UNIT FIVE

PRICE AND OUT PUT DETERMNATION UNDER PERFECT COMPETTION

Introduction

In this chapter, we shall try to see how a given firm operating in a perfectly competitive market determines the profit

maximizing level of output and price, and how equilibrium market price and level of output are determined in a

perfectly competitive market. Our discussion starts with giving a brief description about perfect competition.

Objectives

After successful completion of this unit, you will be able to:

Characterize a perfectly competitive market.

Know how a perfectly competitive firm determines the profit maximizing out put both in the long

run and short run.

Derive the short run supply schedule of an individual firm and industry.

Explain when a perfectly competitive firm should decide to shut down.

How a perfect competition results in efficient allocation of resources.

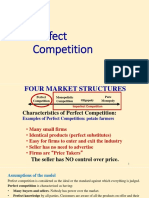

5.1 Perfect Competition

Definition and Assumptions

Perfect competition is a market structure characterized by a complete absence of rivalry among the individual firms.

Thus, perfect competition in economic theory has a meaning diametrically opposite to the everyday use of this term.

Most of the time, we see business men using the word “Competition” as synonymous to “rivalry”. However, in

theory, perfect competition implies no rivalry among firms

Assumptions

The model of perfect competition was constructed based on the following assumptions or imaginations.

1. Large number of sellers and buyers.

The perfect competitive market includes a large number of buyers and sellers. How large should the number of

buyers and sellers is large to the extent that the market share of each firm (and buyer) is too small to have a

perceptible effect on the price of the commodity. That is the action of a single seller or buyer can not influence

the market price of the commodity, since the firm or (the buyer) is too small in relation to the market.

2. Products of the firms are homogeneous.

This means the products supplied by all the firms in the market have uniform physical characteristics (are

uniform in terms of quantity, quality etc) and the services associated with sales and delivery are identical. Thus

buyers can not differentiate the product of one firm from the product of the other firm.

The assumptions of large number of sellers and of product homogeneity imply that the individual firm in pure

competition is a price taker: its demand curve is infinitely elastic, indicating that the firm can sell any amount of

output at the prevailing market price. Since the share of the firm from the market supply is too small to affect

the market price, the only thing that the firm can do is to sell any quantity demand at the ongoing market price.

Thus, the demand curve that an individual firm faces is a horizontal line.

1

�Market P

P=AR=MR

Out put

Fig 5.1 the demand curve indicates a single market price at which the firm can sell any amount of the

commodity demanded. The demand curve also indicates the average revenue and marginal revenue of the firm.

3. Free entry and exit of firms

There is no barrier to entry and exit from the industry. Entry or exit may take time, but firms have freedom of

movement in and out of the industry. If barriers exist the number of firms in the industry may be reduced so that

one of them may acquire power to affect the market price.

4. The goal of all firms is profit maximization.

Of course, firms can have different objectives. Some firms may have the aim of making their product wise,

others may want to maximize their sales even by cutting price, etc. But, in this model, it is assumed that the goal

of all firms is to maximize their profit and no other goal is pursued.

5. No government regulation

By assumption, there is no government intervention in the market. That is there is no tax, subsidy etc. A market

structure in which all the above assumptions are fulfilled is called pure competition. It is different from perfect

competition which requires the fulfillment of the following additional assumptions.

6. Perfect mobility of factors of production

Factors of production (including workers) are free to move from one firm to another through out the economy.

Alternatively, there is also perfect competition in the market of factors of production.

7. Perfect knowledge

It is assumed that all sellers and buyers have a complete knowledge of the conditions of the prevailing and

future market. That is all buyers and sellers have complete information about.

ÂThe price of the product

ÂQuality of the product etc

Thus, a perfectly competitive market is a market which satisfies all the above conditions (assumptions). In

reality, perfectly competitive markets are scarce if not none. But since the theory of perfectly competitive

market helps as a bench mark to analyze the more realistic markets, it is very important to study it.

2

� Given the above assumptions (based which the model of perfect competition was built), we will now examine

how the firm operating in such a market determines the profit maximizing out put both in the short run and in

the long run. But to determine the profit maximizing output, first we have to see what the revenue and cost

functions of the firms operating in perfectly competitive market looks like.

Costs under perfect competition

In the previous chapter, we have said that the per unit cost (AVC &AC) have U –shape due to the law of

variable proportions (in the short run) and the law of returns to scale (in the long run). There is no exception for

firms operating under perfect competition i.e., their cost functions have the behavior mentioned in the last

chapter.

