0% found this document useful (0 votes)

12 views2 pagesRisk Model Calculator

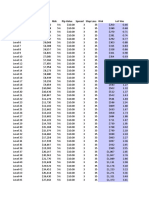

The document outlines a position size calculator for trading, detailing an account size of $500 and a dollar value of $10 per pip. It specifies a risk percentage of 3.00% and provides a formula to calculate the size in lots based on equity at risk, account equity, and the number of pips between entry and stop loss. The key elements include the risk percentage, account size, and pip value for determining position size.

Uploaded by

Anam TawhidCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

12 views2 pagesRisk Model Calculator

The document outlines a position size calculator for trading, detailing an account size of $500 and a dollar value of $10 per pip. It specifies a risk percentage of 3.00% and provides a formula to calculate the size in lots based on equity at risk, account equity, and the number of pips between entry and stop loss. The key elements include the risk percentage, account size, and pip value for determining position size.

Uploaded by

Anam TawhidCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

/ 2