1.

Statement 1: Deposits in different banks are added together for the purpose of the P1,000,000

maximum.

Statement 2: Deposits in different branches of the same bank are insured separately.

A. Both statements are false

B. Both statements are true

C. Only statement 1 is correct

D. Only statement 2 is correct

2. Statement 1: The PDIC is an attached agency of the Department of Finance.

Statement 2: A depositor with single accounts and joint accounts may have insured deposits of

up to Php 2,000,000.

A. Both statements are false

B. Both statements are true

C. Only statement 1 is correct

D. Only statement 2 is correct

3. What is the amount of insured deposit?

A. Minimum of P1,000,000, gross

B. Maximum of P1,000,000, gross

C. Maximum of P1,000,000, net

D. Minimum of P1,000,000, net

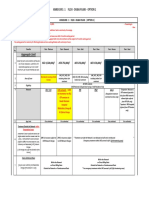

4. Juan dela Cruz has the following deposits in Bank 1 during December 2024

– Individual account in his name: P600,000 savings deposit

– Joint account in his name and Maria dela Cruz: P500,000 time deposit

– Joint account in his name or Pedro dela Cruz: P800,000 demand deposit What is

the total insured deposit of Juan dela Cruz?

A. P500,000

B. P750,000

C. P1,000,000

D. P1,250,000

5. What is the total insured deposit of Maria dela Cruz?

A. Zero

B. P250,000

C. P500,000

D. None of the choices

6. What is the total insured deposit of Pedro dela Cruz?

A. Zero

B. P250,000

C. P400,000

D. P500,000

7. Assuming Juan dela Cruz has the following deposits in Bank 1 during June 2025

– Individual account in his name: P600,000 savings deposit

– Joint account in his name and Maria dela Cruz: P500,000 time deposit

– Joint account in his name or Pedro dela Cruz: P800,000 demand deposit

What is the total insured deposit of Juan dela Cruz?

A. P500,000 C. P1,000,000

B. P750,000 D. P1,250,000

�8. The following are not covered by PDIC deposit insurance except:

I. Investment products

II. Deposit accounts which are unfunded, fictitious or fraudulent

III. Deposit products emanating from unsafe and unsound banking practices

IV. Deposit that are determined to be proceeds of an unlawful activity

A. I only

B. III only

C. II and III

D. None of the above

9. The following are covered by PDIC deposit insurance except:

I. Savings

II. Single accounts

III. Investments products

IV. Time deposits

A. I

B. III

C. I and II

D. All of the above

10. Statement 1. Depositor Protection is to strengthen the mandatory deposit insurance coverage

system and to protect it from illegal schemes and machinations.

Statement 2. Financial stability is to promote and safeguard the interest of the depositing public by way of

providing permanent and continuing insurance coverage on all insurance deposits.

A. Both statements are true

B. Both statements are false

C. Only statement 1 is correct

D. Only statement 2 is correct

11. Statement 1: Joint accounts held in the names of a juridical entity and a natural person shall be presumed to

belong solely to the natural person.

Statement 2: A deposit insurance is essentially the assured amount a bank depositor gets in the case that the

bank can fulfill its obligation.

a. Both statements are true. C. Only statement 1 is correct

b. Both statements are false D. Only statement 2 is correct

12. Statement 1: PDIC is a government instrumentality created in 1963 by virtue of RA 3591.

Statement 2: Deposit products constituting or emanating from unsafe and unsound banking practices is

excluded from PDIC deposit insurance.

A. Both statements are false

B. Both statements are true

C. Only statement 1 is correct

D. Only statement 2 is correct

13. The latest amendments to RA 3591 are contained in RA 10846 signed into law on

.

A. May 23, 2017

B. May 23, 2016

C. April 23, 2016

D. April 23, 2017

�14. The following are the depositors Type, Except :

A. Savings

B. Special savings

C. Demand/Checking

D. Depositors protection

15. It is an individually-owned accounts or accounts held under one name, either as natural person or

judicial entity.

A. Single accounts

B. Natural person

C. Judicial entity

D. Account "By" , "in trust for"

16. The following are excluded from PDIC deposit insurance, whether they are dominated, documented,

recorded or booked as deposit by the bank, Except:

A. Investment products such as bonds, securities and trust accounts.

B. Deposit accounts which are unfunded, fictitious or fraudulent

C. Foreign currencies considered as part of BSP's International reserves

D. Deposit products constituting or emanating from unsafe and unsound banking practices.

17. Deposits in which of the following banks are insured by the PDIC?

I. Commercial banks

II. Savings and mortgage banks

III. Domestic branches of foreign banks

IV. Cooperative banks

V. Savings and loan associations

A. All except IV

B. All except V

C. All except IV and V

D. All banks enumerated above

18. It is a government instrumentality created in 1963 by virtue of Republic Act 3591 to insure the

deposits of all banks which are entitled to the benefits of insurance

A. MDIC

B. ITF

C. PDIC

D. FAO

19. As of March 15, 2025 the Maximum Insurance coverage for the insured deposits amounts to:

a. 0

b. 250,000

c. 500,000

d. 1,000,000

20. Which of the following is not part of the Board of Directors of PDIC

a. Governor of BSP as ex officio Chairperson without compensation;

b. Secretary of COA as ex officio Vice Chairperson

�c. member of the Board without compensation,

d. The President of PDIC appointed by the President

None

21. All of the following are requisites of splitting of deposit except:

a. A deposit account with an outstanding balance more than P500,000 is broken down and transferred to two or

more accounts in the name of persons or entities who have no beneficial ownership in the transferred deposits in

their names

b. within 60 days immediately preceding or during a bank-declared bank holiday or immediately preceding a

closure order issued by the Monetary Board

c. for the purpose of availing the maximum deposit insurance coverage.

d. all of the above

e. none of the above

22. Statement I - if the account is held by a juridical person or entity jointly with one or more natural persons,

the maximum insured deposit shall be presumed to belong entirely to natural person.

Statement II - A joint account regardless of whether the conjunction "and" "or", "and/or is used shall be insured

separately from any individually owned deposit account, provided that is held jointly by two or more natural

persons, or by two or more juridical persons or entities, the maximum insured deposit shall be divided into as

many equal shares as there are individuals, juridical persons or entities, unless a different sharing is stipulated in

the document of deposit.

Statement III - The aggregate of the interest of each co-owner over several joint accounts, whether owned by

the same or different combinations of individuals, juridical persons or entities, shall likewise be subject to the

maximum insured deposit of P1,000.000.

a. Only one statement is true c. All statements are True

b. Only two statements are true d. All statements are False

23. a depositor has a period of _____ to file claim

a. 2 years from actual deposit on the bank c. 6 months from actual

takeover of the closed bank

b. 2 years from actual takeover of the closed bank d. 2 years from actual

deposit on the bank

24. Failure to settle the claim within 6 months from the date of filing of claim for insured

deposit, where such failure was due to grave abuse of discretion, gross negligence, bad

faith or malice, shall upon conviction, subject the directors, officers or employees of PDIC

responsible for the delay, to

a. imprisonment for 1 year to 2 years c. imprisonment from 6

months to 1 year

b. imprisonment for 3 months to 6 months d. imprisonment from 3

months to 2 years

25. The following are the effects of non-filing or non-enforcement of claim within the

periods prescribed by the law which one is not?

a. All rights of the depositor against the PDIC with respect to the insured deposit shall

remain.

b. All rights of the depositor against the closed bank and its shareholders or the

receivership estate to which PDIC may have become subrogated, shall thereupon revert

to the depositor

�c. PDIC shall be discharged from any liability on the insured deposit

d. none of the above

e. all of the above