Demand and revenue functions under perfect competition

Due to the existence of large number of sellers selling homogenous products, each seller is a price taker in

perfectly competitive market. That is, a single seller cannot influence the market by supplying more or less of a

commodity.

If, for example, the seller charges higher price than the market price to get larger revenue, no buyers will buy

the product of this ( the price raising) firm since the same product is being sold in the market at lower price by

other sellers. Obviously, the firm will not also attempt to reduce the price. Thus firms operating in a perfectly

competitive market are price takers and sell any quantity demanded at the ongoing market price.

Hence, the demand function that an individual seller faces is perfectly elastic ( or horizontal line).

Graphically,

P

_ P

P

Fig 5.2 the demand curve that a perfectly competitive firm faces is horizontal line with intercept at the market price.

This indicates that sellers sell any quantity demanded at the ongoing market price and buyers buy any amount they

want at the ongoing market price.

3

� From the buyers’ side too, since there is large number of buyers in the market, a single buyer can not influence the

market price.

Thus, in perfectly competitive market, both buyers and sellers are price takers. They take the price determined by the

forces of market demand and market supply.

Given the horizontal demand function at the ongoing market price, the total revenue of a firm operating under

perfect competition is given by the product of the market price and the quantity of sales, i.e.,

TR = P*Q

Since the market price is constant at P*, the total revenue function is linear and the amount of total revenue depends

on the quantity of sales. To increase his total revenue, the firm should sell large quantity.

Graphically, the TR curve is as shown below.

TR

_

TR=PQ

Fig 5.3 the total revenue of firm operating in a perfectly competitive market is linear (and increasing function)

of the quantity of sales.

The marginal revenue (MR) and average revenue (AR) of a firm operating under perfect competition are equal to the

market price. To see this, let’s find the MR and AR functions from TR functions.

TR= PQ

By definition, MR is the change in total revenue that occurs when one more unit of the output is sold, i.e.

dTR

MR= =P

dQ .Hence MR=P

TR P . Q

AR= = =P

Average revenue is the TR divided by the quantity of sales. i.e. Q Q Hence, AR = P.

4

�Graphically, the demand curve represents the MR and AR of the firm

P= AR = MR

Fig: 5.4 the AR curve, MR curve and the demand curve of an individual firm operating under perfectly

competitive market overlap.

5.3 Short run equilibrium of the firm

A firm is said to be in equilibrium when it maximizes its profit (Õ). Profit is defined as the difference between

total cost and total revenue of the firm:

Õ= TR-TC

Under perfect competition, the firm is said to be in equilibrium when it produces that level of output which

maximizes its profit, given the market price. Thus, determination of equilibrium of the firm operating in a

perfectly competitive market means determination of the profit maximizing output since the firm is a price

taker.

The level of output which maximizes the profit of the firm can be obtained in two ways:

Ì Total approach

Ì Marginal approach

Total approach

In this approach, the profit maximizing level of output is that level of output at which the vertical distance between

the TR and TC curves is maximum. (Provided that the TR curve lies above the TC curve at this point).

5

�Graphically TR TC

TC,TR

Q0 Qe Q1

e

Fig:5.5 The profit maximizing output level is Q because it is at this output level that the vertical distance between

the TR and TC curves (or profit) is maximum.

For all output levels below Q0 and above Q1 profit is negative because TC is above TR.

Marginal Approach

In this approach the profit maximizing level of output is that level of output at which:

MR=MC and

MC is increasing

This approach is directly derived from the total approach. In figure 4.4, the vertical distance between the TR and

TC curve is maximum where a straight line parallel to the TR curve is tangent to the TC curve. Or simply, the

vertical distance between the TC and TR curves is maximum at output level where the slope of the two curves is

equal. The slope of the TR curve constant and is equal to the MR or market price.

Similarly, the slope of the TC curve at a given level of output is equal to the slope of the tangent line to the TC curve

at that level of output, which is equal to MC. Thus the distance between the TR and TC curves ( Õ) is maximum

when MR equals MC.

6

�Graphically, the marginal approach can be shown as follows.

MC, MR

MC

MR

Q* Qe

Fig 5.6: the profit maximizing output is Qe, where MC=MR and MC curve is increasing. At Q*, MC=MR, but since

MC is falling at this output level, it is not equilibrium output. For all output levels ranging from Q* to Qe the

marginal cost of producing additional unit of output is less than the MR obtained from selling this output. Hence the

firm should produce additional output until it reaches Qe.

