0% found this document useful (0 votes)

28 views7 pagesUnit 4 Notes

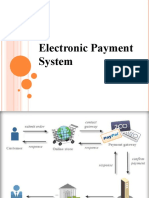

The document discusses Electronic Payment Systems (EPS), which facilitate online transactions through various protocols such as SSL/TLS, SET, and 3D Secure, ensuring secure and efficient fund transfers. It also covers Electronic Fund Transfer (EFT) methods, including direct deposits and wire transfers, highlighting their convenience and security measures. Additionally, it explores payment methods in the digital economy, including electronic cash, e-cheques, and credit cards, each with unique characteristics, advantages, and challenges.

Uploaded by

navgirevinitCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

28 views7 pagesUnit 4 Notes

The document discusses Electronic Payment Systems (EPS), which facilitate online transactions through various protocols such as SSL/TLS, SET, and 3D Secure, ensuring secure and efficient fund transfers. It also covers Electronic Fund Transfer (EFT) methods, including direct deposits and wire transfers, highlighting their convenience and security measures. Additionally, it explores payment methods in the digital economy, including electronic cash, e-cheques, and credit cards, each with unique characteristics, advantages, and challenges.

Uploaded by

navgirevinitCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 7