0% found this document useful (0 votes)

61 views49 pagesMacro Economics Module 2

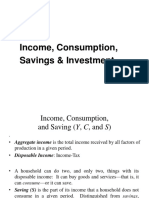

The document discusses the concepts of consumption, investment, and the multiplier effect in economics. It explains the consumption function, its relationship with income, and the psychological law governing consumption behavior, as well as the types of investment and factors affecting them. Additionally, it introduces the multiplier effect, highlighting its significance in understanding how changes in spending can lead to greater changes in overall economic output.

Uploaded by

aaruchaudhary125Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

61 views49 pagesMacro Economics Module 2

The document discusses the concepts of consumption, investment, and the multiplier effect in economics. It explains the consumption function, its relationship with income, and the psychological law governing consumption behavior, as well as the types of investment and factors affecting them. Additionally, it introduces the multiplier effect, highlighting its significance in understanding how changes in spending can lead to greater changes in overall economic output.

Uploaded by

aaruchaudhary125Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 49