Comprehensive Report for Smallcase

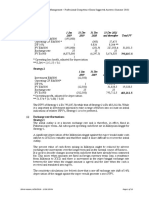

Financial Overview Smallcase's financial path is one of high growth accompanied by

persistent net losses. The top line of the company doubled more than twice in FY2023–24 to

approximately ₹67–75 crore (up from ~₹42 crore in FY22–23). This expansion was

accompanied by a massive decrease in loss, with net loss declining by approximately 74%

year-on-year to about ₹34 crore in FY24. Although this has increased, Smallcase is still not

profitable with an FY24 EBITDA margin of around -41%, or ₹1.60 to generate ₹1 of revenue.

The significant skew towards transaction fees, which are reliant to a great extent on trading

volumes, and a comparitively modest number of paying users still provide profitability

headwinds. Employee benefit costs accounted for ~65% of overall expenses (₹70 crore in

FY24) and were cut ~16%, and marketing expenditure was brought down by ~75%.

Monetization Challenges

Smallcase's revenue model hinges largely on transaction-based volume-driven fees,

representing about 85% of operating FY24 revenues, and limited platform subscriptions.

Platform fees alone accounted for a mere ~39% of FY23 revenues, underlining struggles to

convert consumers into premium-paid subscriptions. Subscriptions are normal in the few

thousands of rupees, hence active paying subscriber numbers are kept low at tens of

thousands only, a minor fraction of 10+ million registered users. Smallcase needs to

improve monetization considerably, potentially needing to triple existing fee levels or

broaden revenue sources in order to achieve break-even

Monetization Strategies: The idea is for smallcase to utilize its 3 way platform

dynamics and monetize few of its constituents. It can be done by monetizing the

supply side as they demand the money being brought in by the users, or the users

themselves who may opt for higher quality on platform beyond building the trust in

platform

Option A: Monetizing Advisors

Fee Structure: Remove the initial investment fee cap, converting it to INR 100 or 1.5% of

investment, whichever is higher, to match advisory efforts and client conviction.

Rationale: Investment journey follows a distinct pattern: Initial high engagement during

account setup and early decisions, followed by a passive monitoring phase. This presents

unique opportunities for platform engagement at different lifecycle stages. Since effort,

conviction and desire is high at initial level, it presents a chokepoint that should be

monetized differently than the rest of the lifecycle. At a Discount rate of 25%, a INR 10/mth

charge on SIP becomes 500 on lifetime basis or INR 175 on 2 year life of SIP. Increassing the

initial entry fees by this amount can show a higher result if SIP fee is rejigged to free on

lifetime basis, making sure people have incentive to enter for the long term. A higher entry

�fee can be monetized from advisors in term of first time transaction commissions from

advisors, that flow into smallcase.

Treatment of Top Smallcases: Higher fees for consistently outperforming smallcases. High

tier small cases in the sense of consistent perform per the theme, or at alpha against the

indices for a sustained duration can command higher fees as a mark of better returns and

sustainable returns which people would wish to pay for. The investment advisor's

incentives are further aligned in this case to seek better sustained returns in order to get a

higher fee on the same AUM. the investment advisor and the platform and the user all

benefit from this differentiation.

Ad Economy on Advisors: Provide advertising opportunities on the platform.

Seach/smallcase finder will have option for advisors to advertise their smallcase basis

relevance, searching user's own risk profile and filters used. Targeted advisor exposure

directly linked to client acquisition. Show Ads for advisors that wish to pay for listing their

smallcase higher.

Tax Planner/Minimizer: Bundled tax planning service with tax statements. the user

knows how out of balance the portfolio is, smallcase provides the option to chose investing

in the smallcase in such a manner that it either closes the gap on the target weightage or

balances it perfectly at the time of investment(done at each X number of SIPs).

Give additional Lumpsum option instead of switching by showing it as tax efficient (done at

each SIP).

Offer switches or rebalances basis the 1.25 lakh LTCG limit on investments that have

crossed the year mark (can be done quarterly or semi-annually).

strategically rebalance short term investments so that booked losses set off booked gains

(can be done quarterly or semi-annually)

Unified Tax statement across all demat accounts (For all Smallcase investors)

Advisor Rationale: Provides actionable tax optimization and solves issues for those who do

active rebalancing

Option B: Monetizing Users

Fee Structure: Remove initial investment fee cap to reflect user willingness to pay.

