0% found this document useful (0 votes)

4 views5 pagesPowerPoint Notes

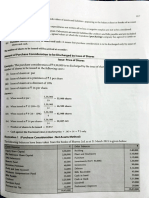

The document outlines the process of recording depreciation and disposing of non-current assets, including scenarios for fully and partially depreciated assets. It details journal entries for discarding assets, recognizing losses or gains on disposal, and the treatment of sales of plant assets based on their book value. Key points emphasize the importance of calculating depreciation prior to disposal and the classification of losses or gains as non-operating activities in financial statements.

Uploaded by

lemenku738Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

4 views5 pagesPowerPoint Notes

The document outlines the process of recording depreciation and disposing of non-current assets, including scenarios for fully and partially depreciated assets. It details journal entries for discarding assets, recognizing losses or gains on disposal, and the treatment of sales of plant assets based on their book value. Key points emphasize the importance of calculating depreciation prior to disposal and the classification of losses or gains as non-operating activities in financial statements.

Uploaded by

lemenku738Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 5