Canadian Tax Return Guide

Uploaded by

caezoniadesynzCanadian Tax Return Guide

Uploaded by

caezoniadesynzName: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

T1 2023

Income Tax and Benefit Return

Protected B when completed

If this return is for a deceased person, enter their information on this page. For more information, see Guide T4011,

Preparing Returns for Deceased Persons.

Attach to your paper return only the documents that are requested to support your deduction, claim or expense. Keep all other

documents in case the Canada Revenue Agency (CRA) asks to see them later.

Step 1 – Identification and other information

7

Identification Marital status on

Social insurance December 31, 2023:

First name Last name number (SIN)

Cezonia Doxtator 5 3 4 6 9 6 8 8 5 1 Married

Mailing address (apartment - number, street)

659 Dundas St Date of birth 2 Living common-law

(Year Month Day)

PO Box RR 3 Widowed

1 9 8 5 0 9 0 5

IL

If this return is for 4 Divorced

MA

City Prov./Terr. Postal code

a deceased person,

London ON N 5 W 2 Z 1 enter the date of death 5 Separated

Email address (Year Month Day)

BY

tokahontas85@icloud.com 6 X Single

By providing an email address, you are registering to receive

email notifications from the CRA and agree to the Terms of END

use. To view the Terms of use, go to canada.ca/cra-email Your language of correspondence: X English

-notifications-terms. Votre langue de correspondance : Français

TS

Residence information

NO

Your province or territory of residence on December 31, 2023: If you became a resident of Canada

Ontario in 2023 for income tax purposes, (Month Day)

enter your date of entry:

Your current province or territory of residence if it is different

- DO

than your mailing address above:

If you ceased to be a resident

of Canada in 2023 for income

Province or territory where your business had a permanent tax purposes, enter your (Month Day)

establishment if you were self-employed in 2023: date of departure:

TE

CA

Your spouse's or common-law partner's information

PLI

Their first name Their SIN

DU

Tick this box if they were self-employed in 2023. 1

Net income from line 23600 of their return to claim certain credits

(or the amount that it would be if they filed a return, even if the amount is "0")

Amount of universal child care benefit (UCCB) from line 11700 of their return

Amount of UCCB repayment from line 21300 of their return

Do not use this area.

Do not use

this area. 17200 17100

5006-R E (23) (Ce formulaire est disponible en français.) Page 1 of 8

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Step 1 – Identification and other information (continued)

Elections Canada

For more information, go to canada.ca/cra-elections-canada.

A) Do you have Canadian citizenship?

If yes, go to question B. If no, skip question B. 1 X Yes 2 No

B) As a Canadian citizen, do you authorize the CRA to give your name, address, date of birth

and citizenship to Elections Canada to update the National Register of Electors or, if you are

14 to 17 years of age, the Register of Future Electors? 1 Yes 2 X No

Your authorization is valid until you file your next tax return. Your information will only be used for purposes permitted

under the Canada Elections Act, which include sharing lists of electors produced from the National Register of Electors

with provincial and territorial electoral agencies, members of Parliament, registered and eligible political parties, and

candidates at election time.

Your information in the Register of Future Electors will be included in the National Register of Electors once you turn 18

and your eligibility to vote is confirmed. Information from the Register of Future Electors can be shared only with provincial

and territorial electoral agencies that are allowed to collect future elector information. In addition, Elections Canada can use

IL

information in the Register of Future Electors to provide youth with educational information about the electoral process.

MA

Indian Act – Exempt income

BY

Tick this box if you have income that is exempt under the Indian Act.

For more information about this type of income, go to canada.ca/taxes-indigenous-peoples. 1

END

If you ticked the box above, complete Form T90, Income Exempt from Tax under the Indian Act, so that the CRA can

calculate your Canada workers benefit for the 2023 tax year, if applicable, and your family's provincial or territorial benefits.

The information you provide on Form T90 will also be used to calculate your Canada training credit limit for the 2024 tax year.

TS

Climate action incentive payment

NO

Tick this box if you reside outside of the census metropolitan areas (CMA) of Barrie, Belleville,

Brantford, Greater Sudbury, Guelph, Hamilton, Kingston, Kitchener-Cambridge-Waterloo,

- DO

London, Oshawa, the Ontario part of Ottawa-Gatineau, Peterborough, St. Catharines-Niagara,

Thunder Bay, Toronto or Windsor, as determined by Statistics Canada (2016), and expect to

continue to reside outside the same CMA on April 1, 2024. 1 X

Note: If your marital status is married or living common-law, and both you and your spouse or common-law partner were

residing in the same location outside of a CMA, you must tick this box on both of your returns.