Investment journey follows a distinct pattern: Initial high engagement during account setup

and early decisions, followed by a passive monitoring phase. This presents unique

opportunities for platform engagement at different lifecycle stages. Since effort, conviction

and desire is high at initial level, it presents a chokepoint that should be monetized

differently than the rest of the lifecycle

At a Discount rate of 25%, a INR 10 charge on SIP becomes 500 on lifetime basis or INR 175

on 2 year life of SIP. Increasing the initial entry fees by this amount can show a higher result

�if SIP fee is rejigged to free on lifetime basis, making sure people have incentive to enter for

the long term.

A higher entry fee can be monetized from advisors in term of first time transaction

commissions from advisors, that flow into smallcase.

User Rationale: High willingness to pay during initial investment.

Treatment of Top Smallcases: Place premium smallcases behind paywalls. High tier small

cases in the sense of consistent perform per the theme, or at alpha against the indices for a

sustained duration can be kept behind a paywall, i.e. smallcase subscription as access to top

advisors, as a mark of better returns and sustainable returns which people would wish to

pay for. The investment advisor's incentives are further aligned in this case as it invites

people who have better CLVs and investment amounts to their smallcase on which they

make better advise fee. In this model, the advise fee model will need to change on a small

percentage base +fix fee model to incentivise the advisors. the investment advisor and the

platform and the user all benefit from this differentiation.

Add on content creation by advisors: Premium investment advisor perform additional

content creation to assure investors. i.e. the investment advisors are given tools on the

platform to engage with their audience by giving explanatory notes, issuing videos and

doing AMAs in sealed question seminars. Quality of seminars can also become part of

advisor rating and further act as assurance on better investment philosophy adopted by the

end user as against going directly to market

User Rationale: Enhances perceived premium value.

Showcase premium offering in search listings/comparisons: Highlight top-performing

advisors organically. In between the listings, tactically place a premium smallcase with

better KPI metrics as are currently visible in the view for users. This acts as Call to action

for people to convert to a paid plan

User Rationale: Maintains trust through unbiased recommendations instead of ads

Tiering Advisors: Implement performance-based advisor tiers. Limit advisor fees across

tiers. Tiers are made using ratings, performance against specific metrics that are being used

to judge whether a smallcase is premium or not. At specific performance levels or efforts

required to execute the research on the idea, the advisor will self select on the performance

to reach a specific tier which awards them with a possibility to charge a higher subscription

charge. For example, a momentum investing smallcase is charging INR3000 per quarter or

INR 8000/year. This fee values are capped by the platform and are only increased if certain

user satisfaction metrics go up for the advisor.

User Rationale: Provides transparency and informed advisor selection.

Tax Planner/Minimizer: Basic tax statements free; premium personalized tax planning in

subscription-based. To provide a higher quality of offering to paid subscribers, feature that

�allow one to auto minimize the tax incidence by orchestrating lumpsum investments and

tactical divestments to rebalance portfolio that do not invite Long term capital gains, or net

off short term capital gains with short term capital losses

All users get to see full statement across all transactions across all brokerage platforms

which enhances their lock in with the platform (i.e. they use Smallcase for unified view,

even if they transacted elsewhere)

Free users are encouraged to transact on the platform. The tax view is unlocked only after

they have transacted on the platform atleast once a year or have an ongoing SIP

User Rationale: Incentivizes subscription upgrades.

Marketing Initiatives for User Growth

Corporate Reachouts: Offer Smallcase services integrated with payroll as employee

benefits.

Gamified Risk Analyzer: Engaging risk assessment tools to educate users. This does not

look at past transaction as most investors are profit seeking in behavior and do not

understand risk. Instead, Smallcase develops inhouse tool on risk appetite identification

basis a large questionnaire that can do granular risk appetite identification. It can have

gamification built in (e.g. flip a coin win 400%, lose 50% vs guaranteed 2x. Then ask at what

point will they prefer the gamble or at what point/value they prefer the guaranteed

reward). The idea is for smallcase to bring to the users a true realization how risk averse or

risk seeking they are.

