Transfer Pricing Directives, 2081 (2024)

Highlights

�Transfer Pricing (TP) refers to the value of transactions between related parties, often influenced by a group's interests rather

than market forces. Companies may manipulate prices to shift profits to lower-tax jurisdictions, reducing taxes in higher-tax

countries. To address this, a TP directive has been issued to ensure that transactions between related multinational

companies are conducted at arm’s length price, ensuring fair taxation for each country involved.

Highlights of the directives are summarized below:

1. Who is covered by the directive?

The directive applies to cross-border transactions in which at least one party is subject to taxation in Nepal as well as

controlled transactions involving the supply of goods or services between related parties. The implementation date of this

directive is FY 2081/82 (2024-25).

2. Associated Persons: Who Are They?

An individual and a partner or family member, a foreign permanent establishment and its owner, or an entity and a person

who, either directly or through one or more intermediary entities, controls or may benefit from fifty percent or more of the

entity's capital, income, or voting power, as the situation calls for, are all considered associated persons.

3. What is the purpose of comparative analysis?

To identify comparable unregulated transactions, comparability analysis is performed. A appropriate comparable transaction

may only be chosen for calculating arm's length price after all factors, including the type of the transaction, business

performance, external economic climate, and contract terms, have been examined.

The following steps should be followed while performing a comparability analysis:

Aspects of business and transactions that are economically significant are examined

The factors of the controlled transaction are compared, and the tested party is selected.

Comparable are found and selected.

A suitable arm's length approach is selected.

A suitable adjustment to comparable is made.

4. How are Arm's Length Price (ALP) calculations made?

The following techniques are used to compare the controlled transactions with independent ones in order to ascertain the

arm's length pricing once comparable independent transactions have been chosen through a comparability analysis:

a) Comparable uncontrolled pricing method (CUP): This method compares the cost of transferring goods or services in a

regulated transaction to the cost of doing so in a comparable uncontrolled transaction under similar conditions.

b) The resale price technique is either concerned with the price at which goods that the company buys from a connected

company are sold again or given to a different company. The resale price approach lowers a product's price by an arm's

length gross margin in comparison to what the associated sales organisation would charge an unrelated customer.

c) Cost plus method: Determines the expenses incurred by the property or service provider in a controlled transaction for

services rendered to a related business or property transferred. These expenses are then increased by a suitable markup,

which is established by comparing the markup obtained by suppliers in similar unregulated transactions. This creates a

suitable transfer price based on the services rendered and the market conditions.

d) Transactional net margin approach: This approach is typically used for functions instead of discrete controlled transactions.

It looks at a net profit indicator, which is the ratio of net profit realized by an assessed from a regulated transaction to the net

profit generated in similar uncontrolled transactions, relative to a suitable basis (such as costs, sales, or assets).

e) Transactional profit split method: This approach views the complete transaction carried out by several related businesses

as a single business event. After deducting expenses based on their respective contributions to the transaction, the group of

related businesses divides the final profit.

�5. How can I choose the best approach?

The following factors determine which of the five approaches is best:

a) The type and class of the international transaction;

b) The class or classes of AEs involved in the transaction and the roles they play in relation to the assets they use or plan to

use and the risks they take on;

c) The availability, coverage, and dependability of the data required for the method's application;

d) The degree of comparability existing between the international transaction and the uncontrolled transaction and between

the enterprises entering into such transactions;

e) The degree to which trustworthy and precise adjustments can be made to take into consideration any discrepancies that

may exist between the international transaction and similar uncontrolled transactions, or between the businesses engaging in

such transactions;

f) The type, scope, and dependability of assumptions that must be made when implementing a method.

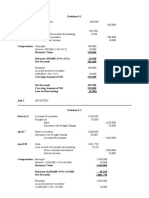

6. What are the steps for TP assessment?

Step 1: Identification of associate relationship To identify whether the parties involved in the particular transaction fall under

the definition of associated persons as defined in the directive.

Step 2: Identification of Intra-Group CrossBorder Transactions For the application of the directive, at least one party to the

transaction shall be non-resident of Nepal. Thus, transactions, where the non-resident parties are involved, shall be identified

for implementation of TP procedures.

Step 3: Function, Assets and Risk (FAR) Analysis It is the most important step in TP assessment as it helps to identify the

comparable transaction by assessing the functions executed, assets involved and risk assumed for completion of the

transaction.

Step 4: Identification of Comparable Transactions Based on the FAR analysis comparable transactions in an Uncontrolled

environment shall be identified for determining the Arm’s Length Price.

Step 5: Selection of the Most appropriate method Based on the availability of the comparable, the most appropriate method

among the five methods mentioned in the directive shall be selected.

Step 6: Comparability Adjustments There may be some contractual differences between the comparable and the assessee

thus such differences shall be adjusted to make comparison more precise.

Step 7: Determination of Arm’s Length Price (ALP) ALP is determined by the application of the most suitable method. In case

where seven or more comparable are available, range concept is used and in case of lesser comparable arithmetic mean is

used to determine ALP.

Step 8: Transfer Pricing Adjustment After determination of ALP, if it is outside the permissible range of 5% such difference

shall be adjusted with the actual price.

�7. What records need to be kept up to date?

Documenting controlled cross-border transactions with affiliated organisations in the approved manner is required of

taxpayers; however, this requirement is not mandatory for taxpayers who trade less than NPR 100 million. According to

section 81 of the Income Tax Act, taxpayers must maintain adequate records for five years starting at the end of the year to

which business income relates. This will allow the IRD to determine whether the business has made money or lost money.

An auditor who is not involved in the financial or tax audit must verify any cross-border transactions between connected

parties that exceed NPR 500 million. A minimum of five years of auditing experience is required of such an auditor.

8. Do penalties, interest, and fines apply?

A fee is assessed under Section 117 if the taxpayer neglects to file statements or maintain necessary records. Under Section

118, interest is assessed for late tax installments. Interest is assessed under Section 119 for late tax payments, and Section

120 levies a fee if less tax is discovered to have been paid.

9. Is it possible to make an advance pricing arrangement?

The taxpayers can file for an Advance Pricing Agreement (APA) and receive results before the transaction is actually carried

out in order to achieve clarity before engaging in an overseas transaction with an associated entity. In accordance with rule

15 of the Income Tax Rule 2059, the taxpayer may submit a written request for an advance pricing arrangement to the

department.

10. What are the possible dispute resolution remedies?

By submitting one-fourth of the disputed amount, the taxpayer may submit an application for administrative review to IRD

under sections 114 and 115 of the Income Tax Act 2058 if they are dissatisfied with the assessing officer's assessment. By

providing written notification to the applicant, the Department may accept or reject, in whole or in part, the issues raised in

the application. According to section 116 of the Income Tax Act, the taxpayer may file an appeal with the Revenue Tribunal if

the department does not notify the applicant of its judgement within sixty days after the application date.

Any taxpayer who is not satisfied with any decision made by the Administrative Review may make an appeal to Revenue

Tribunal. The taxpayer needs to provide application along with depositing 50% of the disputed amount.

Thank – You

Guru & Associates, Chartered Accountants.

Kathmandu Nepal