TE

CA

Foreign property

PLI

Did you own or hold specified foreign property where the total cost amount of all such property,

at any time in 2023, was more than CAN$100,000? 26600 1 Yes 2 X No

If yes, complete Form T1135, Foreign Income Verification Statement. There are substantial penalties for not filing

DU

Form T1135 by the due date. For more information, see Form T1135.

Consent to share contact information – Organ and tissue donor registry

I authorize the CRA to provide my name and email address to Ontario Health so that Ontario Health (Trillium

Gift of Life) may contact or send information to me by email about organ and tissue donation.

For more information about organ and tissue donation in Canada, go to canada.ca/organ-tissue-donation. 1 Yes 2 X No

Note: You are not consenting to organ and tissue donation when you authorize the CRA to share your contact information

with Ontario Health. Your authorization is only valid for the tax year for which you are filing this tax return. Your

information will only be collected under the Ontario Gift of Life Act.

5006-R E (23) Page 2 of 8

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Complete only the lines that apply to you, unless stated otherwise. You can find more information about the lines on this

return by going to canada.ca/line-xxxxx and replacing "xxxxx" with any five-digit line number from this return. For example,

go to canada.ca/line-10100 for information about line 10100.

Step 2 – Total income

As a resident of Canada, you need to report your income from all sources inside and outside Canada.

Employment income (box 14 of all T4 slips) 10100 1

Tax-exempt income for emergency services volunteers 10105

Commissions included on line 10100 (box 42 of all T4 slips) 10120

Wage-loss replacement contributions 10130

Other employment income 10400 + 2

Old age security (OAS) pension (box 18 of the T4A(OAS) slip) 11300 + 3

CPP or QPP benefits (box 20 of the T4A(P) slip) 11400 + 4

Disability benefits included on line 11400 (box 16 of the T4A(P) slip) 11410

Other pensions and superannuation 11500 + 5

Elected split-pension amount (complete Form T1032) 11600 + 6

Universal child care benefit (UCCB) (see the RC62 slip) +

IL

11700 7

UCCB amount designated to a dependant 11701

MA

Employment insurance (EI) and other benefits (box 14 of the T4E slip) 11900 + 8

EI maternity and parental benefits, and provincial parental insurance plan

(PPIP) benefits 11905

BY

Taxable amount of dividends from taxable Canadian corporations (use Federal Worksheet):

Amount of dividends (eligible and other than eligible) 12000 + 9

Amount of dividends (other than eligible) 12010

Interest and other investment income (use Federal Worksheet)

Net partnership income (limited or non-active partners only)

END 12100

12200

+

+

10

11

Registered disability savings plan (RDSP) income (box 131 of the T4A slip) 12500 + 12

TS

Rental income (see Guide T4036) Gross 12599 Net 12600 + 13

Taxable capital gains (complete Schedule 3) 12700 + 14

Support payments received (see Guide P102) Total 12799 Taxable amount 12800 + 15

NO

Registered retirement savings plan (RRSP) income (from all T4RSP slips) 12900 + 16

Taxable first home savings account (FHSA) income (boxes 22 and 26 of all T4FHSA slips) 12905 + 17

- DO

Taxable FHSA income – other (boxes 24 and 28 of all T4FHSA slips) 12906 + 18

Other income (specify): 13000 + 19

Taxable scholarships, fellowships, bursaries and artists' project grants 13010 + 20

Add lines 1 to 20. = 21

TE

Self-employment income (see Guide T4002):

Business income Gross 13499 Net 13500 22

CA

Professional income Gross 13699 Net 13700 + 23

Commission income Gross 13899 Net 13900 + 24

PLI

Farming income Gross 14099 Net 14100 + 25

Fishing income Gross 14299 Net 14300 + 26

= +

Ż

Add lines 22 to 26. Net self-employment income 27

DU

Line 21 plus line 27 = 28

Workers' compensation benefits (box 10 of the T5007 slip) 14400 29

Social assistance payments 14500 + 3,910 20 30

Net federal supplements paid (box 21 of the T4A(OAS) slip) 14600 + 31

14700 = +

Ż

Add lines 29 to 31 (see line 25000 in Step 4). 3,910 20 3,910 20 32

Line 28 plus line 32 Total income 15000 = 3,910 20 33

5006-R E (23) Page 3 of 8

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Step 3 – Net income

Enter the amount from line 33 of the previous page. 3,910 20 34

Pension adjustment

(box 52 of all T4 slips and box 034 of all T4A slips) 20600

Registered pension plan (RPP) deduction

(box 20 of all T4 slips and box 032 of all T4A slips) 20700 35

RRSP deduction (see Schedule 7 and attach receipts) 20800 + 36

FHSA deduction (see Schedule 15 and attach receipts) 20805 + 37

Pooled registered pension plan (PRPP) employer contributions

(amount from your PRPP contribution receipts) 20810

Deduction for elected split-pension amount (complete Form T1032) 21000 + 38

Annual union, professional or like dues (receipts and box 44 of all T4 slips) 21200 + 39