Mathematical derivation of the equilibrium condition

Profit (Õ) = TR-TC

TC is a function of output, TC=f (Q)

TR is also a function of output, TR=f (Q)

Thus, profit is a function of output, Õ=f (Q)

Õ= TR-TC

To determine the profit maximizing output we find the first derivative of the Õ function and equate the result to

zero.

d ∏ dTR dTC

= − =0

dQ dQ dQ

= MR – MC = 0

= MR = MC ----------------------------------- (First order condition necessary condition)

The equality of MC and MR is a necessary, but not sufficient condition. The sufficient condition for maximization

of II is that the second derivative of the II function should be less than zero (or negative) i.e.

d2 ∏ d 2 TR d 2 TC

<0 − <0

dQ2 Ú dQ 2

dQ 2

7

�d 2 TR dMR d 2 TR

= , thus

dQ 2 dQ dQ2 is the slope MR. Since MR is horizontal (or constant), the slope of MR is equal to

zero.

d 2 TC dMC d 2 TC

Like wise, dQ 2 is equal dQ and thus, dQ

2

is the slope of MC, which is not constant

d 2 TR d2 TC

2

<

Thus, dQ dQ2 means

- Slope of MR < Slope of MC

- 0 < Slope of MC or

- Slope of MC > 0 or

- Mc is increasing………………. Sufficient condition

Thus, the condition for profit maximization under perfect competition is

MR= MC………………….necessary condition and

MC is increasing…………. sufficient condition

Conceptually, maximizing the difference between TR & TC means maximizing the area between the MR and MC

curve, i.e., maximizing ∫ (MR-MC)dQ. And the area between the MC and MR would be maximal only when the

firm produces Qe level of output.

The fact that a firm is in the short run equilibrium does not necessarily mean that the firm gets positive profit.

Whether the firm gets positive or zero or negative profit depends on the level of ATC at equilibrium thus;

- If the ATC is below the market price at equilibrium, the firm earns a positive profit equal to the

area between the ATC curve and the price line up to the profit maximizing output (see

fig5.7below)

MC

AC

P MR

Profit

C

Qe Q

8

� Fig 5.7 the firm earns a positive profit because price exceeds AC of production at equilibrium

- If the ATC is equal to the market price at equilibrium, the firm gets zero Õ.

- If the ATC is above the market price at equilibrium, the firm earns a negative profit (incurs a loss)

equal to the area between the ATC curve and the price line.( see fig 5.8 below).

C,P

AC

MC

C

P loss

MR

Qe

Fig 5.8 a firm incurs a loss because price is less than AC of production at equilibrium.

In this case, you may ask that “why do the firm continue to produce if it had to incur a loss?”

However, if the market price falls below the AVC or alternatively, if the TR of the firm is not sufficient to cover at

least the total variable cost, the firm should close (shut down) its factory (business). It will only lose the fixed costs;

but if it continues operation while the TR is unable to cover even the variable costs, the loss is greater than the fixed

costs since part of the variable cost is also not covered by the existing revenue.

To summarize, a firm may continue production even while incurring a loss (when TC > TR). This occurs as far as the

TR is able to cover at least the TVC (TR > TVC). If the TR is less than the TVC, the firm is well advised to

discontinue its operation so that the loss will be minimized. Hence, to continue its operation (or just to stay in the

business) the firm should obtain the TR which can at least cover its variable costs. The following example will make

the discussion clear.

Example:

Suppose a firm has a TFC of $2,000, a TVC of $ 5,000 and a TR of $6,000 at equilibrium. Should the firm stop its

operation? Why?

9

�In fact the firm is incurring a loss of $ 1,000 because TC (2,000 + 5,000=7,000) is greater than the total revenue. But

the firm should continue production because the TR is greater than TVC. If the firm stops operation, it will lose the

fixed cost ($ 2.000). But if it continues production the loss is only $ 1,000 (TR-TC). Thus, the firm requires a

minimum TR of $ 5,000 to continue operation. If the TR is equal to $ 5,000, the firm is indifferent in between

choosing to continue or to discontinue its operations because in both cases the loss is equal to fixed costs. Thus the

level output at which TR and TVCs are equal is called shut down output level. In other words, shut down point is the

point at which AVC equals the market price.

Equally important point is the point of break-even. Break-even point is the out put level at which market price is equal

to the average cost of production so that the firm obtains only normal profit (zero profit).

Numerical example

Suppose that the firm operates in a perfectly competitive market. The market price of his product is$10. The firm

estimates its cost of production with the following cost function:

TC=10q-4q2+q3

A) What level of output should the firm produce to maximize its profit?

B) Determine the level of profit at equilibrium.

C) What minimum price is required by the firm to stay in the market?

