00'0s ) (ooo'0z )

QBZFIS OFT/O9T —000'0F 000°009 000'009

EPT'LEh OFT /09T 00°00 o00'osr 000‘0Sr

Pewsey uONDUIG [VOMLOISTE, poyeysey UONOVLY —[eoyTOWS THT

610z ‘Le toquisseq

0803 “Le 29qureseq

sBuyurue poureyoy,

Tendeo areqg

eiqeded spuog

e[quced eyanos0y

Aymbg sr9poyezeys pus sont

quoudmbe — uojeperdep payemumsy

quemdmbg

Burprmq — voHeardep paye~nums0y

. Surprmg

puey

Goqsoqaeany

syumoooe nFAqnop 105 soUBMOTTY

9[qearaoax syunacoy

~ seg

szossy

(sosod guazino 9Z0z ‘18 9qu1990(] Jo'su1193 UT pazeysay)

wors{sog [BIOUwULY Jo usMaIEIg eAtEIEdUIOD

ANVdWOO0 UV 1d WaAxXa

684

Restated’

3,200,000

3,200,000

414,815

028,667

2,441,482

320,000

2,121,482

1,078,518

640,000

64,000

116,364

30,000

22,190

872,554

205,964

80,000

125,964

612,217

738,181

144,000

En

(Restated to Dees’ December 81, 2020

er 81, 2020 current pesos)

Historical Fraction

gales 3,000,000 160/150

Cost of goods sold: a

Inventory, January 1 350,000 160/136

Purphasee 1,800,000 160/150

: —e

Goods available forsale 2.950.909

Less: Inventory, Dec, 31 300,000 160/150

Cost of goods sold 1,950,000

Grossincome 1,050,000

Bxpenses:

Distribution and

administrative expenses 600,000 160/150

Depreciation — building 40,000 160/100

Depreciation — equipment 80,000 160/110

Interest expense 30,000 160/160

Loss on purchasing power -

Total expenses 750,000

Income before income tax 300,000

Less: Income tax 75,000 160/150

Netincome 225,000

Retained earnings, Jan. 1 530,000

Total 775,000

less: Dividends paid 135,000 160/150

Retained earnings, Dec. 31 620,000

685

594,181

LAR COMPANY

Dear Loss on Purchasing Power

tatio

inal? Year Ended December 31, 2020

tated:

Monetary assets, December 31, 2019, res aeaaae

as 514,286

Accounts receivable ( ra 286) ° 997

‘Allowance for doubtful accounts (__ 34,286) 937,143

Monetary liabilities, December 31, 2019, Pe eg Aa aay

‘Accounts payable 571429914

Bonds payable Eee 2286

Net monetary assets, December 31, 2019, restated 22,857

‘Add: Increase in monetary assets in 2020, restated:

Sales 3,200,000

Total 3,222,857

Lese: Decrease in monetary assets in 2020, restated:

Purchases 2,026,667

Distribution and administrative expenses 640,000

\ Interest expense 30,000

Income tax 80,000

Dividends 144,000 2,920,667

Net monetary assets, December 31, 2020, restated 302,190

* Monetary assets, December 31, 2020

Cash 450,000

Accounts receivable 600,000

‘Allowance for doubtful accounts (__ 20,000) 1,030,000

Monetary liabilities, December 31, 2020:

‘Accounts payable 250,000

Bonds payable + 500,000 _ 750,000

Net monetary assets, December 31, 2020,

Historical cost 280,000

Net monetary assets, December 31, 2020,

Restated (See above) ss 302,190

Loss on purchasing power (22,190)

Observe that the computation of gain or loss on purchasing

power requires only the comparison of net monetary assels

_ at the end of reporting period at historical cost and né

monetary assets at the end of reporting period restated 4!

current or constant pesos.