Universal child care benefit (UCCB) repayment (box 12 of all RC62 slips) 21300 + 40

Child care expenses (complete Form T778) 21400 + 41

Disability supports deduction (complete Form T929) 21500 + 42

Business investment loss (see Guide T4037)

Gross 21699 Allowable deduction 21700 + 43

IL

Moving expenses (complete Form T1-M) 21900 + 44

MA

Support payments made (see Guide P102)

Total 21999 Allowable deduction 22000 + 45

Carrying charges, interest expenses and other expenses

22100 +

BY

(use Federal Worksheet) 46

Deduction for CPP or QPP contributions on self-employment income and

other earnings (complete Schedule 8 or Form RC381, whichever applies) 22200 + • 47

Deduction for CPP or QPP enhanced contributions on employment income

END

(complete Schedule 8 or Form RC381, whichever applies) (maximum $631.00) 22215 + • 48

Exploration and development expenses (complete Form T1229) 22400 + 49

Other employment expenses (see Guide T4044) 22900 + 50

TS

Clergy residence deduction (complete Form T1223) 23100 + 51

Other deductions (specify): 23200 + 52

NO

23300 = –

Ż

Add lines 35 to 52. 53

Line 34 minus line 53 (if negative, enter "0") Net income before adjustments 23400 = 3,910 20 54

- DO

Social benefits repayment:

Complete the chart for line 23500 using your Federal Worksheet if one or more of the following apply:

• You entered an amount for EI and other benefits on line 11900 and the amount on line 23400 is

more than $76,875

TE

• You entered an amount for OAS pension on line 11300 or net federal supplements paid on

line 14600 and the amount on line 23400 is more than $86,912

CA

If not, enter "0" on line 23500. 23500 – • 55

Line 54 minus line 55 (if negative, enter "0")

PLI

(If this amount is negative, you may have a non-capital loss. See Form T1A.) Net income 23600 = 3,910 20 56

DU

5006-R E (23) Page 4 of 8

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Step 4 – Taxable income

Enter the amount from line 56 of the previous page. 3,910 20 57

Canadian Armed Forces personnel and police deduction (box 43 of all T4 slips) 24400 58

Security options deductions (boxes 39 and 41 of T4 slips or see Form T1212) 24900 + 59

Other payments deduction (enter the amount from line 14700 if you did

not enter an amount on line 14600; otherwise, use Federal Worksheet) 25000 + 3,910 20 60

Limited partnership losses of other years 25100 + 61

Non-capital losses of other years 25200 + 62

Net capital losses of other years 25300 + 63

Capital gains deduction (complete Form T657) 25400 + 64

Northern residents deductions (complete Form T2222) 25500 + 65

Additional deductions (specify): 25600 + 66

= –

Ż

Add lines 58 to 66. 25700 3,910 20 3,910 20 67

Line 57 minus line 67 (if negative, enter "0") Taxable income 26000 = 68

Step 5 – Federal tax

IL

Part A – Federal tax on taxable income

MA

Use the amount from line 26000 to complete the appropriate column below.

Line 26000 is more Line 26000 is more Line 26000 is more

Line 26000 is than $53,359 but not than $106,717 but not than $165,430 but not Line 26000 is more

BY

$53,359 or less more than $106,717 more than $165,430 more than $235,675 than $235,675

Amount from line 26000 69

Line 69 minus line 70 – 0.00 – 53,359.00 – END 106,717.00 – 165,430.00 – 235,675.00 70

(cannot be negative) = = = = = 71

Line 71 multiplied by the × 15% × 20.5% × 26% × 29% × 33% 72

percentage from line 72 = = = = = 73

TS

Line 73 plus line 74 + 0.00 + 8,003.85 + 18,942.24 + 34,207.62 + 54,578.67 74

Federal tax on

NO

taxable income = = = = = 75

Enter the amount from line 75 on line 118 and continue at line 76.