Portfolio Benchmark: Allow portfolio performance benchmarking against peers in the

same risk profile. In case going the user monetization way, show premium vs non premium

(or premium users generate X% more alpha)

Goals-Based Planner: Automate SIP recommendations based on financial goals. This

calculates SIP for goals that are input by user and then picks recommended smallcase basis

user risk profile and investment horizon

Financial Goals Calculator: Personalized SIP planning based on income and goals.

Determine your SIP requirements basis your income, future goals and target retirement age.

Find the best corpus amount and compare current SIP vs desired SIP across investment

categories

Change in Fee Settlement for Tax Efficiency

Settle fees directly through brokerage accounts to enhance user tax efficiency, potentially

improving adoption despite an increase in receivables cycle length.

If Fees like SIP fee,initial fee if they are charged by brokers, then they become tax deductible

at the time of calculating gains/losses. Brokers will claim additional income and an

�additional expense (payout to smallcase) so they will not contract additional tax while users

are benefitted. Smallcase may increase their days receivable because of this

Additional Product Offerings and Monetization Strategies

Clearly align triggers for insurance and personal loan user identification with specific

investment behaviors. Integrate financial products seamlessly into goal-setting and

financial planning tools to enhance conversion. Here are potential offerings that smallcase

can offer on platform as a redirect to partner platforms, or in some cases handling them

inhouse.

Handoff to other players:

-Medical & Life Insurance: Conversion commissions based on user investment behavior

and demographics.

-Life Event Investments & NPS Accounts: Integrated into goal-based planning for

enhanced engagement.

Peer-to-Peer Loans & Personal Loans: Earn commissions through user conversion;

identify through financial behavior analytics.

Handle inhouse:

Digital Gold: Monetize through small transaction fees; identify potential investors via

existing transaction data and investment patterns.

US and Global offerings: Expanding into US and international FOFs can significantly

diversify Smallcase’s offerings and attract a broader user base. This includes facilitating

Indian users' investments in global markets, leveraging global trends towards international

portfolio diversification. Smallcase can solve the issues with discovery where people do not

know stocks beyond MAANG/Nvidia etc. but risk appetite exist for global investments.

Regular Mutual funds smallcases: Smallcase can earn commissions from advisors who

recommedn the mutual fund basket. The advisors earn the commission on regular funds

while small case takes monthly fee from advisors for all SIPs basis AUM added and

commission earned by advisors. This is like smallcase is built on top of many Dezerv like

advisors who pay fee to smallcase

App Enhancements and User Experience

The idea behind tech improvements is easing CAC as well as improving retention by

improving UI, besides offering a larger product base to keep the user inhouse on app. (Few

are mentioned as part of marketing strategy as well)

Gamified Risk Analyzer: that does not look at past transaction as most investors are profit

seeking in behavior and do not understand risk. Instead, Smallcase develops inhouse tool on

risk appetite identification basis a large questionnaire that can do granular risk appetite

identification. It can have gamification built in (e.g. flip a coin win 400%, lose 50% vs

�guaranteed 2x. Then ask at what point will they prefer the gamble or at what point/value

they prefer the guaranteed reward)

Automated Portfolio Rebalancer (Available on Ticker, the paid plan)

Family based investing (switching cost) = combined dashboard on smallcase app

Goal based investing- calculates SIP for goals that are input by user and then picks

recommended smallcase basis user risk profile and investment horizon

Compare multiple smallcases against KPIs Benchmark user portfolio performance

against all smallcase users in that risk profile.

Financial goals calculator: Determine your SIP requirements basis your income, future

goals and target retirement age. Find the best corpus amount and compare current SIP vs

desired SIP across investment categories

Backward integration (in both options A & B)

When Smallcase achieves sustained user stickiness and continued growth, backward

integration should be considered. This strategic move involves becoming a full-service

brokerage or merging with an existing brokerage to internalize brokerage activities.

Benefits include significant savings on brokerage fees, enhanced control over customer

experience, and increased cross-selling opportunities.

OPTION C. Syndication of Broker Trades

Envelope brokers by being a platform through which trades are syndicated and presented

to those brokers who provide the best rate for the execution of the trades, thereby

providing best rates to the customers. Be the Uber of stock market and the Amazon of

investment Vehicles.

