Question 3.

On further analysis and discussion, Benedicta and Roger agree that the company will

probably need another round of financing in addition to the current $5 million. Benedicta believes

that Bestafer will need an additional $3 million in equity at the beginning of year 3. While the

first round investors (including herself) will require a 50% return, Benedicta feels that round 2

investors, in recognition of the progress made between now and then, will probably have a hurdle

rate of only 30%. As before, management should have the ability to own a 15% share of the

company by the end of year 5.

a. Based on this new information, what share of the company should Benedicta seek today?

What price per share should she be willing to pay?

b. What share of the company will the Round 2 investors seek? What price per share will

they be willing to pay?

c. Suppose it was apparent in the beginning of year 3 that Bestafer would meet it's financial

targets, but not until the end of year 7. How would your answers to parts 3a and 3b change?

If Benedicta took her pro-rata share of the round (e.g. to keep her percentage ownership of

the company the same after the

Question 3

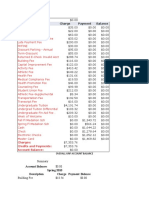

Step 1: What $ amount and share of TV do Round 1 investors expect?

Step 2: What $ amount and share of TV do Round 2 investors expect?

Step 3: What share do Round 1 investors expect given dilution by Round 2 investors?

Benedicta expects: (5*1.5^5)/100 = 38.00%

Before Dilution: 0.38/0.85 = 44.70%

2nd Round Investors: 3*(1.3^3) = $6.59M

Before Dilution: 6.59/85 = 7.75%

Round 1 Investors Expect: 44.7/(1-0.0775) = 48.50%

# Shares for Round 1: X / (1,000,000 + X) = 0.485 X = 941,747

Price: 5,000,000/941,747 = $5.30

Pre-Money Valuation: $5.3M

Post-Money Valuation: $10.3M

New # Shares: 1,941,747

Z / (Z + 1,941,747) = 0.0775 Z = 163,128

Price @ 2nd Round: 3,000,000/163,128 = $18.39

Pre-Money Valuation: 1,941,747 * $18.39 = $35.7M

Post-Money Valuation: $35.7M + $3M = $38.7M

If 15% of Mgt stake is allocated at the beginning:

Value of Company @ 5 = 100M

Round 1 would demand: 5*(1.5^5)/100 = 38%

2nd Round Investors: 3*(1.3^3) = $6.59M

So Round 1 Investors demand: 0.38/(1 - 0.0659) = 40.68%