0% found this document useful (0 votes)

33 views4 pagesFundamental Analysis

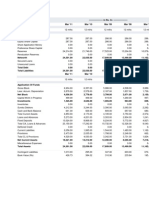

The document presents a comprehensive overview of profitability, liquidity, activity, investment, and capital structure ratios for a company from 2016 to 2019. Key highlights include an increase in gross profit ratio and net profit to turnover, while liquidity ratios show a slight decline. Additionally, the document provides detailed financial metrics such as earnings per share and debt to equity ratio, indicating the company's financial health over the years.

Uploaded by

Muhammad JunaidCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

33 views4 pagesFundamental Analysis

The document presents a comprehensive overview of profitability, liquidity, activity, investment, and capital structure ratios for a company from 2016 to 2019. Key highlights include an increase in gross profit ratio and net profit to turnover, while liquidity ratios show a slight decline. Additionally, the document provides detailed financial metrics such as earnings per share and debt to equity ratio, indicating the company's financial health over the years.

Uploaded by

Muhammad JunaidCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 4