0% found this document useful (0 votes)

17 views38 pagesTopic 9 FOREX

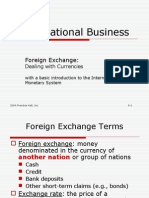

The document provides an overview of the foreign exchange market, detailing its functions such as currency conversion and risk insurance through hedging. It explains key concepts like spot and forward exchange rates, and the factors influencing exchange rate movements, including inflation and interest rates. Additionally, it discusses the implications of currency volatility for management practices and various economic theories related to exchange rate determination.

Uploaded by

heroicrescue2020Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

17 views38 pagesTopic 9 FOREX

The document provides an overview of the foreign exchange market, detailing its functions such as currency conversion and risk insurance through hedging. It explains key concepts like spot and forward exchange rates, and the factors influencing exchange rate movements, including inflation and interest rates. Additionally, it discusses the implications of currency volatility for management practices and various economic theories related to exchange rate determination.

Uploaded by

heroicrescue2020Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 38