THE BHAWANIPUR EDUCATION SOCIETY COLLEGE

A MINORITY RUN COLLEGE. AFFILIATED TO UNIVERSITY OF CALCUTTA

RECOGNISED UNDER SECTION 2(F) & 12 (B) OF THE UGC ACT, 1956

DEPARTMENT OF COMMERCE

(Morning/ Afternoon/ Evening section)

B.Com. - Semester III

Subject: Computerized Accounting and Introduction to Data Science

Skill Enhancement Course (SEC)

Practical Assignment (2024-2025)

Computerized Accounting

1.Create a Company as”National Enterprise” in Tally Prime and display the company creation

window with the following details:

Company Name National Enterprise_Your UID

E.g. if my UID is 010210047, then name of the

company should be

National Enterprise_010210047

Address 27, 80 Ft, Industrial Area Koramangala, Bangalore

State Karnataka

PIN Code 560037

Mobile 9864664666

E-mail nationalenterprise.hotmail.com

Financial year beginning from 1-4-2024

Books beginning from 1-4-2024

Set Tally Vault Password No

Base Currency Symbol INR

# Attach a screenshot of the company creation screen

Page 1 of 8

� THE BHAWANIPUR EDUCATION SOCIETY COLLEGE

A MINORITY RUN COLLEGE. AFFILIATED TO UNIVERSITY OF CALCUTTA

RECOGNISED UNDER SECTION 2(F) & 12 (B) OF THE UGC ACT, 1956

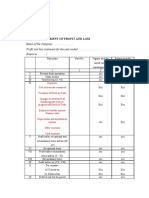

2. From the following details create ledgers and display the Opening Balance Sheet of the concern

Liabilities Amount Assets Amount

Capital 20,00,000 Land And Building 10,20,000

Provision for Tax 25,000 Furniture 85,000

Loans from Shiva Ltd 50,000 Investment 80,000

Parvati Enterprises 10,000 Stock 7,00,000

Punjab National Bank 1,90,000

Prepaid Insurance 10,000

20,85,000 20,85,000

# Attach screenshot of detailed opening balance sheet

3. Record the following transactions:

- On 03-04-2024, Cash ₹ 15,000 withdrawn from Bank for Cash expenses.

- On 09-04-2024, payment of ₹ 7,500 towards Travelling Expenses and ₹ 2,500 towards Labour

Charges through bank vide cheque number 512101 and 512102 respectively

- On 10-04-2024, paid trade license fee ₹ 1,000 in cash

- On 14-04-2024, goods ₹ 5,000 purchased through cash.

- On 16-04-2024, purchased goods worth ₹ 12,000 from Shan Enterprises, Tamilnadu on credit.

- On 17-04-2024, sold goods to Priya Enterprises ₹ 18,000 in cash

- On 02-05-2024, sold goods ₹ 32,000 to Sonam Enterprises on credit

- On 22-05-2024, the payment received from Sonam Enterprises in the bank

- On 31-05-2024, payment of ₹ 8,000 has been made to the Shan Enterprises

# Attach screenshot of Profit and Loss Statement and Balance Sheet (Detailed) after recording

aforesaid transactions in Tally Prime.

4. Krishna Electronics (Prop. Krishan), Karnataka (Pin Code 530068) started the business in April 2024

with a capital of ₹ 20,00,000. The company started recording compliance related transactions from

1st April 2024 in Tally Prime. The company is registered as a Regular Dealer under the Goods and

Services Tax Act. The company deals in multi brands of Television which will attract 18%. The

company has an account in HDFC Bank Current A/c for business purpose.