The Broker Syndication Model is a novel approach wherein Smallcase acts as a brokerage

aggregator, essentially turning the traditional brokerage model on its head. Rather than

executing trades or passing them through a sole brokerage partner, Smallcase would be an

aggregator marketplace or platform that sends user orders to multiple partner brokerages.

The brokers would then be in a competitive position to execute trades, thus encouraging

competitive pricing, service improvement, and perhaps better execution quality.

This model is basically the old "Payment for Order Flow (PFOF)" model in reverse: rather

than a brokerage receiving payments from market makers for routing trades, Smallcase

would allow brokerages themselves to compete to get trade execution flow from users,

effectively reversing the payment dynamic

�How It Works (Operational Flow)

User initiates trade:

A Smallcase user places an order (buy/sell) through the Smallcase platform, either as part

of a smallcase basket or potentially individual securities in the future.

Broker competition:

The order is transparently made available to several partner brokerages. Brokers would

instantly offer competitive quotes, fees, or execution terms (such as the lowest fees, best

execution price, fastest execution).

Dynamic order routing:

Smallcase’s automated system evaluates these competitive offers in real-time, selecting the

optimal broker based on predefined criteria (best price, lowest fee, fastest execution).

Order execution:

The order is routed to the selected broker, executed seamlessly, and confirmed back to the

user through the Smallcase platform.

Revenue Generation:

Instead of charging users directly for transactions (or possibly in addition to minimal direct

charges), Smallcase earns revenue through broker commissions—receiving fees from

brokers that secure the trade execution.

Benefits to Smallcase

New revenue streams:

By monetizing the broker competition, Smallcase gains revenue directly from broker

commissions, possibly offsetting or even replacing direct user transaction fees. This shifts

the revenue model towards broker-funded monetization.

Enhanced user retention:

Providing competitive pricing and superior execution could significantly improve user

satisfaction and retention, reinforcing platform stickiness.

Increased bargaining power:

Broker syndication places Smallcase in a powerful negotiating position, enabling the

company to negotiate better terms with brokers over time, benefiting users and

strengthening Smallcase’s market influence.

Scalable model:

The brokerage aggregation model naturally scales as more users and brokers join the

platform, enabling greater competition and better pricing for users.

Asset-light structure:

Smallcase does not need heavy investment in brokerage infrastructure or licenses, thus

significantly reducing capital expenditure and operational overhead.

�Why This would Work for Users

Improved pricing and transparency:

Users benefit from competition-driven brokerage pricing and clearer visibility into trading

costs.

Optimal trade execution:

Users receive potentially better trade execution quality and speed, as brokers compete not

only on cost but also on execution performance.

Unified platform experience:

Users have access to multiple brokerage services through one integrated platform,

eliminating the need to manage separate brokerage accounts.

Potential Issues

Regulatory landscape:

SEBI and exchange regulations in India might not explicitly cover or permit this aggregator

model, requiring regulatory clarifications or specific approvals. Compliance and

transparency will be critical for regulatory acceptance.

Broker cooperation:

Brokers, especially established market leaders, may initially resist participating in a model

that commoditizes their offering or erodes direct customer relationships.

Technological complexity:

Implementing real-time broker competition and seamless order routing requires advanced

technology infrastructure and reliable APIs to ensure robust performance during peak

trading volumes.

Customer perception and education:

Customers may initially be skeptical about trusting a broker selected by the system rather

than by their own choice. Educational initiatives and transparent disclosures will be

essential to overcome this challenge.

This is UNPROVEN but there are some parallels

Payment Aggregators (e.g., Razorpay, PayU): These companies aggregate various payment

providers and banks, taking small commissions per transaction—illustrating the viability

and scalability of aggregator economics.

Travel Aggregators (e.g., Expedia, Skyscanner): Competitive marketplaces for travel

bookings, taking commissions from providers competing for customer bookings—

demonstrating that competitive aggregation is highly attractive and scalable for customers.

E-commerce Marketplaces (Amazon, Alibaba): Brokers in this model act like sellers on these

marketplaces, competing for order flow by offering the best pricing, service, and delivery

�terms. These models clearly illustrate that marketplaces naturally incentivize competition,

driving better consumer outcomes.

Smallcase should consider careful exploration, pilot-testing, and regulatory

dialogue to feasibly implement this audacious and potentially industry-

changing model.