Solution

Given: p=$10

TC= 10q - 4q2+q3

A) The profit maximizing output is that level of output which satisfies the following condition

MC=MR &

MC is rising

Thus, we have to find MC& MR first

MR in a perfectly competitive market is equal to the market price. Hence, MR=10

dTR

MR=

Alternatively, dq where TR= P.q = 10q

d (10 q )

MR= =10

Thus, dq

dTC d (10 q−dq 2 +q 3 )

= =10−8 q+3 q2

MC= dq dq

To determine equilibrium output just equate MC& MR

And then solve for q.

10

� 10 – 8q + 3q2 = 10

- 8q + 3q2 = 0

q (-8 + 3q) = 0

q = 0 or q = 8/3

Now we have obtained two different output levels which satisfy the first order (necessary) condition of

profit maximization

i.e. 0 & 8/3

To determine which level of output maximizes profit we have to use the second order test at the two output levels

i.e. we have to see which output level satisfies the second order condition of increasing MC.

To see this first we determine the slope of MC

dMC

Slope of MC = dq = -8 + 6q

ö At q = 0, slope of MC is -8 + 6 (0) = -8 which implies that marginal lost is decreasing at q = 0. Thus,

q = 0 is not equilibrium output because it doesn’t satisfy the second order condition.

ö At q = 8/3, slope of MC is -8 + 6 (8/3) = 8, which is positive, implying that MC is increasing at q =

8/3

Thus, the equilibrium output level is q = 8/3

B) Above, we have said that the firm maximizes its profit by producing 8/3 units. To determine the firm’s

equilibrium profit we have calculate the total revenue that the firm obtains at this level of output and the total cost of

producing the equilibrium level of output.

TR = Price * Equilibrium out put

= $ 10 * 8/3= $ 80/3

TC at q = 8/3 can be obtained by substituting 8/3 for q in the TC function, i.e.,

TC = 10 (8/3) – 4 (8/3)2 + (8/3)3 » 23.12

Thus the equilibrium (maximum) profit is

Õ = TR – TC

= 26.67 – 23.12 = $ 3.55

11

�c) To stay in operation the firm needs the price which equals at least the minimum AVC. Thus to determine the

minimum price required to stay in business, we have to determine the minimum AVC.

AVC is minimal when derivative of AVC is equal to zero

dAVC

That is: dQ = 0

Given the TC function: TC = 10q – 4q2 +q3, there is no fixed cost i.e. TC is equal to the TVC.

Hence, TVC = 10q – 4q2 + q3

TVC 10 q−4 q2 +q3

AVC = q = q = 10 – 4q2 + q2

dAVC d (10−4 q+q2 )

=0 =0

dq dq

= -4 + 2q = 0

q = 2 i.e. AVC is minimum when output is equal to 2 units.

The minimum AVC is obtained by substituting 2 for q in the AVC function i.e., Min AVC = 10 – 4 (2) + 22 = 6

Thus, to stay in the market the firm should get a minimum price of $ 6.

5.4 The long-run Equilibrium

1-Equilibrium of an individual firm in the long run

In the long run, firms are in equilibrium when they have adjusted their plant size so as to produce at the minimum

point of their long run Ac curve, which is tangent (at this point) to the demand curve defined by the market price.

That is, the firm is in the long run equilibrium when the market price is equal to the minimum long run AC. Thus

since price is equal to long run AC (LAC now on) at the long run equilibrium, firms will be earning just normal

profits (zero profits), which are included in the LAC. Firms get only normal profit in the long run due to two

reasons.

First, if the firms existing in the market are making excess profits (the market price is greater than their LACs) new

firms will be attracted to the industry seeking for this excess profit. The entry of new firms results in two

consequences:

A. The entry of new firms will lead to a fall in market price of the commodity (which is shown by the down ward

shift of the individual demand curve). This happens because entry of new firms will increase the market supply of

the commodity (which is shown by the right ward shift of the industry supply), resulting in the lower market price.

Moreover, if firms are getting excess profit, they have an incentive to expand their capacity of production, which

increases the market supply and then reduces the market price.

B. Moreover, the entry of new firms results in an upward shift of the cost curves. This happens because, when new

firms enter into the market the demand for factors of production increases which exerts an upward pressure on the

12

� prices of factors of production. An increase in the price of factors of production in turn shifts the cost curves

upward. These changes (decrease in the market price and upward shift of the cost curves) will continue until the

LAC becomes tangent to the demand curve defined by the market price. At this time, entry of new firms will stop

since there is no positive profit (since P = LAC) which attracts new firms in to the market.

