Chapter #3

The Accounting Process

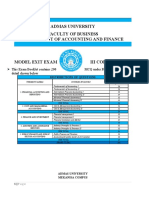

TRUE OR FALSE QUESTIONS

1. In a T-account, this T format graphically depicts the debits on the left side of the T and the credits on

the right side. True

2. An unadjusted trial balance is a listing of all the business accounts that are going to appear on the

financial statements after year-end adjusting journal entries are made. False

3. Accrued expenses are goods or services that have been paid for by a company but have not been

consumed yet. False

4. An accounting cycle is always equal to one calendar period. False

5. The primary objective of the accounting activity is to state an opinion regarding the fairness of

financial statements. False

6. When the trial balance is balanced, it proves the accuracy of the bookkeeping records. False

7. Adjusting entries should be made at the beginning of an accounting period. False

8. Reversing entries are done at the start of a new accounting period. True

9. After closing entries, the debit side of an expense account is equal to its credit side. True

10. To accrue means to pay the expenses when this became due. False

11. All asset accounts are nominal accounts. False

12. Not all the adjusting entries may be reserved. True

13. The accounting cycle starts with the analysis of business transaction. True

14. After proper analysis, the business transaction is recorded in journal in a chronological order. True

15. In accounting/bookkeeping, the term posting refers to transfer of entries from journal to ledger. True

16. The collection or group of accounts in an organization is known as general ledger. True

17. A credit may signify an increase in an expense account. False

18. The income statement is generally prepared first among the financial statements. True

19. For a profitable company, the entry to close the income summary account is debit income summary

and credit retained earnings. True

20. The accumulated depreciation account is not closed to income summary account at the end of the

accounting period. True

21. A worksheet is not a formal statement. True

22. If the total of the debits exceeds the total of the credits in the income statement columns of a

worksheet, there is a net loss. True

23. A simple journal entry consists of two or more debits or two or more credits. False

24. The debit and credit analysis of a transaction normally takes place before an entry is recorded in a

journal. True

25. The left side of an account is always the debit side, and the right side is always the credit side. True

FINANCIAL ACCOUNTING THEORY QUESTIONS

1. Which of the following statements about accounting is false?

A. Accounting is a practical art.

B. Accounting is a social science.

C. Accounting is a service activity.

D. The function of accounting is to provide qualitative information, primarily financial in nature,

about economic entities, that is intended to be useful in making economic decision.

2. Which of the following describes accounting as a science?

A. It requires creative judgment and skills.

B. It follows a systematic and organized path to understanding the economic status of the entity.

C. It presents the financial findings by following and implementing a universally accepted method

(GAAP).

D. Accounting is the application of knowledge comprising of some accepted theories, rules, concept

and conventions.

Page 1 of 13

�3. Which of the following describes accounting as an art?

A. Accounting includes rules, principles, concepts, conventions, and standards.

B. Accounting requires gaining knowledge about the economic status of an entity by systematic

study.

C. Recording, classifying, and summarizing of business transaction is done on the basis of certain

principles of double entry book-keeping system which are universally applicable.

D. It tells us the manner through which some special objectives, like ascertaining the operating

result for an accounting period and the financial position of the business on a particular date, can

be achieved.

4. Which of the following is not an economic entity?

A. Cardo Cruz Massage Spa and Other Services

B. Mr. Leonard Bryan G., owner of facial and skin care clinic.

C. Philippine Review Institute for Accountancy, Inc. (PRIA)

D. PDAC & Co., CPAs (Certified Public Accountants and Management Consultants)

5. Ma C. Si (MCS) is the owner and manager of Masipag Construction Services. MCS purchased a

condominium unit for personal use and a pick-up truck to be used in the construction business.

Which of the following assumptions, principles, or constraints would be violated if both the

condominium unit and the pick-up truck are recorded as assets of the business?

A. Conservatism constraint

B. Continuity assumption

C. Materiality constraint

D. Separate entity assumption

6. It is an accounting device for accumulating increases and decreases relating to a particular

accounting value such as an asset or a liability.

A. Account

B. Journal

C. Trial balance

D. Worksheet

7. An account in financial reporting that increases the book value of a liability account.

A. Adjunct account

B. Contra account

C. Nominal adjunct account

D. Nominal contra account

8. The natural balance of a contra account

A. is the same as the account with which it is paired.

B. is always the opposite of the account with which it is paired.

C. couldn’t be the opposite of the account with which it is paired.

D. may or may not be the opposite of the account with which it is paired.

9. Which of the following documents is generated by the vendor when a company purchases goods on

account?

