PROBLEM 1-1

On August 1, 2021, Wood Corporation issued 100,000 shares of its P20 par value common stock for the net assets of Pine Inc., in a business combination accounted for by the acquisition method. The market value of Wood's common stock on August 1 was P35 per share. Wood paid a fee of P200,000 to the consultant who arranged this acquisition. Cost of registering and issuing the equity securities amounted to P50,000.

Required:

1. What amount should Wood capitalize as the cost of acquiring Pine's net assets?

2. How much id the goodwill (gain) on combination assuming the fair value of Pine's net assets is P3,000,000?

PROBLEM 1-2

On June 30, 2021 White Corporation issued 50,000 shares of its P20 par value common stock for the net assets of Black Company. The market value of White's common stock on June 30 was P36 per share. White paid a fee of P100,000 to the broker who arranged this acquisition. Costs of SEC registration and issuance of the equity securities amounted to P50,000. Below is the structure of assets and liabilities of Black Company as of the date of acquisition.

Book Value Fair Value

Accounts Receivable 500,000 550,000

Inventory 600,000 400,000

PPE 1,400,000 1,600,000

Accounts Payable 300,000 300,000

Notes Payable 700,000 700,000

Required:

1. Determine the amount of consideration

2. Compute the goodwill/ (gain) on combination

3. Journalize the transactions in the books of White Corporation

PROBLEM 1-3

On January 2, 2022, P Company purchased the net asset of S Company by paying P500,000 cash and issuing 100,000 shares of stocks at P3,000,000 fair market value. The par value of P's shares is P24 per share. Book value and fair value data on the Statement of Financial Position on January 2, 2022 are as follows:

P Company S Company

Book Value Fair Value Book Value Fair Value

Cash 4600000 4600000 300000 300000

Accounts Receivable 1000000 1000000 980000 980000

Inventory 1500000 1300000 710000 600000

PPE, net 1800000 1460000 1520000 1064000

Goodwill 90000 80000

Total 8900000 8360000 3600000 3024000

Liabilities 1000000 1000000 570000 570000

Share Capital 1600000 600000

Share Premium 900000 960000

Retained Earnings 5400000 1470000

Total 8900000 3600000

P incurred and paid legal and brokerage fees of P50,000 for business combination; share issue costs of P30,000 and P20,000 indirect acquisition cost. It is determinable that contingency fee of P150,000 (estimated fair value) would be paid within the year.

Required:

1. Determine the amount of consideration

2. Compute the goodwill / (gain) on combination

3. Journalize the transactions in the books of the acquirer

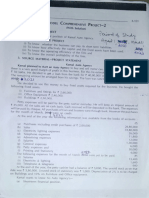

Problem 1-4

A condensed Statement of Financial Position of Cable Company at August 1, 2022 and related fair value are presented below:

Book Value Fair Value

Current Assets 368000 404500

Plant Assets 592500 690000

Patent 58500 48000

Total 1019000

Current Liabilities 107500 107500

Long-term debt 280000 280000

Share Capital, P20 par 210000

Retained Earnings 421500

Total 1019000

On August 1, 2022, Sky Corporation paid P800,000 cash for the net assets of Cable Company

Required:

1. How much is the goodwill on combination? Journalize the transaction in the books of Sky

2. Assuming Sky purchased all the outstanding voting shares of Cable, how much is the goodwill on combination? Journalize the transactions in the books of Sky

3. Assuming Sky purchased 80% of the outstanding voting shares of Cable, how much is the goodwill on combination? Journalize the transaction in the books of Sky.

a. If NCI is measured at Fair Value

b. If NCI is measured at Proportionate

Problem 1-5

On May 1, 2022, Kingdom Corporation paid cash of P600,000 for all of the net assets of United Company and United is dissolved. The carrying value of the assets and liabilities of United on May 1, 2022 follow:

Cash 60000

Inventory 180000

Plant and equipment (net of accumulated depreciation of P220,000) 320000

Goodwill 100000

Liabilities 120000

On May 1, 2022, United's inventory had a fair value of P150,000, and the plant and equipment (net) had a fair value of P380,000

What is the amount of goodwill recorded in the books of Kingdom as a result of the business combination?

Problem 1-6

Lee Land Company acquired 75% of Way Maker Company's ordinary share for P510,000 cash. At that date, Way Maker reports identifiable assets with book value of P1,040,000 and a fair value of P1,280,000, and it has liabilities with book value and fair value of P716,000.

How much is the goodwill or gain on acquisition arising from combination if control premium of P30,000 is included in the purchase price?

Assuming:

1. NCI is measured at Fair Value

2. NCI is measured at Proportionate

�PROBLEM 2-1

The condensed balance sheet as of December 31, 2021 of Moses Corporation and Jacob Corporation are:

Moses Corp Jacob Corp

Current Assets 350000 150000

Noncurrent Assets 550000 350000

Total Assets 900000 500000

Liabilities 250000 100000

Ordinary Share, P20 par 400000 250000

Retained earnings 250000 150000

Total Liabilities & SHE 900000 500000

On January 1, 2022, Moses Corp. issued 20,000 shares of its ordinary shares in exchange of all the outstanding voting shares of Jacob Corp. Moses Corp. shares has market value of P30 per share. The combination qualifies as an acquisition and Moses incurred legal fees of P50,000 and share issuance cost of P10,000.

