0% found this document useful (0 votes)

272 views13 pagesMidterm Exam

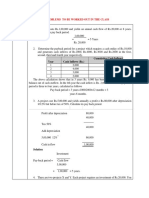

The document is a midterm exam for a Finance course, consisting of multiple-choice questions, practice problems related to coupon bonds, and essay questions discussing financial systems and government financing. It covers topics such as the functions of money, financial markets, public finance, and the relationship between assets and liabilities. The exam is structured into three parts, with a total of 6 marks for multiple-choice questions and additional marks for practice and essay questions.

Uploaded by

26a4030569Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

272 views13 pagesMidterm Exam

The document is a midterm exam for a Finance course, consisting of multiple-choice questions, practice problems related to coupon bonds, and essay questions discussing financial systems and government financing. It covers topics such as the functions of money, financial markets, public finance, and the relationship between assets and liabilities. The exam is structured into three parts, with a total of 6 marks for multiple-choice questions and additional marks for practice and essay questions.

Uploaded by

26a4030569Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 13