- DO

Part B – Federal non-refundable tax credits

Basic personal amount:

If the amount on line 23600 is $165,430 or less, enter $15,000.

If the amount on line 23600 is $235,675 or more, enter $13,520.

TE

Otherwise, use the Federal Worksheet to calculate the amount to enter. (maximum $15,000) 30000 15,000 00 76

Age amount (if you were born in 1958 or earlier) (use Federal Worksheet) (maximum $8,396) 30100 + 77

CA

Spouse or common-law partner amount (complete Schedule 5) 30300 + 78

Amount for an eligible dependant (complete Schedule 5) 30400 + 79

PLI

Canada caregiver amount for spouse or common-law partner, or eligible dependant age 18 or older

(complete Schedule 5) 30425 + 80

+

DU

Canada caregiver amount for other infirm dependants age 18 or older (complete Schedule 5) 30450 81

Canada caregiver amount for infirm children under 18 years of age (see Schedule 5)

Number of children you are claiming this amount for 30499 × $2,499 = 30500 + 82

Add lines 76 to 82. = 15,000 00 83

5006-R E (23) Page 5 of 8

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Part B – Federal non-refundable tax credits (continued)

Enter the amount from line 83 of the previous page. 15,000 00 84

Base CPP or QPP contributions (complete Schedule 8 or Form RC381, whichever applies):

through employment income 30800 • 85

on self-employment income and other earnings 31000 + • 86

Employment insurance premiums:

through employment (boxes 18 and 55 of all T4 slips) (maximum $1,002.45) 31200 + • 87

on self-employment and other eligible earnings (complete Schedule 13) 31217 + • 88

Volunteer firefighters' amount (VFA) 31220 + 89

Search and rescue volunteers' amount (SRVA) 31240 + 90

Canada employment amount:

Enter whichever is less: $1,368 or line 1 plus line 2. 31260 + 91

Home buyers' amount (maximum $10,000) 31270 + 92

Home accessibility expenses (use Federal Worksheet) (maximum $20,000) 31285 + 93

Adoption expenses 31300 + 94

Digital news subscription expenses (maximum $500) 31350 + 95

= +

Ż

Add lines 85 to 95. 96

IL

Pension income amount (use Federal Worksheet) (maximum $2,000) 31400 + 97

MA

Add lines 84, 96 and 97. = 15,000 00 98

Disability amount for self

(if you were under 18 years of age, use Federal Worksheet; if not, claim $9,428) 31600 + 99

BY

Disability amount transferred from a dependant (use Federal Worksheet) 31800 + 100

Add lines 98 to 100. = 15,000 00 101

Interest paid on your student loans (see Guide P105) 31900 + 102

Your tuition, education and textbook amounts (complete Schedule 11)

Tuition amount transferred from a child or grandchild

END 32300

32400

+

+

103

104

Amounts transferred from your spouse or common-law partner (complete Schedule 2) 32600 + 105

TS

Add lines 101 to 105. = 15,000 00 106

Medical expenses for self, spouse or common-law partner

and your dependent children under 18 years of age 33099 107

NO

Amount from line 23600 3,910 20 × 3% = 117 31 108

Enter whichever is less: $2,635 or the amount from line 108. – 117 31 109

Line 107 minus line 109 (if negative, enter "0") =

- DO

110

Allowable amount of medical expenses for other dependants

(use Federal Worksheet) 33199 + 111

33200 = +

Ż

Line 110 plus line 111 112

TE

Line 106 plus line 112 33500 = 15,000 00 113

Federal non-refundable tax credit rate × 15% 114

CA

Line 113 multiplied by the percentage from line 114 33800 = 2,250 00 115

Donations and gifts (complete Schedule 9) 34900 + 116

Line 115 plus line 116 Total federal non-refundable tax credits 35000 = 2,250 00 117

PLI

DU

5006-R E (23) Page 6 of 8

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Part C – Net federal tax

Enter the amount from line 75. 118

Federal tax on split income (TOSI) (complete Form T1206) 40424 + • 119

Line 118 plus line 119 40400 = 120

Amount from line 35000 2,250 00 121

Federal dividend tax credit (use Federal Worksheet) 40425 + • 122

Minimum tax carryover (complete Form T691) 40427 + • 123

= –

Ż

Add lines 121 to 123. 2,250 00 2,250 00 124

Line 120 minus line 124 (if negative, enter "0") Basic federal tax 42900= 125

Federal surtax on income earned outside Canada (complete Form T2203) + 126

Line 125 plus line 126 = 127

Federal foreign tax credit (complete Form T2209) 40500 – 128

Line 127 minus line 128 = 129

Recapture of investment tax credit (complete Form T2038(IND)) + 130

Line 129 plus line 130 = 131

Federal logging tax credit – 132

IL

Line 131 minus line 132 (if negative, enter "0") Federal tax 40600 = • 133

Federal political contribution tax credit (use Federal Worksheet)

