0% found this document useful (0 votes)

232 views14 pagesNike DCF Model

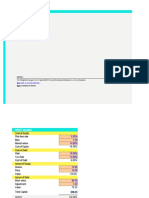

The document provides an overview of Chipotle's financial situation, including a bullish outlook based on digital sales growth and expansion opportunities, alongside concerns about rising costs and competition. It includes detailed financial projections, valuation metrics, and a discounted cash flow analysis for Nike Inc., showing an intrinsic value close to its current market price. Additionally, it offers resources for further learning and engagement in investment banking and financial modeling.

Uploaded by

Ronel FernandesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

232 views14 pagesNike DCF Model

The document provides an overview of Chipotle's financial situation, including a bullish outlook based on digital sales growth and expansion opportunities, alongside concerns about rising costs and competition. It includes detailed financial projections, valuation metrics, and a discounted cash flow analysis for Nike Inc., showing an intrinsic value close to its current market price. Additionally, it offers resources for further learning and engagement in investment banking and financial modeling.

Uploaded by

Ronel FernandesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 14