0% found this document useful (0 votes)

17 views13 pagesInventory Notes

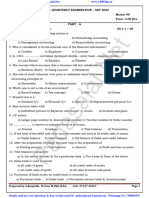

Chapter 4 of the Financial Accounting document focuses on inventory and trading entities, detailing the differences between consumable and trading inventories, as well as the calculation of gross profit and selling prices. It explains the periodic and perpetual inventory systems, including their features and accounting entries. The chapter concludes with an illustrative example of a trading entity's transactions and how to prepare financial statements reflecting trading activities.

Uploaded by

kabeloramohlaleCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

17 views13 pagesInventory Notes

Chapter 4 of the Financial Accounting document focuses on inventory and trading entities, detailing the differences between consumable and trading inventories, as well as the calculation of gross profit and selling prices. It explains the periodic and perpetual inventory systems, including their features and accounting entries. The chapter concludes with an illustrative example of a trading entity's transactions and how to prepare financial statements reflecting trading activities.

Uploaded by

kabeloramohlaleCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 13