MA

Total federal political contributions

(attach receipts) 40900 (maximum $650) 41000 • 134

Investment tax credit (complete Form T2038(IND)) 41200 + • 135

BY

Labour-sponsored funds tax credit

Net cost of shares of a provincially

registered fund 41300 Allowable credit 41400 + • 136

Add lines 134 to 136.

Line 133 minus line 137 (if negative, enter "0")

END

41600 =

Ż

41700

–

=

137

138

Advanced Canada workers benefit (ACWB) (complete Schedule 6) 41500 + • 139

TS

Special taxes 41800 + • 140

Add lines 138 to 140. Net federal tax 42000 = 141

NO

Step 6 – Refund or balance owing

Amount from line 42000 142

- DO

CPP contributions payable on self-employment income and other earnings

(complete Schedule 8 or Form RC381, whichever applies) 42100 + • 143

Employment insurance premiums payable on self-employment and other eligible earnings

(complete Schedule 13) 42120 + 144

TE

Social benefits repayment (amount from line 23500) 42200 + 145

Provincial or territorial tax

CA

(complete and attach your provincial or territorial Form 428, even if the result is "0") 42800 + • 146

Add lines 142 to 146. Total payable 43500 = • 147

PLI

DU

5006-R E (23) Page 7 of 8

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Step 6 – Refund or balance owing (continued)

Enter the amount from line 147 of the previous page. 148

Total income tax deducted (amounts from all Canadian slips) 43700 • 149

Refundable Quebec abatement 44000 + • 150

CPP or QPP overpayment 44800 + • 151

Employment insurance (EI) overpayment 45000 + • 152

Refundable medical expense supplement (use Federal Worksheet) 45200 + • 153

Canada workers benefit (CWB) (complete Schedule 6) 45300 + • 154

Canada training credit (CTC) (complete Schedule 11) 45350 + • 155

Multigenerational home renovation tax credit (MHRTC)

(complete Schedule 12) 45355 + • 156

Refund of investment tax credit (complete Form T2038(IND)) 45400 + • 157

Part XII.2 tax credit (box 38 of all T3 slips and box 209 of all T5013 slips) 45600 + • 158

Employee and partner GST/HST rebate (complete Form GST370) 45700 + • 159

Eligible educator school supply tax credit

Supplies expenses (maximum $1,000) 46800 × 25% = + 46900 • 160

IL

Canadian journalism labour tax credit (box 236 of all T5013 slips) 47555 + • 161

Return of fuel charge proceeds to farmers tax credit (complete Form T2043) 47556 + • 162

MA

Air quality improvement tax credit

(box 238 of all T5013 slips or from partnership letter) 47557 + • 163

Tax paid by instalments 47600 + • 164

BY

Provincial or territorial credits (complete Form 479, if it applies) 47900 + • 165

= –

Ż

Add lines 149 to 165. Total credits 48200 166

Line 148 minus line 166 END

If the amount is negative, enter it on line 48400 below.

If the amount is positive, enter it on line 48500 below. Refund or balance owing = 167

TS

Refund 48400 • Balance owing 48500 •

For more information and ways to enrol for direct deposit, Your balance owing is due no later than April 30, 2024.

NO

go to canada.ca/cra-direct-deposit. For more information on how to make your payment,

go to canada.ca/payments.

- DO

Ontario opportunities fund Amount from line 48400 above 1

You can help reduce Ontario's debt by completing this area to Your donation to the

donate some or all of your 2023 tax refund to the Ontario Ontario opportunities fund 46500 – •2

TE

opportunities fund. Please see the provincial pages for details. Net refund (line 1 minus line 2) 46600 = •3

I certify that the information given on this return and in any If this return was completed by a tax professional, tick the

CA

attached documents is correct, complete and fully discloses applicable box and provide the following information:

all of my income.