A. Collection letter

B. Official receipts

C. Purchase journal

D. Sales invoice

10. When the manufacturing department is in need of goods or materials to complete its upcoming jobs,

what document will it issue to the purchasing department?

Page 2 of 13

� A. Billing statement

B. Cash advance summary

C. Purchase requisition

D. Sales order

11. In terms of debits and credits, which types of accounts will have the same normal balances?

A. Dividends, expenses, assets

B. Assets, capital stock, revenues

C. Expenses, liabilities, capital stock

D. Retained earnings, dividends, liabilities

12. Every transaction will affect how many accounts?

A. Only one

B. Only two

C. Two or more

D. At least three

13. When special journals are used, a General Journal is

A. not needed.

B. still required.

C. used only to record sales returns and allowances.

D. used only to record cash deposits of owner investments.

14. Which of the following transactions is recorded in a cash receipts journal?

A. Credit sales

B. Inventories are received

C. Collection of accounts receivable

D. Sales revenue is billed to the customers

15. A ledger

A. is a book of original entry.

B. contains only asset and liability accounts.

C. should show accounts in alphabetical order.

D. is a collection of the entire group of accounts maintained by a company.

16. This ledger may contain transactions about receipts into stock, movements of stock to the production

floor, conversion into finished goods, scrap and rework reporting, write-offs for obsolete items, and

sales to customers.

A. Accounts payable ledger

B. Fixed assets ledger

C. Inventory ledger

D. Purchases ledger

17. An error which is disclosed by a trial balance is

A. double-posting a credit to Sales amounting to P15,000.

B. an omission of a journal entry on purchases on account.

C. posting to the correct debit or credit side of a wrong account.

D. a journal entry for salaries paid amounting to P180,000 was not posted.

18. Which of the following statements is false regarding adjusting entries?

A. Adjusting entries involve accruals or deferrals.

B. Cash is neither debited nor credited as a result of adjusting entries.

C. Each adjusting entry affects one revenue account and one expense account.

D. Each adjusting entry affects one statement of financial position and one income statement

account.

Page 3 of 13

�19. Which of these items least resembles a typical adjusting entry?

A. Debit an asset, credit a liability

B. Debit an asset, credit a revenue

C. Debit an expense, credit a liability

D. Debit a revenue, credit a liability

20. Which of the following statements is true regarding debits and credits?

A. Before adjustments, debits will not equal credits in the trial balance.

B. In the income statement, revenues are increased by debit whereas in the statement of financial

position, retained earnings account is increased by a credit.

C. In the income statement, debits are used to increase account balances whereas in the statement

of financial position, credits are used to increase account balances.

D. The rules for debit and credit and the normal balance of share capital are the same as the

liabilities.

21. A debit balance in the nominal “income summary” account represents

A. capital

B. liability

C. net income

D. net loss

22. Certain accounts are closed at the end of an accounting period to

A. reduce the number of accounts that appear in the ledger.

B. transfer the effect of transactions recorded in the real accounts to owner’s equity.

C. reduce the number of items that get reported in the general-purpose financial statements.

D. prepare those accounts for recording of transactions of the subsequent accounting period.

23. What is the normal order of accounts in preparing a post-closing trial balance?

A. Asset, liability, and equity

B. Asset, liability, equity, income, and expenses

C. Asset, equity, income, expenses, and liability

D. All accounts with debit balances and then all accounts with credit balances

24. Which of the following items would appear in the post-closing trial balance?

A. Distribution cost

B. Increase in the fair value of trading securities

C. Loss from write-down of inventory to net realizable value

D. Cumulative balance of unrealized fair value gain of FA-FVOCI

25. Which is an optional step in the accounting cycle?

A. Adjusting entries

B. Closing entries

C. Financial statements

D. Reversing entries

26. An appropriate reversing entry

A. is dated the first day of the next accounting period.

B. must be made because they are required by accounting standards.

C. is usually made for adjusting entries that affect deferred items only.

D. is often used to correct entries which were initially based on estimates.

Page 4 of 13

�PRACTICAL FINANCIAL PROBLEMS

A. Muntinlupa Enterprise reported the following events to its bookkeeper that occurred on April 15,

2021:

Hired five (5) employees who will be assigned to handle the delivery operations of the company.