Required:

1. Journalize the transaction in the book of Moses Corp. to recognize the purchased of interest in Jacob Corp.

2. Journalize the working paper elimination entries as of the date of acquisition

Problem 2-2

The condensed balance sheet as of December 31, 2021 of Moses Corporation and Jacob Corporation are:

Moses Corp Jacob Corp

Current Assets 750000 250000

Noncurrent Assets 550000 450000

Total Assets 1300000 700000

Liabilities 300000 200000

Ordinary share, P20 par 500000 300000

Retained earnings 500000 200000

Total Liabilities & SHE 1300000 700000

On January 1, 2022, Moses Corp. paid P405,000 for 60% of the outstanding voting shares of Jacob Corp. The combination qualifies as an acquisition and Moses incurred legal fees of P50,000. Also, Moses will pay additional P75,000 to Jacob if it will hit a profit that is higher by at least 20% compare to the average profit of the latest 3 years of operation. The contingent consideration, when the condition is met, is payable on January 31, 2023. Based on the most reasonable estimates, the probability that the target will be satisfied is between 45% to 75%.

Also, the current assets of Jacob are fairly valued except for Inventory with fair value lower than the recorded amount by P20,000. Of the noncurrent assets, machinery is assessed to be undervalued by P70,000, the rest are fairly stated. Non-controlling interest is measured based on proportionate share of Jacob's identifiable net assets.

Required:

1. Allocation Schedule

2. Journalize the transaction in the book of Moses Corp to recognize the purchase of interest in Jacob Corp

3. Journalize the working paper elimination entries as of the date of acquisition

4. Consolidated Statement of Financial Position as of date of acquisition

PROBLEM 2-3

Consolidated Statement of Financial Position of Love Corp and You Corp as of December 31, 2021 are as follows:

Love You

Current Assets 175000 65000

Noncurrent Assets 725000 425000

Liabilities 65000 35000

Ordinary shares, P20 par 550000 300000

Share premium 35000 25000

Retained earnings 250000 130000

On January 1, 2022, Love Corp issued 35,000 shares with a market value of P25/ share for the assets and liabilities of You Corp.

The book value reflects the fair value of the assets and liabilities except that the noncurrent assets of You have fair values of P630000, and the noncurrent assets of Love are overstated by P30000. Contingent consideration, which is determinable, is equal to P15000. Love also paid for the stock issuance costs worth P34000 and other acquisition costs amounting to P10000.

Required:

1. Consolidated assets as of date of acquisition

2. Consolidated equity as of date of acquisition

PROBLEM 2-4

On January 2, 2022, the Statement of Financial Position of Love and Hope Company prior to combination are:

Love Company Hope Company

Cash 225000 7500

Inventories 150000 15000

PPE 375000 52500

Total Assets 750000 75000

Current Liabilities 45000 7500

Ordinary Share, P100 par 75000 7500

Ordinary Share Premium 225000 15000

Retained Earnings 405000 45000

Total Liabilties and SHE 750000 75000

The fair market value of Hope Company's PPE (net) is P76,500

Required:

1. Assuming Love Company acquired all the outstanding share of Hope Company resulting to a goodwill of P33,000, the contingent consideration is P18,000, compute the consolidated balances of the following as of date of acquisition:

a. Assets

b. Liabilities

c. Shareholders Equity

2. Assuming Love Company acquired 90% of the outstanding ordinary share of Love Company for P121,500 and NCI is measured at fair value, compute the consolidated balances of the following as of date of acquisition:

a. Assets

b. Liabilities

c. Shareholders Equity

PROBLEM 2-5

On January 1, 2022, P Company acquired 2,700 shares of the outstanding ordinary share of S Company for P540,000. As of this date, the shareholders equity section of S Company consisted of Share Capital, P100 par, P300,000 and Retained Earnings, P150,000. The carrying value of S Company's identifiable assets and liabilities are equal to their fair market values except for equipment, which is undervalued by P50,000, with remaining useful life of 5 years. P opt to measure NCI at fair value.

Required:

1. Goodwill/ gain on bargain purchase

2. Entries in the book of the parent as of date of acquisition

Elimination entries as of date of acquisition

PROBLEM 2-6

Romeo Company issued 120,000 shares of P10 par ordinary shares with a fair value of P30 per share for all the net assets of Jorge Company. Romeo's retained earnings prior to business combination amounted to P1,000,000. Romeo incurred the following additional costs:

Legal fees to arrange the business combination P25000

Accounting and consultancy fees related with business combination 12000

Costs of printing and issuing new stock certificates 3000

Indirect costs of combinining, including allocated overhead and executive salaries 20000

Broker's and finder's fee related with business combination 30000

Immediately before the business combination in which Jorge Company was dissolved, Jorge's assets and equities were as follows:

Book value Fair value

Current assets 1000000 1100000

Plant assets 1500000 2200000

Liabilities 300000

Ordinary shares 2000000

Retained earnings 200000

Required:

1. how much is the retained earnings after the business combination?

2. how much is the net increase in the shareholders equity of the acquirer?