Page 2 of 8

� THE BHAWANIPUR EDUCATION SOCIETY COLLEGE

A MINORITY RUN COLLEGE. AFFILIATED TO UNIVERSITY OF CALCUTTA

RECOGNISED UNDER SECTION 2(F) & 12 (B) OF THE UGC ACT, 1956

GST Details

State Karnataka

Registration type Regular

Assessee of Other Territory No

Applicable from 1-Apr-23

GSTIN/UIN 29ADMPK2640M1Z4

Periodicity of GSTR 1 Monthly

Set/alter GST rate details Yes

HSN of Electrical Appliances 85287219

Enable tax liability on advance receipts No

Enable tax liability on reverse charge (Purchase from unregistered No

dealer)

Enable GST Classifications No

Provide LUT/Bond details No

Invoice Features

e-Way Bill applicable No

e-Invoicing applicable No

# Attach screenshot of company creation screen and screen showing GST Setup

- Create following party ledgers

Name Charan Ltd. Sajan Enterprises

Under Creditors Debtors

State Karnataka Karnataka

Pin 560105 560821

Type Regular Regular

GSTIN 29AAACO8313M1Z3 29AIEPM9849F1ZP

In case, you find any issue in GSTIN then use another GSTIN of a dealer from Karnataka

Page 3 of 8

� THE BHAWANIPUR EDUCATION SOCIETY COLLEGE

A MINORITY RUN COLLEGE. AFFILIATED TO UNIVERSITY OF CALCUTTA

RECOGNISED UNDER SECTION 2(F) & 12 (B) OF THE UGC ACT, 1956

- Create Inventory Masters

Item LG 32’ Smart TV Mi 32’ Smart TV

Unit Numbers Numbers

GST Applicable Applicable

Type of Supply Goods Goods

Rate of Duty 18 18

- As on 06-04-2024, the company purchased the following goods from Charan Ltd, Karnataka on

credit with Supplier Invoice no. CE/PUR/11

-

Name of Item Quantity Rate per (₹) Amount (₹)

LG 32’ Smart TV 5 Nos 15,000 75,000

MI 32’ Smart TV 3 Nos 13,000 39,000

- As on 10-04-2024, the company sold the following goods to Sajan Enterprises on credit with Sale

Bill No. 1

Name of Item Quantity Rate per (₹) Amount (₹)

LG 32’ Smart TV 3 Nos 16,500 49,500

MI 32’ Smart TV 2 Nos 14,000 28,000

# Attach copy of the invoice printed from the system (screenshot is not required)

- Attach screenshot of GSTR 3B and GSTR 1 report for the month of April 2024

5. Create a Company TPI LTD in Tally Prime with Bank Balance of ₹ 10,00,000 and Show the Cost

Allocation for the following:

As on 5th June 2024, company made a payment towards Travelling & Food Expenses for ₹

2,00,000, vide SBI cheque no: 000004 dated 05-06-2024. Allocate the total amount as follows

Page 4 of 8

� THE BHAWANIPUR EDUCATION SOCIETY COLLEGE

A MINORITY RUN COLLEGE. AFFILIATED TO UNIVERSITY OF CALCUTTA

RECOGNISED UNDER SECTION 2(F) & 12 (B) OF THE UGC ACT, 1956

Cost Centre ₹

Mahendra 60,000

Jitendra 60,000

Prakash 40,000

Shekar 40,000

# Attach screenshot of Cost Center Summary report showing aforesaid allocation.

Introduction to Data Science

1. a) Make a Database in MS Access named “People”.

b) Make the following Table in MS Access:

Table Name: Person

Primary Key: PID

Column Name Data Type Remarks

PID Short text

PName Short Text

Page Number

PGender Short Text Male, Female

PCategory Short Text General, SC, ST

c)Insert at least 10 appropriate data.

d)Write the SQL Code for the following Queries

i. Display the entire table.

ii. Display the names of all males below the age of 42.

iii. Display the name and age of all females belonging to the General category.

iv. Display the Count of each Gender.

