0% found this document useful (0 votes)

30 views21 pagesSimulation

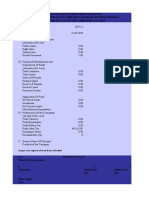

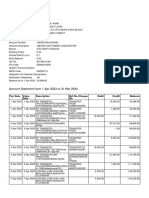

The balance sheet and profit & loss statement for the fiscal years ending March 2023 and March 2022 show no recorded assets, liabilities, or revenues, indicating a lack of financial activity. Key financial ratios such as ROCE, RONW, and others are marked as #DIV/0!, suggesting that calculations cannot be performed due to the absence of data. The document also includes projections and illustrative examples for future earnings and valuations, but all values remain undefined.

Uploaded by

chandninhemsecuritiesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

30 views21 pagesSimulation

The balance sheet and profit & loss statement for the fiscal years ending March 2023 and March 2022 show no recorded assets, liabilities, or revenues, indicating a lack of financial activity. Key financial ratios such as ROCE, RONW, and others are marked as #DIV/0!, suggesting that calculations cannot be performed due to the absence of data. The document also includes projections and illustrative examples for future earnings and valuations, but all values remain undefined.

Uploaded by

chandninhemsecuritiesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 21