686

gain oF loss on Purchasing po:

wer

e net moneta;

etary assets at ei at historical cost exceed the net

wrobasing power, rent pesos, there is a gain 07

jn the other hand, if

oO st are less than the

there is loss on purch;

nee net monetary assets at historical

~~ Monetary assets at current pesos,

‘asing power.

he rule is the reverse for ney monetary liabilities.

The Gee a i for mula may be used in computing the “constant

peso ‘ary assets at the end of current year:

netary assets, beginning, restated xx

Less: Monetary liabilities, beginning, restated x

Net monetary assets, beginning, restated xe

‘Add: Increase in net monetary assets, restated ES

otal ; a

Less: Decrease in net monetary assets, restated ==

Net monetary assets, end, restated =

Another illustration

On January 1, 2020; an entity had monetary assets of

P5,000,000 and monetary liabilities of P3,000,000 and

therefore net monetary assets of P2,000,000.

During 2020, the entity's monetary inflows and outflows were

relatively constant and equal so that it ended the year with

the same net monetary assets of P2,000,000.

‘The general price index number was 125 on January 1 and

200 on December 31, 2020.

Since there is no change in the net monetary assets, the gain

or loss on purchasing power is simply computed as follows:

Net monetary assets — December 31, 2020, historical cost —_2,000,000

| Netmonetary assets, December 31, 2020, restated

| 000,000 x 200/ 125) (8,200,000)

‘oss on purchasing power 2,200,000)

687

Economy ceasing to be hyperinflationary

Judgment shall also be exercised whether an economy ig no

longer hyperinflationary.

The criterion is that whether the cumulative inflation rate

drops below 100% in a three-year period.

When an economy ceases to be hyperinflationary, an entity

shall discontinue the preparation and presentation of

financial statements under a condition of hyperinflationary

economy.

The amounts expressed in the measuring unit current at the

end of the previous reporting period shall be the carrying

amounts in subsequent financial statements.

Disclosures for hyperinflationary financial statements

a. The fact that the financial statements have been restated

for changes in the general purchasing power of the

reporting currency.

b. Whether the financial statements are based on historical

cost approach or current cost approach.

c. The nature and level of the price index at the end of

reporting period and the movement in the index during

the current and previous reporting period.

688

QUESTIONS

L Explain 4 general price change,

g. Explain a specific Price change.

3, Distinguish inflation and deflation.

4, What is hyperinflation?

5. What are the characteristics of an economic environment

indicating hyperinflation? Hid

6. Explain the financial reporting ; ere

economy. i Porting in a hyperinflati ‘y

7, What is constant peso accounting?

8, Explain monetary items,

9. Explain nonmonetary items,

10. What is purchasing power?

11. What items are restated in the financial statements”

prepared in a hyperinflationary economy?

12. What is the formula for restatement?

13,.What are the procedures for restating financial

statements in a hyperinflationary economy?

4. Explain the accounting treatment when an economy

ceases to be hyperinflationary.

15. What are the disclosures when financial statements are

Prepared in a hyperinflationary economy?

689

PROBLEMS

Problem 22s1(ACP)

Sunflower Cemipany yeport

svatement of financial posit

ted the following liabilities in ty

tion at- year-end:

Accounts payable 1,000,009

Accrued expenses : in

Bonds payable ,000,009

Finance lease liability 4,000,000

“Unearned revenue [ 300,000

Advances from customers 1,200,000

Estimated warranty liability 200,000

Deferred tax liability 400,000

What: total amount should be classified. as monetary

liabilities?

a. 4,500,000

b. 8,500,000.

c. 9,700,000

d. 8,900,000

Problem 22-2 (AICPA Adapted)

Gardenia: Company reported the following assets in the

statement of financial position at year-end:

* Cash in bank + 2,000,000

Accounts receivable 4,000,000

Tnventory : 1,500,000

Available for sale securities 500,000

Patent 1,000,000

Advances to employees 200,000

Advances to suppheis 400,000

Prepaid expenses 100,000

What total amount should be classified as monetary assets!