Each employee signed a P15,000 monthly salary contract.

The purchasing officer prepared a purchase order (PO) for inventory amounting to P85,000. The

said PO has been mailed to the supplier on the same date.

Muntinlupa’s chairman, Mr. Hini M. Atay, suffered a heart attack and immediately died. The

expected loss for this to Muntinlupa is estimated at P10,000,000.

Billing for electricity for the month of March 2021 received today amounting to P13,600.

Delivered P300,000 worth of inventories to customer with selling price of P350,000

(1) How much is the total accountable event that occurred on April 15, 2021?

a. P323,600

b. P663,600

c. P748,600

d. P833,600

B. Marikina Trading Corporation recorded the journal entries for the following:

Accrual of water consumption of P35,000.

Declaration of P800,000 cash dividends.

Sales on account of P350,000.

Purchase of computer equipment for P350,000 cash.

Issuance of capital stock for cash at par amounting to P400,000.

(2) What net effect do these entries have on equity?

a. Decrease of P85,000

b. Decrease of P450,000

c. Decrease of P50,000

d. Increase of P85,000

(3) What net effect do these entries have on assets?

a. Decrease of P400,000

b. Decrease of P435,000

c. Increase of P750,000

d. Increase of P400,000

C. Parañaque Inc., a VAT registered entity, issued Sales Invoice No. 35 for an item sold on credit for

P250,000 and granted multiple discounts to the client at 15% and 3%.

(4) The correct entry to record this transaction includes a debit to Account Receivable for

a. P205,000

b. P206,125

c. P229,600

d. P230,860

(5) The journal entry for the above transaction would include a credit to Sales for

a. P205,000

b. P206,125

c. P229,600

d. P250,000

Page 5 of 13

�D. Makati Cleaning Services is a manpower firm that provides housekeeping, janitorial and laundry

services. As the bookkeeper of Makati, the following documents were provided to you:

Official Receipt (OR)

o OR No. 254 – P35,000 (payment for SI No. 1117)

o OR No. 255 – P26,500 (payment for SI No. 1119)

o OR No. 256 – P38,950 (payment for SI. No. 1118)

o OR No. 257 – P15,000 (Cash sales)

Acknowledgement Receipt (AR)

o AR No. 143 – P300,000 (payment of share subscribed)

o OR No. 255 – P200,000 (refund of security deposit for rent)

Service Invoice (SI)

o SI No. 1120 – P55,000

o SI No. 1121 – P35,000

o SI No. 1122 – P85,000

(6) How much is the total debit to cash in the cash receipts books?

a. P100,450

b. P115,450

c. P615,450

d. P790,450

(7) How much should be recorded in the sales books?

a. P175,000

b. P190,000

c. P290,450

d. P790,450

E. The Navotas Wholesale Company began operations on September 1, 2021. The following

transactions occurred during the month of September.

The stockholders of Navotas paid P100,000 cash in exchange for P10,000 ordinary shares.

Rent on office space was paid on September 1 amounting to P12,000, applicable to September

and October rent.

A photocopying machine was purchased for P40,000 cash.

A note payable is signed for P30,000 representing loans payable to a bank.

On September 5, 2021, Navotas purchased inventory on account costing P76,000.

P44,000 worth of merchandise was sold on account for P80,000.

Customers paid P30,000.

Navotas paid its suppliers amounting to P40,000.

Salaries and wages of P14,000 for the month of September were paid on September 30, 2021.

The president of Navotas borrowed P40,000 from the company.

(8) What is the correct ending balance of Cash?

a. P14,000

b. P18,000

c. P22,000

d. P30,000

Page 6 of 13

� F. The following T-accounts for assets are available in the records of Man Company:

Cash

10,000 85,000

17,500

Inventories

13,000 18,000

Accounts Receivable

75,000 93,000

18,000

Page 7 of 13

� Equipment

80,000

10,000

Cash

o The beginning balance of cash is P17,500.

o The credit to cash pertains to cash sales.

Account Receivable

o The beginning balance of this account is P75,000 and the ending balance is P93,000.

o Credit sales of P18,000 was recorded and posted.

Inventories

o This account has a balance of nil at the beginning.

o Inventory worth P18,000 was purchased on credit.

o Sold inventory worth P13,000.