2. a) Make a Database in MS Access named “College”.

b) Make the following Table in MS Access:

Table Name: Student

Primary Key: UID

Page 5 of 8

� THE BHAWANIPUR EDUCATION SOCIETY COLLEGE

A MINORITY RUN COLLEGE. AFFILIATED TO UNIVERSITY OF CALCUTTA

RECOGNISED UNDER SECTION 2(F) & 12 (B) OF THE UGC ACT, 1956

Column Name Data Type Remarks

UID Short text

SName Short Text

Page Number

Pgender Short Text Male, Female

c)Make the following Table in MS Access:

Table Name: Marks

Primary Key: UID

Column Name Data Type Remarks

UID Short text

Class10 Short Text 0 <= Class10 <= 100

0 <= Class12 <=

Class12 Number

100

d)Create a Relationship between the two tables based on the UID.

e) Insert at least 15 appropriate data.

f) Write the SQL Code for the following Queries

i. Display the names of all females.

ii. Display the name and Class 10 marks of all females who got more than 90 in their

Class 10 Exams.

iii. Display the name of the Student with the highest marks in Class 10.

3. Using MS Access Insert the following values in table Student using the form:

Roll No First Last Name Date of Gender Phone Course Fees

Name Birth

1 Shyam Sharma 11/11/2000 Male 124567890 PGDCA $110.00

2 Ramesh Mehta 12/10/2020 Male 124567890 DCA $230.00

3 Kiran Shikari 05/04/2001 Female 124567890 PGDCA $110.00

4 Vaishali Shikari 09/11/2020 Female 124567890 PGDCA $110.00

5 Prakash Thakur 06/10/2000 Male 124567890 CPCT $210.00

6 Prakash Rathore 06/12/2001 Male 124567890 DCA $230.00

7 Rahul Vasuniya 12/03/2001 Male 124567890 PGDCA $110.00

8 Pallavi Rathore 01/01/2000 Female 124567890 DCA $230.00

4. We have taken a loan of Rs. 150,000 to buy ourselves a brand new sports car. The loan is for

10 years, bearing a yearly interest rate of 5%. What would be the annual payment using MS

Excel?

Page 6 of 8

� THE BHAWANIPUR EDUCATION SOCIETY COLLEGE

A MINORITY RUN COLLEGE. AFFILIATED TO UNIVERSITY OF CALCUTTA

RECOGNISED UNDER SECTION 2(F) & 12 (B) OF THE UGC ACT, 1956

5. The following worksheet contains Name & Taxable Income for 10 employees. Calculate

Income Tax Surcharge and Total Tax for the following worksheet using MS Excel:

Income Tax is calculated as follows:

Taxable Income Income tax

First 1,50,000 Nil

Next 1,00,000 10%

Next 75,000 20%

Excess 30%

Surcharge is 3% on Income Tax if Taxable income is above 5,00,000

6. Write the appropriate answer in your own words.

i. What is the purpose of an e-PAN card? Is EPAN valid without signature? Can we

convert ePAN to physical PAN card?

ii. What security features are implemented in DigiLocker? Is it safe to put my data on

DigiLocker platform?

iii. What are the key components of DigiLocker?

iv. What is the use of Parivahan? What is the full form of RTO?

Page 7 of 8

� THE BHAWANIPUR EDUCATION SOCIETY COLLEGE

A MINORITY RUN COLLEGE. AFFILIATED TO UNIVERSITY OF CALCUTTA

RECOGNISED UNDER SECTION 2(F) & 12 (B) OF THE UGC ACT, 1956

Assignment Copy Preparation Instructions:

1. Write the question as given in the assignment followed by their steps(formula) of

solving on the ruled portion and take colour printout of the output/result pages.

2. Cut and paste the printouts on the white pages corresponding to the question/ solution

steps.

3.CU Roll Number must be mentioned on the header of every output (printout).

4. Hard Bound Lab Notebook (shoelace file), to be used.

5. On the first page, mention the following details:

- Name of the Candidate

- Semester

- CU Roll Number (used in Semester II examination)

- CU Registration Number

- College UID

5. Cover your assignment copy with brown/white paper.

6. Create an index page on your first page of your lab notebook.

7. The detailed schedule will be shared with the students later.

Prof. Minakshi Chaturvedi Mr. Saspo Chakraborty

Co-Ordinator Vice Principal, Dept. of Commerce

Department of Commerce (Morning Section) (Afternoon & Evening Section)

Page 8 of 8