6,200,000 a

6,600,000 :

6,700,000

. 17,700,000

BoP

690

| @

problem 22-3 (AICPA Adapteg)

Dafnees from historia) cecto8 January 1, 2014. Selected

on December 31, 2029 were: beseeeeietu trac: euereele

hased on Jam

and purcha wary 1, 2014 100

qavestment in long-term bonds purchas d oe

january 1, 2017 Ce 1,200,000

gong term debt issued on January 1, 2014 1,600,000

all price ind

phe general price index was 190 on Ja: 1, 2014, 150 on

janvary 1, 2017 and 800 on Decembor 31, 2026.

1, What amount should be reported in a hyperinflationary

statement of financial Position for land? ~

2,400,000

6,000,000

4,800,000

3,000,000

eeose

2, What amount should be reported in a hyperinflationary

statement of financial position for investmentin bonds?

a, 3,000,000

b. 2,400,000

c. 1,200,000

d. 1,500,000

' 3. What amount should be reported in a hyperinflationary

statement of financial position for long-term debt?

a. 4,000,000

b. 3,200,000

¢. 2,000,000

4. 1,600,000

691

Problem 22-4 (IFRS)

ing i inflationa:

Zeus Company was operating in a hyperinflationary econo,

and provided the following statement of financial position 7

December 31, 2020:

Property, plant and equipment 900,000

Inventory 2,700,000

Cash 350,000

Share capital issued December 31, 2016 400,009

Noncurrent liabilities 500,000

Current liabilities 700,000

Retained earnings 2,350,000

The general price index had moved on December 31 of each

year: 2016-100, 2017-130, 2018-150, 2019-240 and 2020-300,

The property, plant and equipment were purchased on

December 31, 2018,

The noncurrent liabilities were loans raised on December

31, 2019. .

1, What ie the amount of total assets after restatement for

hyperinflation?

a, 5,150,000

b. 3,960,000

ec. 4,800,000

d, 4,850,000

+2. What is the amount of total liabilities after restatement

for hyperinflation?

a. 2,400,000

b, ‘1,200,000

c. 1,325,000

d. 1,500,000

3, What is the balance of retained earnings after adjusting

* for hyperinflation?

2,350,000

2,750,000

3,550,000 .

2,625,000

Be oP

692

saan

problem 22-5 (LAA)

ville Company provided the following historical incom?

at

smrement data for 2020;

' 100

salentory —January 1 5,000

Poon 2, 500,000

faventory - December 31 150,000

one 2,000,000

2,000,000

pepreciation

ales are earned and expe i

throughout the year, pensed: are ie

Inventory was acquired during ‘he last week of each year

quired on

rred evenly

Depreciable assets have a 6- i

et ooiT. year life and were act

The index numbers are 126 on January 1, 2017, 140 on January

1, 2020, and 360 on December 31, 2020,

1. What is the amount of sales after restatement for

hyperinflatiion?

a. 7,200,000

b, 5,000,000

c. 7,000,000

d. 9,000,000

2, What is the cost of goods sold after restatement for

hyperinflation?

a, 2,350,000

b, 4,000,000

c, 3,384,000

d. 3,780,000

rating in a hyperinflationary economy,

4. Ifthe entity is ope!

Id be reported as net loss?

what amount shoul

- a, 6,440,000

b, 1,860,000

¢, 1,944,000

d. 4,824,000

‘Problem 22-6. (IAA) : '

e following information for the

Ivan Company proyided th

current year:

8

Net monetary assets — January 1 3,000 00

Pavthases 1,200,000

Expenses ent

,000

Income-tax

Cash dividend paid on December 31 200,000

mses and income tax accrued evenly

The sales, purchases, expe Siege urosli0'en January)

during the year. The index nw

and 140 on December 31.

-What is the gain or loss on purchasing power?

a. 100,000 gain

b. 100,000 loss

c. 276,000 loss

d. 276,000 gain .