Equipment

o Purchased office equipment on credit amounting to P80,000.

o Sold for P10,000 an old laptop acquired three years ago for P250,000.

(9) What is the correct ending balance of Cash?

a. P82,500

b. P92,500

c. P102,500

d. P112,500

(10) What is the correct ending balance of all assets above?

a. P112,500

b. P262,500

c. P280,500

d. P290,500

G. You received the unadjusted trial balance of Las Piñas Merchandising for the month ended January

31, 2021:

Debit Credit

Cash 35,000

Accounts Receivable 85,000

Merchandise Inventories 28,500

Prepaid expenses 15,000

Land 150,000

Machinery – net of depreciation 85,700

Accounts Payable 98,500

Interest Payable 15,000

Ordinary Shares 224,000

Retained Earnings 185,000

Sales 340,400

Cost of Goods Sold 71,000

Rent Expense 35,000

Salaries and wages 38,700

Interest expense 44,000

TOTAL 552,900 897,900

Page 8 of 13

� The following information are also available:

Company checks amounting to P85,000 were already recorded but remained in the possession of

Las Piñas as of January 31, 2021.

Credit sales amounting to P561,000 recorded as P156,000. The related debit to accounts

receivable was correctly recorded.

The balance of furniture and equipment amounting to P350,000 was not included in the list

above.

Share Premium of P285,000 from issuance of shares was recorded as part of Retained Earnings.

Based on inventory records, the balance of cost of goods sold should be P471,000.

(11) What is the correct trial balance total?

a. P1,352,900

b. P1,452,900

c. P1,487,900

d. P1,552,900

H. The following transactions for Novaliches Design have been journalized and posted to the proper

accounts:

Mr. Arki Tekto invested P8,000 cash in Novaliches.

Novaliches paid the first months’ rent with P300 cash.

Purchased equipment by paying P2,000 cash and executing a note payable for P3,000.

Purchased supplies for P200 cash.

Novaliches billed clients for a total of P1,000 for design services rendered.

Received P750 cash from clients for services rendered above.

Mr. Tekto took a withdrawal of P2,000.

(12) What is the correct trial balance total?

a. P10,000

b. P12,000

c. P14,000

d. P16,000

I. The following information is available for Val Services at March 31, 2021:

Description Amount

Bank Loan 14,000

Financial Asset at FVPL 6,500

Bill Payable 1,000

Unearned Revenue 3,500

Sundry Debtors 12,000

Outstanding salaries 2,500

Prepaid rent 2,000

Insurance expense 7,300

Owner’s investment 95,000

Rent and Rates Expense 400

Accumulated Depreciation – Equipment 14,000

Accrued Revenue 15,000

Machinery 25,000

Drawings 3,500

Equipment 40,000

Maintenance expense 5,000

Miscellaneous expense 4,800

Accrued expenses 1,500

Page 9 of 13

� Depreciation expense – equipment 2,000

Unexpired insurance 8,500

Vendor’s payable 500

(13) What is the correct trial balance total?

a. P120,000

b. P123,000

c. P130,500

d. P132,000

J. Prepaid Insurance accounts began the year with a balance of P23,000. During the year, insurance in

the amount of P57,000 was purchased. At the end of the year March 31 st, 2021, the amount of

insurance still unexpired was P35,000.

(14) If the asset method is used, the adjusting entry will include a debit to insurance expense of

a. P35,000

b. P45,000

c. P57,000

d. P69,000

K. On July 3, a deposit in the amount of P5,000 was received for services to be performed. By the end of

the month, services in the amount of P1,200 were performed.

(15) Using the liability method, the initial entry will include a

a. credit to cash for P1,200

b. credit to revenue for P5,000

c. credit of unearned revenue for P5,000

d. credit to earned revenue for P1,200

(16) Using the revenue method, the adjusting entry will include a

a. debit to revenue for P1,200

b. debit to revenue for P3,800

c. credit to unearned revenue for P1,200

d. credit to revenue for P1,200

L. Bacoor Realty Co. pays weekly salaries of P125,000 on Friday for a five-day week ending on that day.

(17) The adjusting entry at the end of the accounting period, assuming that the period ends on

Thursday, will include a

a. debit to salaries payable for P100,000

b. credit to salaries payable for P125,000

c. debit to salaries expense for P100,000

d. debit to salaries expense for P125,000

M. For the year ending December 31, 2021, Imus Janitorial Services mistakenly omitted adjusting

entries for P86,000 of unearned revenue that was earned, earned revenue that was not billed of

P125,000 and accrued wages of P29,000.

