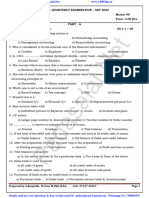

ANSWERS

1. (d)

Working Note:

1 2 2

Share acquired by Karan from Parnav = � �

4 3 12

1 1 1

Share acquired by Karan from Rahim = � �

4 3 12

3 2 36 � 10 26

Parnav’s New Share = � � �

5 12 60 60

2 1 24 � 5 19

Rahim’s New Share = � � �

5 12 60 60

26 19 1

New Ratio of Parnav, Rahim and Karan = : : = 26 : 19 : 15.

60 60 4

2. (d)

Working Note:

� 4�

Hidden Goodwill = � ` 2, 00 , 000 � � – (` 5,40,000 – ` 1,00,000 + ` 2,00,000) = ` 1,60,000

� 1�

1

Sanjana’s Share of Goodwill = ` 1,60,000 × = ` 40,000.

4

3. (d)

Working Note:

Combined Capital of X and Y for 4/5th Share = ` 4,50,000

5

Total Capital of Firm = ` 4,50,000 × = ` 5,62,500

4

1

Z’s Capital = ` 5,62,500 × = ` 1,12,500.

4. (b) 5

5. (c)

` 1,10 , 000 � ` 1, 00 , 000 � ` 98 , 000 � ` 1, 24 , 000 ` 4 , 32, 000

Average Profit = �

4 4

= ` 1,08,000

Normal Profit = Capital Employed* × Normal Rate of Return

12

= ` 3,15,000 × = ` 37,800.

100

*Capital Employed = Total Assets – Current Liabilities

= ` 3,50,000 – ` 35,000 = ` 3,15,000

Super Profit = Average Profit – Normal Profit

= ` 1,08,000 – ` 37,800 = ` 70,200

Value of Firm’s Goodwill = Super Profit × No. of Years’ Purchase

= ` 70,200 × 2 = ` 1,40,400

1

Atul’s Share of Goodwill = ` 1,40,400 × = ` 35,100.

4

1

� 6. (c)

Working Note:

JOURNAL ENTRY FOR GOODWILL

Date Particulars L.F. Dr. (`) Cr. (`)

Premium for Goodwill A/c (` 35,100 × 60/100) ...Dr. 21,060

Atul’s Current A/c (` 35,100 × 40/100) ...Dr. 14,040

To Amol’s Capital A/c 23,400

To Ameet’s Capital A/c 11,700

(Adjustment entry passed for share of goodwill)

7. JOURNAL

Date Particulars L.F. Dr. (`) Cr. (`)

Investment Fluctuation Reserve A/c ...Dr. 10,000

To Investment A/c 10,000

(Value of Investments brought down to market value)

Workmen Compensation Reserve A/c ...Dr. 1,500

To Provision for Workmen Compensation Claim A/c 1,500

(Amount of claim adjusted)

General Reserve A/c ...Dr. 50,000

Contingencies Reserve A/c ...Dr. 4,500

Profit & Loss A/c ...Dr. 30,000

Investment Fluctuation Reserve A/c [` 15,000 – (` 2,00,000 – ` 1,90,000)] ...Dr. 5,000

Workmen’s Compensation Reserve A/c (` 12,000 – ` 1,500) ...Dr. 10,500

To Ram’s Capital A/c 60,000

To Mohan’s Capital A/c 40,000

(Transfer of accumulated profits to Old Partners’ Capital A/cs in their

Old Ratio)

Ram’s Capital A/c ...Dr. 6,000

Mohan’s Capital A/c ...Dr. 4,000

To Advertisement Expenditure A/c 10,000

(Transfer of accumulated loss to Old Partners’ Capital A/cs in their

Old Ratio)

Note: Employees’ Provident Fund is a liability due to employees towards Provident Fund and is not an accumulated

profit, hence is not distributed among the partners.

8.

Dr. REVALUATION ACCOUNT Cr.

Particulars ` Particulars `

To Provision for Outstanding By Provision for Doubtful Debts A/c 25

Bill for Electricity A/c 3,325 (` 1,200 – 2.5% of ` 47,000)

By Sundry Creditors A/c 2,500

By Loss on Revaluation transfer to:

Kavi’s Capital A/c 500

Ravi’s Capital A/c 300 800

3,325 3,325

2

�Dr. PARTNERS’ CAPITAL ACCOUNTS Cr.

Particulars Kavi Ravi Chhavi Particulars Kavi Ravi Chhavi

` ` ` ` ` `

To Revaluation A/c (Loss) 500 300 ... By Balance b/d 1,50,000 90,000 ...

To Profit and Loss A/c 12,500 7,500 ... By Workmen Compensa-

To Bank A/c 5,000 3,000 ... tion Reserve A/c 20,000 12,000 ...

To Bank A/c (Bal. Fig.) 62,000 37,200 ... By Premium for Goodwill 10,000 6,000 ...

To Balance c/d 1,00,000 60,000 40,000 (WN 1)

By Bank A/c ... ... 40,000

1,80,000 1,08,000 40,000 1,80,000 1,08,000 40,000

BALANCE SHEET as at 1st April, 2024

Liabilities ` Assets `

Creditors 17,500 Debtors 47,000

Provision for Outstanding Bill for Electricity 3,325 Less: Provision for Doubtful Debts 1,175 45,825

Bank Overdraft (WN 3) 47,000 Stock 27,000

Capital A/cs: Land and Building 1,50,000

Kavi 1,00,000 Machinery 45,000

Ravi 60,000

Chhavi 40,000 2,00,000

2,67,825 2,67,825

Working Notes:

1. Sacrifice = Old Profit Share – New Profit Share

5 5 5

Kavi’s Sacrifice = � � ;

8 10 40

3 3 3

Ravi’s Sacrifice = � � ;

8 10 40

5 3

Hence, Sacrificing Ratio = : or 5 : 3.

40 40

5

2. Total Capital of New Firm = ` 40,000 × = ` 2,00,000

1

5

Kavi’s New Capital = ` 2,00,000 × = ` 1,00,000

10

3

Ravi’s New Capital = ` 2,00,000 × = ` 60,000.

10

3.

Dr. BANK ACCOUNT Cr.

Particulars ` Particulars `

To Balance b/d 4,200 By Kavi’s Capital A/c 5,000

To Chhavi’s Capital A/c 40,000 By Ravi’s Capital A/c 3,000

To Premium for Goodwill A/c 16,000 By Kavi’s Capital A/c 62,000

To Balance c/d 47,000 By Ravi’s Capital A/c 37,200

1,07,200 1,07,200