Problem 22-7 (LAA)

Helen Company provided the following information for the

current year:

Monetary assets:

January 1 250,000

December 31 700,000

_Monetary liabilities:

January 1 100,000

December 31 300,000

Increase in net monetary items as restated to

constant peso + 8,500,000

Decrease in net monetary items as restated to

constant peso 3,000,000

General price index:

January 1 125

December 31 300

What is the gain or loss on purchasing power?

a. 460,000 gain

b., 460,000 loss oo

c. 250,000 gain

d. 252,000 loss

694

OO __—————————

problem 22-8 AICPAAdapted)

the. beginning of ouprene

| Aonetary assets oF PB po geet Gumaméla Company -had

3,000,000. 00 and monetary liabilities of

ing the curre;

Flog rr isle mrs monn nda ad

the year with the saihe ne monetary ese 000000.

he index number on gq AY assets of 2,000,000.

Fon :.

number on December 31 wae nae 1 was 125 and the index

280.

at is the gain g;

Wrent year?" 19s8:on purchasing power during the

a. -2;480,000 gain

b. 2,480,000 loss

¢. 3,720,000 gain

4. 3,720,000 loss

problem 22-9 (AICPA Adapted)

Cherry Company reported that financi ition did not

change during the current yoke financial position did no’

The general price index wa:

December 31. 's 120 on January 1 and 300 on

The entity provided the following statement of financial

position on January 1 and December 31:

Cash ; 250,000

Accounts receivable 500,000

‘Trading securities 400,000

Inventory 2,500,000

Land 1,350,000

; 5,000,000

Accounts payable 1,500,000

Mortgage payable 500,000

Share capital 2,500,000

Retained earnings 500.000

5,000,000

What is the purchasing power gain or loss for the current year?

& 1,875,000 gain

4. 1875,000 Toss

i 1,275,000 gain

: 1,275,000 loss

695

Problem 22-10 (IFRS) °

Maximus Company provided the ate

equity 7 a hyperinflationary econo!

Before restatement After restatement

g liabilities and

iabiliti 2,000,000 2,500,000

Shave cepa 5,000,000 8,500,000

Revaluation surplus 1,000,000 ?

Retained earnings 1,500,001 titiet

Total liabilities and equity 9,500,000 26,000,000

1. What is the revaluation surplus after restatement?

a. 5,000,000

b. 1,000,000

c. 8,500,000

a. 0

2. What amount should be reported as retained earnings

after restatement?

4,000,000

5,000,000

1,500,000

0

Problem 22-11 (AICPA Adapted)

Agnes Company reported the following assets in the statement

of financial position at year-end:

ae op

Demand bank deposit. 8,000,000

Net long-term receivables - 2,000,000

Patent and trademark 7 1,000,000

Inventory 2,500,000

Loans to employees 300,000

Deferred tax asset 1,500,000

What total amount should be reported as monetary assets?

a. 5,300,000

b. 5,000,000

¢. 3,000,000 :

d. 6,800,000 7

696

r

problem 22-12 (AICPA Adaptea)

axiposa Company repoy, i

gna equipment on Decemberatt®, following property, plant

yearseauired Percentdepreciated Gost Index number

2018

2019 oo 3,000,000 100

2020 10 2,000,000 125

1,000,000 300

pepreciation is calculated at 10% straight line

depreciation j Fi aoe

A full year ciation is charged ition.

here were no disposals re 2080 in the year of acquisil

What amount of depreciation should be included in the-2020

jncome statement adjusted for hyperinflation?

a. 1,480,000

1,800,000

, 1,620,000

4. 600,000

Problem 22-13 (AICPA Adapted)

- Acacia Company reported the following machinery on

December 31, 2020:

Cost Accumulated

depreciation

Acquired in December 2017 4,000,000 1,600,000

Acquired in December 2019 1,000,000 200.000

Index numbers at the end of each year: z

2017 120

2019 125

2020 360

Ina -hyperinflationary statement of financial position

Prepared on December 31, 2020, what should be reported as

carrying amount of the machinery?

