Assessor: Mr. LE Mkhize. UJ Accounting student.

(224…….)

Basic mathematics for finance. 22,76 MARKS 12.64 minutes. 1 minute / 1.8

marks.

1. When Mr. Madiba invests every R6,00 in a savings scheme, he gains an

interest rate of 5% compounded monthly so that the accumulated amount of

this R6,00 after x years is R400. Determine the number of years that will enable

Mr. Madiba to earn the total interest of R45,61 in return if he chooses this as an

investment option. (Note: n ≥ 6) round off your answer to the nearest whole

number. (5 marks)

OOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOO.

2. Luyanda Mhlophe received an amount of R90 000 upon her retirement as a

saleswoman at Ntombi Pty (Ltd). She wants to invest this amount as a fixed

deposit and she is unsure whether to invest at ABSA Bank for a nominal interest

rate of 12,6% compounded semiannually for n years, or for 6% interest rate

compounded monthly at FNB Bank for 3 years. The financial advisor, Mr. L Mkhize

(CA), advised Luyanda Mhlophe to invest her funds at ABSA Bank.

Note: Number of years is denoted by n.

2.1 Perform calculations and comment whether the advice from the financial

advisor was good or not. Note: The financial advisor has been a qualified Charted

Accountant (SA) since 2016. (4 marks)

2.2 If Luyanda decides to invest at both Banks and wishes to earn the total

interest of R70 063,10 after 6 years, what amounts must be invested in ABSA

and FNB so that this goal can be achieved?

(6 marks)

2.3 If you were Luyanda and you want to earn an accumulated amount of

R46 787,86 having R17 000 as an initial investment amount, with an interest

rate offered by FNB Bank, how many years it will take your initial investment to

accumulate. (2,66 marks)

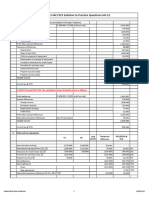

3. UJ Ltd is a well-developed company and listed under the main board. The board of

directors have decided to obtain a long-term loan R400 000 to finance the

company’s assets, they agreed upon a13% interest rate, and the loan will be repaid

by 13 monthly installments. 13% interest rate agreed upon is the actual cost of the

loan.

a) Prepare an amortization schedule for the long-term loan. (Use a financial

calculator to get your PMT). Round all your answers into 2 decimal places.

(5.1 marks).

Be sure that you’ve answered what was

required…….