PLI

Was a fee charged? 49000 1 Yes 2 No

Sign here

It is a serious offence to make a false return. EFILE number (if applicable): 48900

DU

Telephone number: 519 854-8240 Name of tax professional:

Date: Telephone number:

Personal information (including the SIN) is collected and used to administer or enforce the Income Tax Act and related programs and activities

including administering tax, benefits, audit, compliance and collection. The information collected may be disclosed to other federal, provincial,

territorial, aboriginal or foreign government institutions to the extent authorized by law. Failure to provide this information may result in paying

interest or penalties, or in other actions. Under the Privacy Act, individuals have a right of protection, access to and correction of their personal

information, or to file a complaint with the Privacy Commissioner of Canada regarding the handling of their personal information. Refer to Personal

Information Bank CRA PPU 005 on Information about Programs and Information Holdings at canada.ca/cra-information-about-programs.

Do not use • 48600 •

48700 48800

this area.

5006-R E (23) RC-23-107 Page 8 of 8

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Form ON428

Ontario Tax 2023

Protected B when completed

For more information about this form, go to canada.ca/on-tax-info.

Part A – Ontario tax on taxable income

Enter your taxable income from line 26000 of your return. 1

Use the amount from line 1 to complete the appropriate column below.

Line 1 is more than Line 1 is more than Line 1 is more than

Line 1 is $49,231 but not $98,463 but not $150,000 but not Line 1 is more

$49,231 or less more than $98,463 more than $150,000 more than $220,000 than $220,000

Amount from line 1 2

Line 2 minus line 3 – 0.00 – 49,231.00 – 98,463.00 – 150,000.00 – 220,000.00 3

(cannot be negative) = = = = = 4

Line 4 multiplied by the × 5.05% × 9.15% × 11.16% × 12.16% × 13.16% 5

IL

percentage from line 5 = = = = = 6

+ 0.00 + 2,486.17 + 6,990.89 + 12,742.42 + 21,254.42 7

MA

Line 6 plus line 7

Ontario tax on

taxable income = = = = = 8

BY

Enter the amount from line 8 on line 51 and continue at line 9.

Part B – Ontario non-refundable tax credits Internal use 56050

Basic personal amount

Age amount (if you were born in 1958 or earlier) (use Worksheet ON428)

END Claim $11,865 58040

(maximum $5,793) 58080 +

11,865 00 9

10

Spouse or common-law partner amount:

TS

Base amount 11,082.00 11

Your spouse's or common-law partner's net income

NO

from line 23600 of their return – 12

58120 = +

Ż

Line 11 minus 12 (if negative, enter "0") (maximum $10,075) 13

Amount for an eligible dependant:

- DO

Base amount 11,082.00 14

Your eligible dependant's net income from line 23600 of their return – 15

58160 = +

Ż

Line 14 minus line 15 (if negative, enter "0") (maximum $10,075) 16

TE

Ontario caregiver amount (use Worksheet ON428) 58185 + 17

Add lines 9, 10, 13, 16 and 17. = 11,865 00 18

CA

CPP or QPP contributions:

Amount from line 30800 of your return 58240 • 19

PLI

Amount from line 31000 of your return 58280 + • 20

Employment insurance premiums:

Amount from line 31200 of your return +

DU

58300 • 21

Amount from line 31217 of your return 58305 + • 22

Adoption expenses 58330 + 23

= +

Ż

Add lines 19 to 23. 24

Line 18 plus line 24 = 11,865 00 25

5006-C E (23) (Ce formulaire est disponible en français.) Page 1 of 4

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Part B – Ontario non-refundable tax credits (continued)

Amount from line 25 of the previous page 11,865 00 26

Pension income amount (maximum $1,641) 58360 + 27

Line 26 plus line 27 = 11,865 00 28

Disability amount for self

(claim $9,586 or, if you were under 18 years of age, use Worksheet ON428) 58440 + 29

Disability amount transferred from a dependant (use Worksheet ON428) 58480 + 30

Add lines 28 to 30. = 11,865 00 31

Interest paid on your student loans (amount from line 31900 of your return) 58520 + 32

Your unused tuition and education amounts (attach Schedule ON(S11)) 58560 + 33

Amounts transferred from your spouse or common-law partner (attach Schedule ON(S2)) 58640 + 34

Add lines 31 to 34. = 11,865 00 35

Medical expenses:

Go to canada.ca/on-tax-info and read line 58689

under "Form ON428 – Ontario Tax". 58689 36

IL

Amount from line 23600 of your return 3,910 20 37

Applicable rate × 3% 38

MA

Line 37 multiplied by the percentage from line 38 = 117 31 39

Enter whichever is less: $2,685 or the amount on line 39. – 117 31 40

BY

Line 36 minus line 40 (if negative, enter "0") = 41

Allowable amount of medical expenses for other dependants

(use Worksheet ON428) 58729 + 42

Line 41 plus line 42

Line 35 plus line 43

END 58769 =

Ż

+

58800 = 11,865 00 44

43

Ontario non-refundable tax credit rate × 5.05% 45

TS

Line 44 multiplied by the percentage from line 45 58840 = 599 18 46

Donations and gifts:

NO

Amount from line 13

of your federal Schedule 9 × 5.05% = 47

Amount from line 14

- DO

of your federal Schedule 9 × 11.16% = + 48

Line 47 plus line 48 58969 =

Ż

+ 49

Line 46 plus line 49

Enter this amount on line 52. Ontario non-refundable tax credits 61500 = 599 18 50

TE

Part C – Ontario tax

CA

Ontario tax on taxable income from line 8 51

Ontario non-refundable tax credits from line 50 – 599 18 52

PLI

Line 51 minus line 52 (if negative, enter "0") = 53

Ontario tax on split income (complete Form T1206) 61510 + • 54

DU

Line 53 plus line 54 = 55

Ontario minimum tax carryover:

Enter the amount from line 53 above. 56

Ontario dividend tax credit (use Worksheet ON428) 61520 – • 57

Line 56 minus line 57 (if negative, enter "0") = 58

Amount from line 40427 of your return × 33.67% = 59

Enter whichever is less: amount from line 58 or line 59. 61540 – • 60

Line 55 minus line 60 (if negative, enter "0") = 61

5006-C E (23) Page 2 of 4

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Part C – Ontario tax (continued)

Amount from line 61 of the previous page 62

Ontario surtax:

Amount from line 62 63

Ontario tax on split income from line 54 – 64

Line 63 minus line 64 (if negative, enter "0") = 65

Complete lines 66 to 68 if the amount on line 65 is more than $5,315.

If the amount is less than $5,315, enter "0" on line 68 and continue on line 69.

(Line 65 – $5,315) × 20% (if negative, enter "0") = 66

(Line 65 – $6,802) × 36% (if negative, enter "0") = + 67

Line 66 plus line 67 =

Ż

+ 68

Line 62 plus line 68 = 69

Ontario dividend tax credit from line 57 – 70

Line 69 minus line 70 (if negative, enter "0") = 71

Ontario additional tax for minimum tax purposes:

IL

If you entered an amount on line 98 of Form T691, use Worksheet ON428 to calculate your

additional tax for minimum tax purposes. +

MA

72

Line 71 plus line 72 = 73

Ontario tax reduction

BY

Enter "0" on line 80 if any of the following applies to you:

• You were not a resident of Canada at the beginning of the year END

• You were not a resident of Ontario on December 31, 2023

• There is an amount on line 72

• The amount on line 73 is "0"

TS

• You were bankrupt at any time in 2023

• Your return is filed for you by a trustee in bankruptcy

NO

• You are choosing not to claim an Ontario tax reduction

If none of the above applies to you, complete lines 74 to 80 to calculate your Ontario tax reduction.

- DO

Basic reduction 274.00 74

If you had a spouse or common-law partner on December 31, 2023,

only the individual with the higher net income can claim the amounts

TE

on lines 75 and 76.

Reduction for dependent children born in 2005 or later:

CA

Number of dependent children 60969 × $506 = + 75

Reduction for dependants with a mental or physical impairment:

PLI

Number of dependants 60970 × $506 = + 76

Add lines 74 to 76. = 77

DU

Amount from line 77 above × 2 = 78

Amount from line 73 above – 79

Line 78 minus line 79 (if negative, enter "0") Ontario tax reduction =

Ż

– 80

Line 73 minus line 80 (if negative, enter "0") = 81

Provincial foreign tax credit (complete Form T2036) – 82

Line 81 minus line 82 (if negative, enter "0") = 83

5006-C E (23) Page 3 of 4

Name: Cezonia Doxtator SIN:534 696 885 Printed on:2024/04/24 10:41 EDT

Protected B when completed

Part C – Ontario tax (continued)

Amount from line 83 of the previous page 84

Low-income individuals and families tax (LIFT) credit (complete Schedule ON428–A) 62140 – • 85

Line 84 minus line 85 (if negative, enter "0") = 86

Community food program donation tax credit for farmers:

Enter the amount of qualifying donations that have

also been claimed as a charitable donation. 62150 × 25% = – 87

Line 86 minus line 87 (if negative, enter "0") = 88

Ontario health premium (complete the chart below) + 89

Line 88 plus line 89

Enter this amount on line 42800 of your return. Ontario tax = 90

Ontario health premium

Go to the line on the chart below that corresponds to your taxable income from line 1 to determine your Ontario health premium.