& 8,960,000

7,800,000

® 9,240,000

4 3.200,000

697

Problem.22-14 (IFRS)

Highland Company provided the following information ne

December 31, 2020:

Cash 2,000,009

Trade and other receivables” 2,600,000

Property, plant and équipment—net $800,009

‘Trade and other payables 800,009

Share capital 4,000,009

Revaluation surplus 400,600

Retained earnings 3,000,000

mbers are 112 on January 1, 2017

The general price index nu

3 n December 31, 2019

which is the date of incorporation, 125 o

and-280 on December 31, 2020.

* The property, plant and equipment were acquired on January

1, 2017 but were revalued on December 31, 2019.

1, What amount should be reported as total assets in a

hyperinflationary statement of financial position?

a. 14,904,000

b. 13,800,000

¢. 10,800,000

d. 16,100,000

2. What is the balance of retained earnings after

restatement?

a, 3,104,000

b. 3,000,000

c. 3,504,000

d. 3,400,000

3. What is the total shareholders’ ity after

restatement? r She tact

a. 13,104,000

b. 10,000,000

c. 13,504,000

d. 7,000,000

698

r

problem 22-15 daa)

| star Company provided the fo)

ition accounts on lowing statement of financial

Pet Seember 81, 2020 based on historical

Fost:

cash i

ts receivable 100,000

Aovoun! ;

javentory (most recent acquiisition) 1,200,000

‘ag 400,000

fosumulated depreciation — building 00

Bquipment eee 500,000

cumulated depreciation — equipment 250,000

counts payable © * 600,000

share capital ~ issued January 1, 2015 2,000,000

Retained earnings 1,050,000

Date acquired Index number

Land January 1, 2015 100

Building January 1, 2015 100

Equipment — : January 1, 2017 125

End of reporting period December 31, 2020 260

“average index during 2020 240

1. What amount should be reported as total assets after

restatement for hyperinflation?

a. 3,550,000

b. 6,000,000

c. 6,780,000

d. 5,000,000

2, What is the balance of retained earnings after

restatement?

| a. 950,000

|b. 200,000

e. 400,000

a. 500,000

. What is the total shareholders' equity after restatement?

a. 5,200,000

b. 5,400,000 : ,

© 6,150,000 '

4. 5,800,000

699

a

Problem 22-16 (LAA)

Lunar Company provided the following information;

2019

20%

: 000,000 .

Cash and cash equivalents 3 200,000 soot

Inventory 1,500,000 1,409,090

Faipment (120) 4,500,000 4,500,099

wry tary) 1,500,000 2,000, 000

Current liabilities (all monetary, 8/000,000 8.500

Noncurrent liabilities (all monetary) 3000/0004

Share capital "700,000 1.88 0

Retained earnings " 8 000005

Sales . enn

Inventory, January 1 | 2,200,000

Purchases Bape 000

Inventory, December 31 1 0,000

Distribution and administrative expenses +700,000

Depreciation 100,000

Income tax 500,000

Cash dividend 360,000

Additional information

* -The pertinent index numbers are:

January 1, 2018 100

January 1, 2019 100

December 31, 2019 H 120

December 31, 2020 200

* The land and equipment were acquired on January 1, 2018.

* The entity was organized on January 1, 2018.

* The cash dividend was paid December 31, 2020.

Required:

1. Prepare a comparative statement of financial position on

December 31, 2020 restated to 2020 price level.

2. Prepare an income statement for 2020 restated to 2020

price level.

8. Compute the gain or loss on purchasing power for 2020.

700 |

L

problem 22-17 Multiple choice (IFRS)

inflation ie in: .

j, Hyperinflation is indicated by al ofthe following, except

, The general . .

* nonmonetary anyeation Prefers to keep its wealth in

* Interest rate; . +

b index. ®, wages and prices are linked to a price

c, The cumulative inflati .

approaching or exceeds ‘Toon over three years 16

a. of these indicate hyperinflation.

