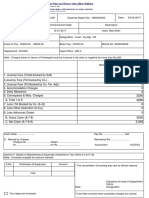

V.

No_______

Hkkjrh; [kfu fo|kihB] /kuckn Date________

INDIAN SCHOOL OF MINES, DHANBAD

TRAVELLING ALLOWANCE BILL /CLAIM FORM

(ISM-JRF/ M.TECH/ M.PHIL/ 5 YRS DD/ 5 YRS MSC/MSC TECH/ B.TECH)

PART – A (To be filled in by Student)

1. Name 2. Admission No.

3. Department

3. Purpose of Journey 4. Expenditure Head

5. Contact No (Mobile)

6. Details of journey(s) performed:

Departure Arrival Mode of journey Fare paid in Distance in Ticket Duration of

and class of Rupees KM No. Halt

Date & From Date & To accommodation

Time Time

1 2 3 4 5 6 7 8 9

8. Dates of absence from place of halt on account of :

a) RH and CL _________________

b) Not being actually in camp on Sundays and Holidays ________________

9. Date on which free board and /or lodging provided by any organization financed by state funds:

Board only/Lodging only/Boarding and lodging ________________________________________

10. Amount of TA/DA drawn from other organization, if any (please give details)________________________________

11. Particulars to be furnished along-with hotel / guest house receipts etc. , for stay in Hotel/ Guest House / other establishments providing

board and / or lodging at scheduled tariffs (please attach hotel bills):

Period of Stay (Date and time) Name of the Hostel / Guest Bill No and Daily rate of Total amount

From To House (whether Govt. or Date lodging charges paid (Rs.)

Private) (Rs.)

12. Amount of TA advance drawn, if any Rs _____________________ Date of drawal ________

Signature_____________________

Page 1 of 4

�13. CLAIM OF LOCAL CONVEYANCE CHARGES ON TOUR FOR OFFICIAL PURPOSES AT

(CITY)__________ from (Date)________ to ___________

FROM TO Mode of No of Rate Amount Purpose/

Date Time Office/Place Date Time Office/ Transport Kms. Paid Work done

Place

14. Details of daily expenses on food (Please attach supporting bills for reimbursement)

S No Date Purpose Cash Memo/ Bill Amount

No

Signature_____________________

Page 2 of 4

�15. Other Expenses in respect of Foreign Tour :-

1 Local Conveyance Charges

2 Registration Fee

3 Other expenses, if any, please mention

Certified that above expenses is actual and paid by me in connection with food expenses during tour.

Date ____________ Name: __________________________________

1 Tour approval Bank details :-

2 Tour Diary Bank Name :

3 Food bill IFSC Code :

4 Hotel Bill Bank A/c No. :

Certificate in respect of Official Journey

Period from (date) ___________ to (date)____________

(i) Certified that the mileage claimed in the TA bill is correct to the best of my knowledge.

(ii) Certified that I did not perform the road journeys for which mileage allowance has been claimed at the

higher rate prescribed in rule 48 of supplementary Rule by taking a single seat in any public ) fixed

rates. Also certify that the journey was not performed in any other vehicle without paying its hire

charges or incurring running charges.

(iii) Certified that journey was performed by the shortest and cheapest route of the entitled class and fares

claimed were actually paid by me to the Railway/ Air/ Transport authorities

(iv) Certified that no such travelling allowance bill for the period mentioned above has been claimed from

any other source.

(v) Certified that I did not avail myself of any casual leave/RH for the days for which Daily Allowance

(food/ hotel bills) are claimed.

(vi) Certified that I did not avail of free boarding and / or lodging at the expense of State Govt or any

organization financed from state funds during the days for which food expenditure has been claimed.

(vii) Certified that I travelled by air to which I am entitled and air tickets were purchased on cheapest fare

of the entitled class and mileage earned on the tickets will be used for the official purposes only.

(viii) Certified that the information as given above is true and correct to the best of my knowledge and

belief.

Date: Signature of Claimant ______________

Signature of HOD _________________________

Signature_____________________

Page 3 of 4

� Part-B (For the use of Accounts Section)

(Rupees)

1. Rail fare

Air fare

Road fare

2. Road mileage (as per column 13 for Kms. @ Rs. per km)

3. Accommodation/ Hotel Charges (as per column 11)

4. Daily Allowance (Reimbursement of food bills as per column 14):

Foreign DA

Domestic DA:-

1. Days @ Rs per day Rs.

2. Days @ Rs per day Rs.

3. Days @ Rs per day Rs.

5. Other Expenses :

Local Conveyance Charges

Registration Fee

Other expenses, if any, please mention

6. Gross amount (Rupees )

7. Less amount of TA Advance drawn if any

8. Net amount Payable / Recoverable

(Rupees :- )

The above expenses is debitable to:-

Dealing Assistant Junior Superintendent (A/C) Section Officer (I/A) Asstt. Registrar (I/A)

Asstt. Registrar (A/C) / Dy Registrar (F&A) Dean (Academic)

Received Rs. vide cash / cheque No. dated

Signature

Page 1 of 1