Taxable income Ontario health premium

IL

MA

Ż Ż Ż

$20,000 or less $0

more than $20,000 but

not more than $25,000 – $20,000 = × 6% =

BY

more than $25,000 but Ż Ż Ż

not more than $36,000 END $300

more than $36,000 but

not more than $38,500 – $36,000 = × 6% = + $300 =

TS

more than $38,500 but Ż Ż Ż

not more than $48,000 $450

NO

more than $48,000 but

not more than $48,600 – $48,000 = × 25% = + $450 =

- DO

more than $48,600 but Ż Ż Ż

not more than $72,000 $600

TE

more than $72,000 but

not more than $72,600 – $72,000 = × 25% = + $600 =

CA

more than $72,600 but Ż Ż Ż

not more than $200,000 $750

PLI

more than $200,000 but

not more than $200,600 – $200,000 = × 25% = + $750 =

DU

Ż Ż Ż

more than $200,600 $900

Enter the result on line 89 above.

See the privacy notice on your return.

5006-C E (23) Page 4 of 4

You might also like

- 2023 - T1 General - JOSE LUIS CUADROS DAVILANo ratings yet2023 - T1 General - JOSE LUIS CUADROS DAVILA8 pages

- Murielle's 2023 Federal Return-240801-15 - 20 - 32 - 632No ratings yetMurielle's 2023 Federal Return-240801-15 - 20 - 32 - 63226 pages

- Gordon Marr 2023 41524 - 240416 - 061944No ratings yetGordon Marr 2023 41524 - 240416 - 06194435 pages

- Income Tax and Benefit Return For Non-Residents and Deemed Residents of CanadaNo ratings yetIncome Tax and Benefit Return For Non-Residents and Deemed Residents of Canada8 pages

- Matthew - CRA - TAX - SUMMARY - DETAILED - 2023 - ENNo ratings yetMatthew - CRA - TAX - SUMMARY - DETAILED - 2023 - EN51 pages

- Margaret CRA TAX SUMMARY DETAILED 2023 ENNo ratings yetMargaret CRA TAX SUMMARY DETAILED 2023 EN23 pages

- Nedai, Abbas (562-388-900) and Hosseini Ssayadnavard, MaryamNo ratings yetNedai, Abbas (562-388-900) and Hosseini Ssayadnavard, Maryam122 pages

- Income Tax and Benefit Return: T1 General - CondensedNo ratings yetIncome Tax and Benefit Return: T1 General - Condensed5 pages

- Business Mathematics Gross and Net EarningsNo ratings yetBusiness Mathematics Gross and Net Earnings7 pages

- Sro. 55 of 2025 Dated 24.01.2025 Regarding Annex J & Annex H For Commercial Importers, DistributorsNo ratings yetSro. 55 of 2025 Dated 24.01.2025 Regarding Annex J & Annex H For Commercial Importers, Distributors2 pages

- Atlas Consolidated Mining and Development Corporation v. CIRNo ratings yetAtlas Consolidated Mining and Development Corporation v. CIR2 pages

- Jean Suret-Canale, French Colonialism in Tropical Africa, 1900-1945. New York Pica Press, 1971100% (2)Jean Suret-Canale, French Colonialism in Tropical Africa, 1900-1945. New York Pica Press, 1971530 pages

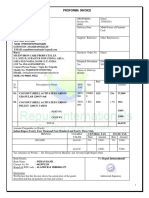

- I 009g - Proforma Invoice For Pellet & Granular Activated Carbon - Environ CareNo ratings yetI 009g - Proforma Invoice For Pellet & Granular Activated Carbon - Environ Care2 pages

- Beauty Without Cruelty - India: Be Part of Our Movement and Donate NowNo ratings yetBeauty Without Cruelty - India: Be Part of Our Movement and Donate Now2 pages

- Çiftlik: S, Landed Elites, and Tax Allocation in Eighteenth-Century Ottoman VeroiaNo ratings yetÇiftlik: S, Landed Elites, and Tax Allocation in Eighteenth-Century Ottoman Veroia36 pages

- Briefing On RA 10963: Tax Reform For Acceleration and Inclusion (Train) - Value Added TaxNo ratings yetBriefing On RA 10963: Tax Reform For Acceleration and Inclusion (Train) - Value Added Tax32 pages

- President Signs Three Executive Orders On Oil and Gas ReformsNo ratings yetPresident Signs Three Executive Orders On Oil and Gas Reforms7 pages