All would indicate that hyperinflation exists, except

a, The general population regards monetary amounts in

terms of xelatively stable foreign currency.

b, The cumulative inflation rate over three years is

approaching or exceedg 100%,

c, Inflation rates have exceeded interest rates in three

successive years,

d, The general population prefers to keep ita wealth in

nonmonetary assets,

~

Which would indicate that hyperinflation exists?

| a. Sales on credit are at lower prices than cash sales.

| b. Inflation is approaching or exceeds 20% per year.

c. Monetary items do not increase in value.

d. People prefer to keep their wealth in nonmonetary

assets or a stable foreign currency.

4, An entity that wishes to present 'information about the

effect of changing prices in a hyperinflationary economy

should report this information in

a.. The body of the financial statements

b, The notes to the financial statements

| ¢ Supplementary schedule

| d. Management's report to shareholders

5; In a hyperinflationary economy, monetary items

a Are not restated because they are already expressed in

terms of the measuring unit current at year-end.

. Are measured at fair value. oleh

© Are restated applying the general price index.

4. Ave restated applying the specific price index.

701 '

x

. All of the following

nancial statements for chan, 86

4 justing fi i! r

. Fer purposes of adjusting Monetary items consist of

ice level,

in the general pri

a. Assets and jiabilities whose amounts are fixed by

* contract or otherwise 10 terms of pesos

b. Assets and liabilities classified as current.

c. Cash and cash equivalents plus all receivables,

d. Cash, other assets expected to be converted into cash,

and current liabilities.

are monetary items, except

a. Accounts payable

b. Accounts receivable

c. Administration costs paid in cash

d. Loan repayment at face value

;, The financial statements of,an entity that reports in the

. currency, of a hyperinflationary economy shall be stated in

10.

terms of

a. Historical cost

b. Current cost

c. Fair value

d. Measuring unit current at the end of reporting period

. The gain or loss on the net monetary position in a

hyperinflationary economy shall be included in

Profit or loss and separately disclosed

Retained earnings

Equity

Other comprehensive income

peop

b a hyperinflationary economy, amounts not expressed it

e measuring unit current at the e i riod

are restated by applying nd of reporting pe!

General price index

Specific price index

Both general price index and specific price index

. Either general price index or specific price index

Bee

702

22- :

problem 22-18 Multiple choice (AICPA Adapted)

f aie

, When of the following is classified as.nonmonetary?

a. Allowance for doubtful

kb Accumulated depreciation

a oe on bonds payable

d. Advances to unconsolidated subsidiaries

3, Which of the following is classified as nonmonetary?

a. Warranty liability

pb, Accrued expense

c. Unamortized discount on b

d. Refundable deposit —

3, Which of the following is classified as nonmonetary?

a. Cash surrender value

b. Long-term receivable i.

c. Accrued liability on firm purchase commitment

d. Inventory :

Which of the following is classified as monetary?

=

a. Goodwill

b. Equipment

c. Patent . ce

d. Allowance for doubtful accounts

Purchasing power gain or loss results from

a. Monetary asset only

b. Monetary liability only

c. Both monetary asset and monetary liability’

d. Nonmonetary asset and nonmonetary liability

703

6.

10.

, During a period of inflation, an acc

i i t balance remaj

i iod of inflation, an accoun' mi

ee a With respect to this account, a purchasing

power loss will be recognized if the account is a

a. Monetary asset

b. Monetary liability

c. Nonmonetary asset,

d. Nonmonetary liability

int balance remaing

i is it, a purchasi;

constant, With respect to this punt ] sing

power gain will be recognized if the account is a

a. Monetary liability

b. Monetary asset

c. Nonmonetary liability

d. Nonmonetary asset

. During a period of deflation in which a liability account

balance remains constant, which of the following occurs?

a. A purhasing power loss if the item is a nonmonetary

liability. 1 .

b. A purchasing power gain if the item is a nonmonetary

liability. i :

ce. A purchasing power loss if the item is a monetary

liability.

d. A purchasing power gain if the item is a monetary

liability.

