0% found this document useful (0 votes)

23 views4 pagesInventory Homework4 Solution Problem4+5 Revised

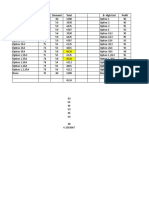

The document presents calculations related to demand forecasting, including expected demand, standard deviation, order quantities, and expected profits for different scenarios. It details the expected demand of 540 units, a standard deviation of 135.65, and optimal order quantities for three stock bins. Additionally, it outlines the expected profit for various order quantities and the impact of different parameters on profitability.

Uploaded by

sunnifaseleneCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

23 views4 pagesInventory Homework4 Solution Problem4+5 Revised

The document presents calculations related to demand forecasting, including expected demand, standard deviation, order quantities, and expected profits for different scenarios. It details the expected demand of 540 units, a standard deviation of 135.65, and optimal order quantities for three stock bins. Additionally, it outlines the expected profit for various order quantities and the impact of different parameters on profitability.

Uploaded by

sunnifaseleneCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 4