0% found this document useful (0 votes)

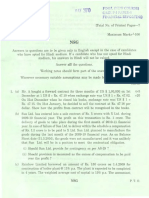

98 views4 pagesCA Final Group I - Advanced Accounting - May 2008

Uploaded by

nehag9054Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

98 views4 pagesCA Final Group I - Advanced Accounting - May 2008

Uploaded by

nehag9054Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 4