. During a period.of inflation in which a liability account

balance remains constant, which of the following occurs?

a. A purchasing power loss if the item is a nonmonetary

liability.

b. A purchasing power gain if the item is a nonmonetary

liability.

c« A purchasing power loss if the item is a monetary

liability.

aA purchasing power gain if the item is a monetary

liability.

During a period.of deflation, an entity would have the

greatest gain in general purchasing power by holding

a. Cash :

b. Property, plant and equi

c. Finance lease liability: moment

d. Mortgage payable

704

r

problem 22-19 (AICPA Adapted)

nancial stateme;

1. Finetary unit are (° “Eat are expressed under a stable

Constant ‘

a. t Peso financial

b. Nominal peso financial statement

, Current cost financial statements

d.’ Fair value financial statements

1 price 1 i ition i

g, A general p: level statem ition 18

prepared and presented in femme EET, a

a. The general purchasin, e latest

end of reporting poregPower of the peso at ths

b. pei general Purchasing power of the peso in the base

The avera

c. ‘ge general purchasing power of the peso.

d, The general purchasing power ofthe peso at the time

the financial statements are issued.

3, Which method of reporting ‘attempts to eliminate the

effect of the changing value of the peso?

a. Discounted net present value of future cash flows _

b. an cost restated for change in the general price

eve.

c. Replacement cost

d. Exit value

4, The restatement of historical peso financial statements

to reflect the general price level change results in

presenting assets at

.a, Lower of cost or net realizable value

b. Fair value

ec. Cost adjusted for purchasing power change

d. Current replacement cost

. Which argument in favor of price level adjusted financial

statements is not valid?

a. Price level financial statements use historical cost.

b. Price level financial statements compare uniform

pruchasing power among various periods.

c. Price level financial statements measure current

Value. . 7

d. Price level financial statements measure earnings in

terms of a common peso.

705

You might also like

- Financial Reporting in Hyperinflationary Economies100% (1)Financial Reporting in Hyperinflationary Economies7 pages

- PAS 29 - Financial Reporting in Hyperinflationary EconomiesNo ratings yetPAS 29 - Financial Reporting in Hyperinflationary Economies7 pages

- PSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Basic Earnings Per ShareNo ratings yetPSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Basic Earnings Per Share2 pages

- Mendoza - Unit 1 - Statement of Changes in EquityNo ratings yetMendoza - Unit 1 - Statement of Changes in Equity10 pages

- Assignment 3 Consolidation. Subsequent To The Date of AcquisitionNo ratings yetAssignment 3 Consolidation. Subsequent To The Date of Acquisition4 pages

- Accounting For Business Combination Final ExaminationNo ratings yetAccounting For Business Combination Final Examination18 pages

- Corporate Liquidation: Statement of AffairsNo ratings yetCorporate Liquidation: Statement of Affairs5 pages

- FAR 06 Investment in Equity Shares Part 2No ratings yetFAR 06 Investment in Equity Shares Part 23 pages

- 112 Practice Material: Cash, Cash Equivalents, Bank Reconciliation Petty CashNo ratings yet112 Practice Material: Cash, Cash Equivalents, Bank Reconciliation Petty Cash7 pages

- Chapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter OverviewNo ratings yetChapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter Overview20 pages

- Final Examination in Accounting For Business CombinationNo ratings yetFinal Examination in Accounting For Business Combination9 pages

- MODULE 12 Accounting For Business Combination PART 2No ratings yetMODULE 12 Accounting For Business Combination PART 234 pages

- Chapter 1 Business Combination Part 1 TestbankNo ratings yetChapter 1 Business Combination Part 1 Testbank8 pages

- Chapter 24 Reporting in Hyperinflationary EconomyNo ratings yetChapter 24 Reporting in Hyperinflationary Economy15 pages

- 2 - Variable Costing V Absorption CostingNo ratings yet2 - Variable Costing V Absorption Costing16 pages