Second, if the firms are incurring losses in the long run (P < LAC) they will leave the industry (shut down). This

will result in higher market price (because market supply of the commodity decreases) and lower costs (because the

market demand for inputs decreases as the number of firms in the market decreases). These changes will continue

until the remaining firms in the industry cover their total costs inclusive of the normal rate of profit.

Thus, due to the above two reasons, firms can make only a normal profit in the long run.

The following figure shows how firms adjust to their long run equilibrium position excess profit ( higher price than

minimum lack) if the market price is p, the firm is making excess profit working with plant size whose cost is

denoted by SAC, ( short run average cost1). It will therefore have an incentive to build new capacity or larger plant

size and it moves along its LAC. At the same time new firms will be entering the industry attracted by the excess

profits. As quantity supplied in the market increases(by the increased production of expanding old firms and by the

newly established ones) the supply curve in the market will shift to the right and price will fall until it reaches the

level of P1, at which the firms and the industry are in the long- run equilibrium.

P P

Market

LAC

Supply SMC1

LMC

New Market SAC1

Supply SMC2 SAC2

P Pe

Pe

P1

P1

P1 Market

Demand

Q Q

Qe Qe

Fig5.9: Long run equilibrium of the firm. Entry of new firms reduces the market price from p to p 1 (in panel A) and

the long run equilibrium is established at E (panel B).

The condition for the long run equilibrium of the firm is that the long run marginal cost (LMC) should be equal to

the price and to the LAC i.e. LMC = LAC = P.

13

�The firm adjusts its plant size to so as to produce that level of output at which the LAC is the minimum possible,

given the technology and prices of inputs. At equilibrium the short – run marginal cost is equal to the long run

marginal cost and the short –run average cost is equal to the long run average cost. Thus, given the above condition,

we have,

SMC = LMC = SAC = LAC = P = MR

This implies that at the minimum point of the LAC the corresponding short run plant is worked at its optimal

capacity so that the minimum of the LAC and SAC coincide.

Long run shut down decision

In the short-run the firm should continue production as far as the market price is greater than the minimum AVC, If

the market price falls below the minimum AVC, the firm is well advised to shut down because if it shut down it well

loose only the fixed costs but if it continues production the loss is greater than the fixed cost.

The long-run shut down decision (point) is different from that of the short run. The firm shuts down if its revenue is

less than its avoidable or a variable cost. In the long run all costs are variable because the firm can change the

quantity of all inputs. Thus, in the long run the firm shuts down when its revenue falls below the long run total cost.

In other words, in the long run shut down decision occurs if the market price falls below the minimum LAC of the

firm.

The long-run supply curves the firm

Previously, we have noted that in the long run the firm shuts down if the market price is below the its minimum long

run average cost. Thus, the firm will not supply for all price levels below the minimum LAC. On the other hand, the

firm's long run equilibrium output is defined by the equality of the MR and its LMC. As a result, a firm’s long- run

supply curve is its LMC curve above the minimum of its long-run average cost curve.

Long run supply curve of the industry

The long run supply curve of the industry is the horizontal sum of the supply of individual firms just like the case of

short run supply curve of the industry. Thus, the long run supply curve of the industry is up ward sloping, provided

that the firms are of different size. This is because, firms with relatively lower minimum LAC, are writing to inter

the market than others. So that as the market price increased in the long run more firms will find it profitable to inter

the market, resulting in upward sloping long-run supply curve of industry.

14

� Long-run equilibrium of the industry

An industry is in the long-run equilibrium when the price is reached at which all firms are in equilibrium. That is,

when all firms are producing at the minimum point of their LAC curve and making just normal profits, the industry

is said to be in the long-run equilibrium. Under these conditions there is no further entry or exit of firms in the

industry (since all the firms are getting only normal profit), so that the industry supply remains stable.

The long-run equilibrium of the industry is shown by fig 5.13.At the market price, P, the firms produce at their

minimum LAC, earning just normal profits. At this price all firms are in equilibrium because

LMC=SMC=P=MR and they get only normal profit because LAC=SAC=P.

P P

Industry ss LAC

SMC LMC

SAC

P=Me

Pe Pe

Market dd

Q

Qe Qe

Q

Industry equilibrium Firm’s equilibrium

Fig5.10: long-run equilibrium of the industry is defined by the price at which all individual firms are in equilibrium,

marking just normal profit.

While the industry is in the short run equilibrium, we have seen that, individual firms can earn positive, normal or

negative profits depending on the level of their AC s relative to the equilibrium market price. However, this is not

the case in the long-run. That is, while the industry is in the long run .equilibrium all firms earn only normal profit.

15