(18) What is the combined effect of the errors on revenue, expenses, and net income, respectively?

a. P39,000 understated, P29,000 understated, P182,000 understated

b. P39,000 understated, P29,000 understated, P96,000 understated

c. P211,000 understated, P29,000 understated, P182,000 understated

d. P211,000 overstated, P29,000 understated, P240,000 understated

Page 10 of 13

�N. The adjustment for accrued fees of P267,000 was journalized as a debit to Accounts Payable for

P267,000 and a credit to Service Revenue of P267,000. In addition, the adjustment for depreciation

of P163,000 was journalized as a debit to Depreciation Expense for P136,000 and a credit to

Accumulated Depreciation for P163,000/

(19) Which of the following statements is true?

a. The trial balance totals are equal.

b. Excluding the error in the adjusting entry for depreciation, the trial balance totals are equal.

c. The debit total of the trial balance is higher by P27,000.

d. Excluding the error in the adjusting entry for accrued fees, the trial balance totals are equal.

O. Sta. Rosa Enterprise hires outside salespersons with the following terms on salaries and

commissions:

Fixed monthly salaries and commissions based on net sales.

Sales commissions are computed and paid on a monthly basis (in the month following the month

of sale) and the fixed salaries are treated as advances against commissions.

If the fixed salaries for salespersons exceed their sales commissions earned for a month, such

excess is not charged back to them.

The following information are available for the month of June 2021 for the three (3) outside

salespersons:

Fixed salaries Net sales Commission rate

Donna 25,000 225,000 10%

Regine 37,500 625,000 10%

Mikey 62,500 1,000,000 15%

(20) What should Sta. Rosa Enterprises accrue for sales commissions at June 2021?

a. P110,000

b. P112,500

c. P125,000

d. P235,000

P. Cabuyao Leasing’s unadjusted prepaid expense account at December 31, 2021, revealed the

following:

An opening balance of P120,000 for an insurance policy, Cabuyao had paid an annual premium of

P240,000 on July 1, 2020.

A 360,000 annual insurance premium payment made July 1, 2021.

A P1,000,000 advance rental payment for a warehouse Cabuyao leased for one year beginning

January 1, 2022.

(21) What amount should Cabuyao report as prepaid expense in its December 31, 2021 statement of

financial position?

a. P180,000

b. P1,180,000

c. P1,300,000

d. P1,360,000

Q. San Pedro Company presented the following data for 2021:

Assets, January 1 5,400,000

Liabilities, January 1 3,240,000

Page 11 of 13

� Shareholders’ equity, January 1 ?

Dividends paid in 2013 1,080,000

Increase in share capital – ordinary 972,000

Shareholders’ equity, December 31 ?

Net income 1,080,000

(22) What is the shareholders’ equity at December 31, 2021?

a. P1,890,000

b. P1,998,000

c. P3,132,000

d. P3,186,000

R. Bocaue Trading provided the following information for the year:

Accounts receivable, January 1 190,000

Collections from customers 2,100,000

Shareholders’ equity, January 1 380,000

Total assets, January 1 750,000

Total assets, December 31 880,000

Accounts receivable, December 31 360,000

Total liabilities, December 31 390,000

(23) What is the net income for the current year?

a. P70,000

b. P110,000

c. P150,000

d. P490,000

S. The adjusted trial balance of Malolos Fabrication for the month ended January 31, 2021 shows the

following:

Debit Credit

Cash 150,000

Accounts Receivable 355,000

Prepaid expenses 88,000

Land 250,000

Machinery – net of depreciation 185,700

Accounts Payable 198,500

Interest Payable 8,000

Ordinary Shares 350,000

Retained Earnings 450,000

Revenue 585,100

Direct Labor 185,000

Direct Materials 157,000

Depreciation expense 13,300

Rent expense 115,000

Utilities expense 78,600

Interest expense 14,000

TOTAL 1,591,600 1,591,600

(24) What is the correct trial balance total after all closing entries are made?

a. P1,028,700

b. P1,050,900

Page 12 of 13

�c. P1,569,400

d. P1,591,600

Page 13 of 13